New Cato SASE Study: Channel Partners Care More About Scalability Than Margins

Partners ranked scalability and ease of management as their biggest criteria for picking a security vendor.

Most secure access service edge (SASE) providers aren’t actually providing SASE, according to Cato Networks.

The vendor on Tuesday released a new study that contends that many of its rivals are not truly converging advanced security and networking features into a single platform, but rather offering a variety of point solutions. Cato queried more than 2,000 IT leaders and channel partners, the majority of which do not transact with Cato. The study, “Security or Performance: How Do You Prioritize,” concluded that the respondents that utilize “SASE” solutions still face very similar problems compared to those who have not deployed them.

Cato’s Eyal Webber-Zvik

“SASE’s benefits come from a rethinking of security and networking architectures by converging them into the cloud,” said Eyal Webber-Zvik, vice president of product marketing at Cato Networks. “If you continue using SASE portfolios made up from legacy point-solutions and appliance architectures, you can’t expect to realize SASE’s benefits.”

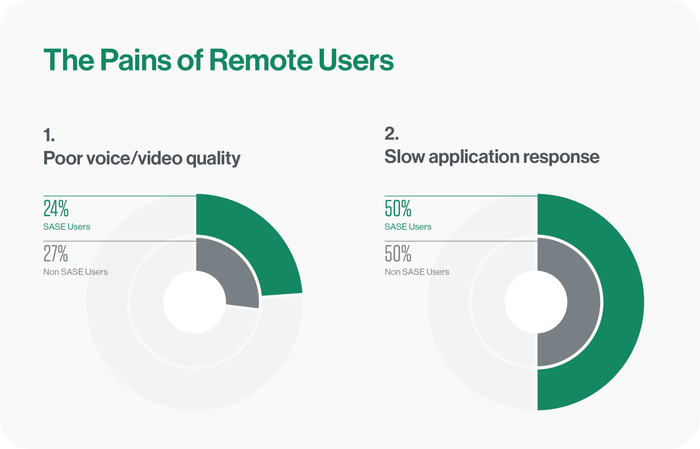

For example, SASE users and non-SASE users scored nearly identical results when it came to remote worker experiences. SASE users scored slightly fewer incidents of poor voice and video quality, but one-half of both SASE and non-SASE users reported slow application responses.

Source: Cato Networks

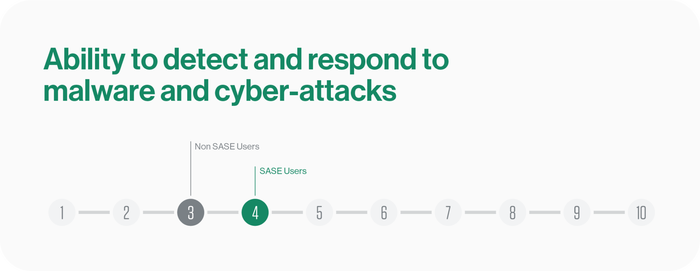

In addition, SASE users only scored one point better than non-SASE users in their preparedness for cybersecurity attacks. When asked how they respond to performance issues, two in three (67%) SASE users said they added more bandwidth. Sixty-one percent of non-SASE users said the same.

Source: Cato Networks

The overall study found that only 29% of businesses do not want to plan to deploy SASE.

Partner Perspective

Cato surveyed just under 1,000 channel partners in addition to prospective customers. Those partners fall into the VAR, agent, MSP and TSB models. They spread out fairly evenly between the Americas (33%), EMEA (26%) and APAC (41%).

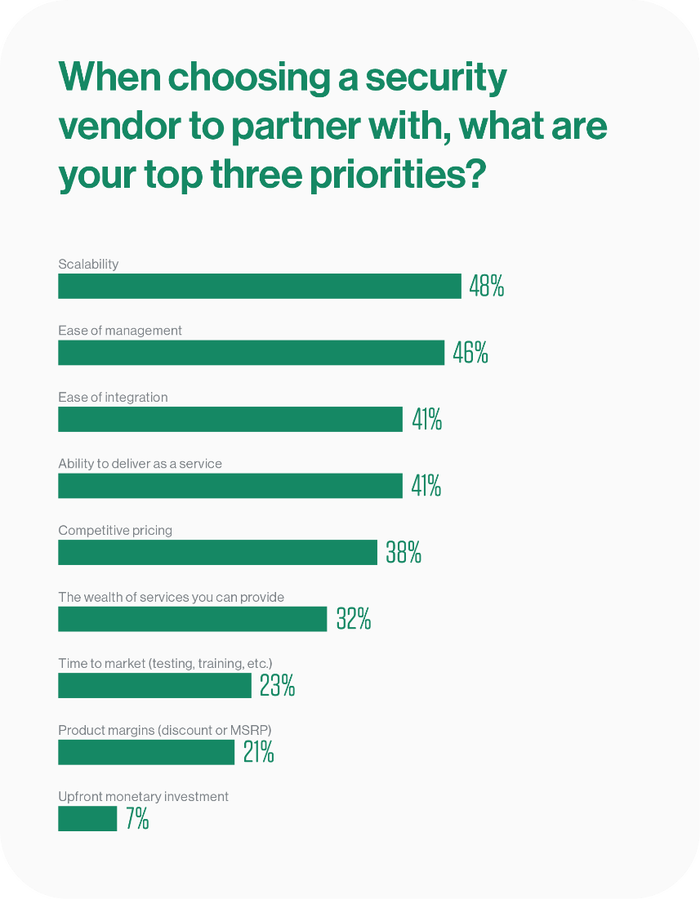

The responses show an interesting trend: Partners are caring less and less about margins when considering the products they sell. Cato asked partners to list their top three priorities for picking a security vendor. Scalability, ease of management and ease of integration landed in the top three. Product margins, on the other hand, landed eighth. One cause, the authors surmised is that, “the overhead of delivering appliances often outweigh the margins in selling them.”

That data fit well with what we’ve seen market research firms say about the future of network hardware. Dell’Oro Group concluded that hardware-based access routers declined in the first six months of 2021. More than 60% of partners Cato interviewed said they consider reselling security appliances a “risky business.”

It’s worth noting, however, that 38% of partners picked competitive pricing as a key priority.

Matthew Toth, president of the Cato partner C3 Technology Advisors, touched on the importance of vendor support in a recent article about the habits of successful channel managers. For Toth and many other partners, a vendor’s ability to successfully help the customer through the entire sales lifecycle can trump product and pricing.

C3’s Matthew Toth

“I don’t care how good your product is. If you don’t have a [channel manager] that can put one foot in front of the next, we’re never bringing this guy in. I don’t care if you’re selling the most amazing UCaaS product that costs 50 cents a month,” Toth said.

Partners also expressed the expectation that customers will turn to SASE en masse. Eighty-five percent said SASE will become customers’ preferred choice.

Resourcive’s Kyle Hall

“From my perspective, I’m seeing a lot fewer clients choose to buy and deploy a box,” Kyle Hall, president of Resourcive told Channel Futures last year. “They seem really interested in procuring it as a service.”

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author(s)

You May Also Like