Quarterly Survey Analysis: AI Jumps Into the Driver’s Seat for Vendor Additions

Our analyst takes a deep dive into our most recent partner survey.

December 18, 2023

Overview

Each quarter Channel Futures takes the pulse of the channel market via its dynamic Quarterly Market Outlook surveys. These quarterly surveys provide an abundance of relevant channel market data which allows us to gauge the market from the perspectives of prominent channel partners: managed service providers (MSPs) and technology agents/ advisors (TAs). The survey results give us an assessment of partners’ sentiments about the market and their opinions about vendors and other partners. We’re also able to evaluate the technology services distribution market from the unique perspective of TAs, a tight-knit group that often gets overlooked in the channel.

Below are key insights from this quarter’s survey which are pertinent for both vendors and partners.

Key Managed Service Provider (MSP) Findings

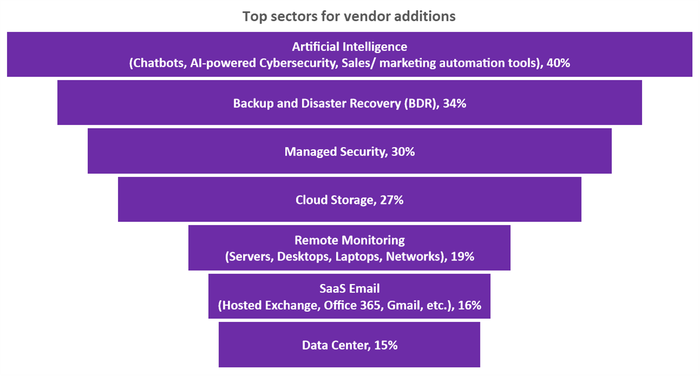

1. Vendor Additions Endure: As MSPs continue to explore ways to grow their business, the right vendor and supplier partnerships are critical to capitalizing on the latest channel opportunities and trends. In the third quarter of 2023, 63% of MSPs added vendors. The top service areas for those additions were artificial intelligence (AI) (40%), backup and disaster recovery (34%), and managed security (30%). AI was a newly added option to the survey last quarter, and it made an immediate impact by being the top sector for vendor additions by MSPs.

The main reason for MSP vendor additions last quarter was to supplement existing tools/technologies (53%), followed by selling to new sectors/ new offerings (32%).

2. Confidence in the U.S. Economy Wanes, Along with Sales Projections: This year, the U.S. economy is being impacted by a slew of macroeconomic conditions, including inflation, high interest rates, global wars and more. Yet, unlike the previous quarter where MSPs’ confidence in the U.S. economy’s performance was unfazed, last quarter the results noticeably declined: Seventy percent of MSPs indicated average or better confidence in the U.S. economy’s performance, down from 81% the previous quarter (2Q23).

Subsequently, the proportion of MSPs that projected 2023 full-year sales increases, compared to 2022, declined from 71% in Q2r to 66% in 3Q23. MSPs still see growth in 2023, yet headwinds from the U.S. economy may have dampened some of their expectations.

Key Technology Agent/ Advisor (TA) Findings

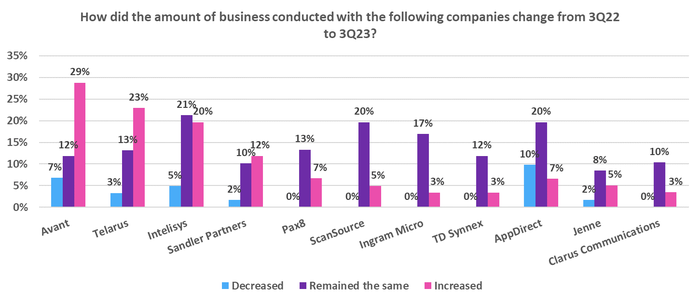

1. Select TSDs Are Prime Targets: Consolidation is nonstop in the channel, especially in the technology services distributors (TSDs) market. This trend is impacting the entire channel landscape, particularly TAs that help sell vendors’ solutions to end users with considerable support from TSDs for marketing, lead generation, procurement, financing and more. This is why a TA’s decision to work with certain TSDs is so vital, and based on 3Q23 survey feedback, Avant, Telarus, Intelisys, Sandler Partners and Pax8 were the most coveted TSDs that TAs increased business with the most since last year (3Q22).

2. Customers and Vendors Present Roadblocks: The job of a TA is already inherently difficult. They have numerous competitors including other TAs and other partners (MSPs, resellers, consultants) that they must contend with; plus, often a vendor’s direct sales teams. Yet, this past quarter, a less obvious encounter was their biggest obstacle — customer’s inaction (44%, ranked No. 1) — when clients prefer to procure and manage their own legacy technology in lieu of adopting more modern solutions offered as a service that TAs recommend. The remaining top deterrents were a vendor’s direct sales teams (43%, No. 2) and other TAs (39%, No. 3). Notably, marketplaces (18%) ranked No. 6, yet saw the largest year-over-year rise (14 percentage points) from 3Q22, a threat that should not be overlooked or taken for granted.

Key MSP and TA Findings

1. AI Tools Are Becoming More Pivotal for Go-to-Market (GTM): When asked what go-to-market enhancements have been made in the last six months or are planned to be made to improve business outcomes, MSPs’ and TAs’ needs slightly differ.

MSP top enhancements include new customer segment targets (49%), sales team additions (40%), AI-generated marketing tools/strategies (40%) and lead generation (36%).

TA top enhancements include customer cross-sells or upsells (46%), targeted customer engagements (30%), targeted branding (26%) and AI-generated marketing tools/strategies (25%).

A commonality between MSPs and TAs was the increased use of AI-generated marketing tools/ strategies, which experienced the largest quarter-over-quarter rise (11 percentage points) in both groups.

2. AI Proliferation Continues in the Channel: There are endless use cases for generative AI, so it’s no surprise that MSPs and TAs are adopting the technology for both in-house and external customer use.

In 3Q23, 71% of MSPs stated their in-house use of AI increased, while 61% saw increased AI-related customer deployments.

The number of TAs using generative AI large language models (LLMs) rose to 44% (10 percentage points) from last quarter. Top AI use cases for TAs mostly consisted of tools capable of improving business efficiency and augmenting sales and communications activities, such as email (62%), sales and marketing (46%), and social media posts (31%).

Conclusion

The were three clear takeaways from this past quarter’s survey results.

MSPs are actively searching for strategic vendor partnerships and AI is a key technology target.

TAs have a variety of TSDs they can work with, yet there are a select few that they hold in high regard.

AI is still in its early adoption phase and partners continue to find new ways to benefit from it internally, through improved business operations, and externally, via increased sales to customers.

Based on the results, vendors seeking new partnerships should focus on developing solutions in the areas where partners are seeking vendor additions; for example, AI, backup/disaster recovery and cybersecurity. Also, vendors looking to expand their TSD partnerships should target those that TAs themselves covet, including Avant, Telarus, Intelisys, Sandler Partners and Pax8.

For more in-depth insights and analysis of the Channel Futures Quarterly Market Outlook Survey and to get a unique perspective on the key trends impacting the channel from the lens of prominent MSPs and TAs, check out the recently published Omdia Quarterly Market Outlook Survey Insights – 3Q23 report.

About the Author(s)

You May Also Like