Avant Survey: Partners Must Adapt to Industry Change or Risk Falling Behind

A new report from the master agent found that cloud-centric partners with a broad portfolio of services outsold competitors with fewer offerings and legacy marketing practices.

April 19, 2019

By Jeffrey Burt

In a rapidly changing IT world that’s quickly embracing the cloud, channel partners that aren’t selling emerging services like software-defined WAN and unified communications as a service risk being run over by the competition, according to a new survey by Chicago-based master agent Avant.

In Avant’s 2019 Cloud Channel survey, the company found that cloud-centric partners routinely outsell those hanging on to legacy products and services, are viewed by customers as much-needed trusted advisers and are embracing new marketing avenues that enable them to outperform their slow-evolving brethren.

Avant’s Alex Danyluk

“What we found out is the more successful of partner sells a broader portfolio of services,” Alex Danyluk, chief strategy officer at Avant, told Channel Partners. “If you’re having a sales conversation at a higher level in the stack, if you’re having a conversation about security, about SD-WAN, about UCaaS, you’ve automatically pulled through voice and data services.”

The key message “for the people who are still playing the same old playbook that they’ve played for the last 10 years is that they’re probably terminally ill and they don’t know it,” Danyluk said. “If they keep playing the same playbook, they’re not going to be able to continue to do that because … it’s going to be their demise.”

That was illustrated by the success of cloud-centric infrastructure partners as outlined in the survey. Those partners made up 24 percent of the 187 channel sellers surveyed and sold a broad portfolio of services — voice, UCaaS, SD-WAN, data connectivity, colocation, infrastructure as a service (IaaS), security as a service (SECaaS), office productivity and software as a service (SaaS). However, they grabbed 41 percent of the network and voice sales, outperforming the 39 percent of partners that sold mostly voice, UCaaS, SD-WAN and data connectivity.

Courtesy: Avant

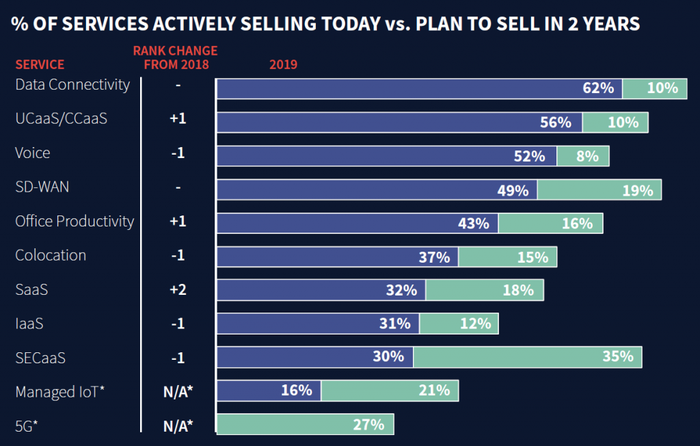

The Cloud Channel survey, conducted in conjunction with a range of other companies, including Channel Partners, 8×8, Oracle and Masergy, was one of two channel-centric surveys presented earlier this month at the Channel Partners Conference and Expo. Included in the survey was a look at the fastest-selling services today and how that will change in the next two years.

Overall, data connectivity continues to be the top-selling service at 62 percent, and will continue in that spot over the next two years; however, fast-growing services like UCaaS, SD-WAN and SECaaS will move up the ladder and other services that are just beginning to come into view – particularly 5G and the internet of things (IoT) – also will quickly grow in demand. Partners need to understand what customers want now and will want in the future and be ready to meet that demand.

“Change is constant, but the rate of change is accelerating,” Danyluk said. “There are disruptive technologies coming in and they are disrupting the traditional IT landscape. Telecom services are very mature – voice, MPLS, those types of things – are on the inside of the bell-shaped curve of adoption. There are brand-new technologies coming out – like SD-WAN, UCaaS has been around a bit longer – that are just decimating the legacy environment because they’re adding capabilities and features and functions that just cannot be upgraded to the old technologies.”

Likewise, there are also a host of new partners and advisers that will …

… disrupt the market, he said.

“There now are service providers that three or four years ago, nobody heard of, who are now the darlings of the industry,” Danyluk said. ‘In fact, if you’re a large public company, you’re in the worst spot today because it’s difficult for you to evolve. These small, nimble companies with these new capabilities and technologies are your very biggest threat.”

In the survey, Avant delineates between two types of partners, those it calls “lean forward” partners and others called “lean back.” The lean-forward partners reported closing more deals and a higher percentage of growth than lean-back partners.

The lean-back camp is stuck making their sales based on products and costs, while the lean-forward folks rely on selling more unique IP and information on services that help customers improve their agility, availability and competitiveness, he said. The two groups tend to agree on some points, such as vendor criteria (being channel-friendly) and decision criteria (ROI); however, there also are key differences in how they approach the market.

For example, lean-forward partners see comparative product information and sales training as resources for success, while lean-back partners point to lead generation and account planning. Lean-forward partners say their value-add is a broad portfolio, while their lean-back counterparts point to training.

There also are key differences in their marketing approaches. Both camps invest in website development (though Lean Forward people invest 1.5 times more), but lean-forward partners then say their other top efforts are around hosted events and social media PR. Lean-back partners turn to email campaigns and collateral, which Danyluk called “passive” and “old school.”

“There’s a new world out there,” he said. “There’s a new way that customers consume information and the lean-forward partners are figuring it out in terms of engaging online with websites and having events and active social media engagements.”

However, customers also are struggling with the fast pace of change, and that’s opening up opportunities in the channel if partners can adapt.

“There’s never been a better time to be a trusted adviser in this market,” Danyluk said. “Because of the rate of change, customers are confused. Because there are so many companies that they’ve never heard of before … that are the right decisions for them, there’s no way they can figure it out on their own without engaging a trusted adviser. Or if they try to do it on their own, it will take them too long. The competition will run past them.”

Read more about:

AgentsYou May Also Like