$12.3 Billion Proofpoint Private Equity Deal Worries MSPs

It's the largest private equity SaaS investment ever by some accounts.

The gargantuan Thoma Bravo acquisition of cybersecurity provider Proofpoint comes with a $12.3 billion price tag.

Yes, billion.

The private equity firm on Monday announced a definitive agreement to acquire the Sunnyvale, California-based vendor. The deal would bolster the Thoma Bravo cybersecurity play in a big way. Its cybersecurity profile also includes Sophos, DigiCert, Imperva, Barracuda Networks and several other companies. Canalys vice president of channels Alex Smith said the transaction positions Thoma Bravo as a top five cybersecurity provider. It would trail Cisco, Palo Alto and Fortinet, according to Smith.

Proofpoint would exit the Nasdaq and all other public markets as a result of the acquisition.

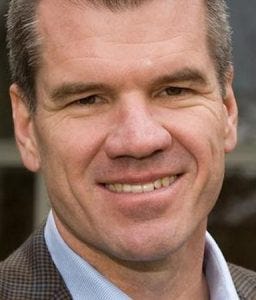

Proofpoint’s Gary Steele

“We believe that as a private company, we can be even more agile with greater flexibility to continue investing in innovation, building on our leadership position and staying ahead of threat actors,” Proofpoint Chairman and CEO Gary Steele said.

Steele credited Thoma Bravo for its expertise in software investment. He said Proofpoint became the first SaaS-based cybersecurity and compliance vendor to top $1 billion in annual revenue last year. Proofpoint also noted the investor’s “operating capabilities, capital support and deep sector expertise,”

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

“This is an exciting new chapter for Proofpoint that would not have been possible without our employees’ hard work and commitment to our customers, partners and each other,” Steele said.

According to CNBC, it’s the largest private equity cloud software deal in history. Hellman and Friedman bought Ultimate Software for approximately $11 billion in 2019. Insight Partners’ purchase of Veeam cost $5 billion.

Details

The announcement starts a 45-day “go-shop” period, in which Proofpoint’s board of directors can seek other purchase offers and possibly terminate the Thoma Bravo deal if a “superior” buyer emerges. However, the companies said they anticipate the $12.3 billion acquisition to close in the third quarter of 2021. The Proofpoint board of directors unanimously agreed to the deal and recommended that Proofpoint shareholders vote similarly at an upcoming special meeting. Shareholders would get $176 per share, according to the terms of the agreement.

Proofpoint announced its first quarter earnings on the same day. The company reported nearly $288 million in revenue, which eclipsed the roughly $250 million that it drove in the first quarter of 2020.

Proofpoint shares jumped from $131 on Friday to $173 on Monday morning following both the earnings report and acquisition announcement.

Seth Boro, managing partner at Thoma Bravo, said his firm will work to drive “continued business growth” for Proofpoint.

Thoma Bravo’s Seth Boro

“Thoma Bravo’s approach to value creation is rooted in partnering with the organization in which we invest and looking for opportunities to both enhance their existing operations and build technology platforms that drive significant growth,” Boro said.

Thoma Bravo last month announced the $2.4 billion acquisition of publicly traded French data company Talend.

Market Trends

Rik Turner, principal analyst in Omdia‘s security and technology team, noted that although Proofpoint has been increasing its top line numbers, its net income has plummeted deeper into the negative.

He said an optimistic take on Thoma Bravo’s acquisition is that the private equity firm is buying cloud businesses and cloud security companies in an increasingly work-from-home era.

“The negative spin, meanwhile, is that private equity firms generally move in when a company is encountering serious headwinds in its chosen market,” Turner said.

Turner said Proofpoint has made the email security market its bread and butter. For starters, Office 365 leads the way in enterprise email services, while Gmail has made in-roads with SMBs. Although secure email gateway providers (SEGs) have migrated to the cloud in order to keep pace with customers, Microsoft’s products increasingly contain overlapping security functions.

Omdia’s Rik Turner

Turner pointed to the rise of ……business email comprise (BEC), which doesn’t rely on bad attachments and URLs. Traditional email security systems can’t detect BEC, because it tends to use social pretexting rather than malware. As a result, many new email security vendors are solely tackling BEC-style attacks and make no pretense of providing secure email gateway. Omdia calls this new type of player “non-SEG.”

“Of course, the secure email gateway community hasn’t sat still, adding functionality of its own to compete with the no-SEG players, but the presence of Microsoft in their neighborhood inevitably puts pressure on their bottom lines, as even Proofpoint, the market leader in SEGs, demonstrates,” Turner said.

Partner Impact

Proofpoint noted last year that it had completely pivoted from fully direct sales to “100% channel.”

“We have now completely converted into a channel company, and all new business going forward goes through the channel,” an executive told Channel Futures in February 2020.

However, it remains to be seen how partners will respond to the news. MSP Reddit users seem less than thrilled. Multiple commenters wrote that private equity acquisitions typically hamper research and development efforts.

Comment from discussion amw3000’s comment from discussion "Thomas Bravo buys ProofPoint".

Dave Sobel, host of the Business of Tech podcast, advised MSPs to keep a watchful eye.

Dave Sobel

“As I note every time an acquisition happens, the product today is the same as the product yesterday. The deal isn’t done, but assuming it happens, expect them to run the same playbook Thoma Bravo leverages,” said Sobel, who added that the “playbook” typically features additional M&A. “Thoma Bravo is buying security companies, so I’d guess a rollup. What that playbook doesn’t promise is R&D investments. For MSPs, it means judge the company based on today’s product, not on any future promises, and have a ‘show me’ attitude to those promises.”

Analyst Perspective

Wedbush Securities’ Daniel Ives called the transaction a “very attractive offer” from Proofpoint’s perspective. He predicted that no other suitors will emerge during the 45-day period. In addition, Ives predicted a proliferation of tech M&A.

“In this cybersecurity arms race and with $500 billion of dry powder among PE/financial buyers and strategic players, we expect a massive M&A spree in the software and cybersecurity space over the next 12-18 months,” Ives said.

Proofpoint first launched in 2002 before going public in 2012. In February, the company announced that it was buying InteliSecure for $62.5 million. InteliSecure provides managed services for data loss protection.

About the Author

You May Also Like