AT&T, Lumen Lead U.S. Ethernet Market as DIA Grows

The growing maturity of SD-WAN and SASE and the accelerated decommissioning of copper are fueling a migration from switched services to dedicated internet access.

The U.S. Ethernet market grew 2.4% in 2023 despite switched services declining in demand, according to Vertical Systems Group.

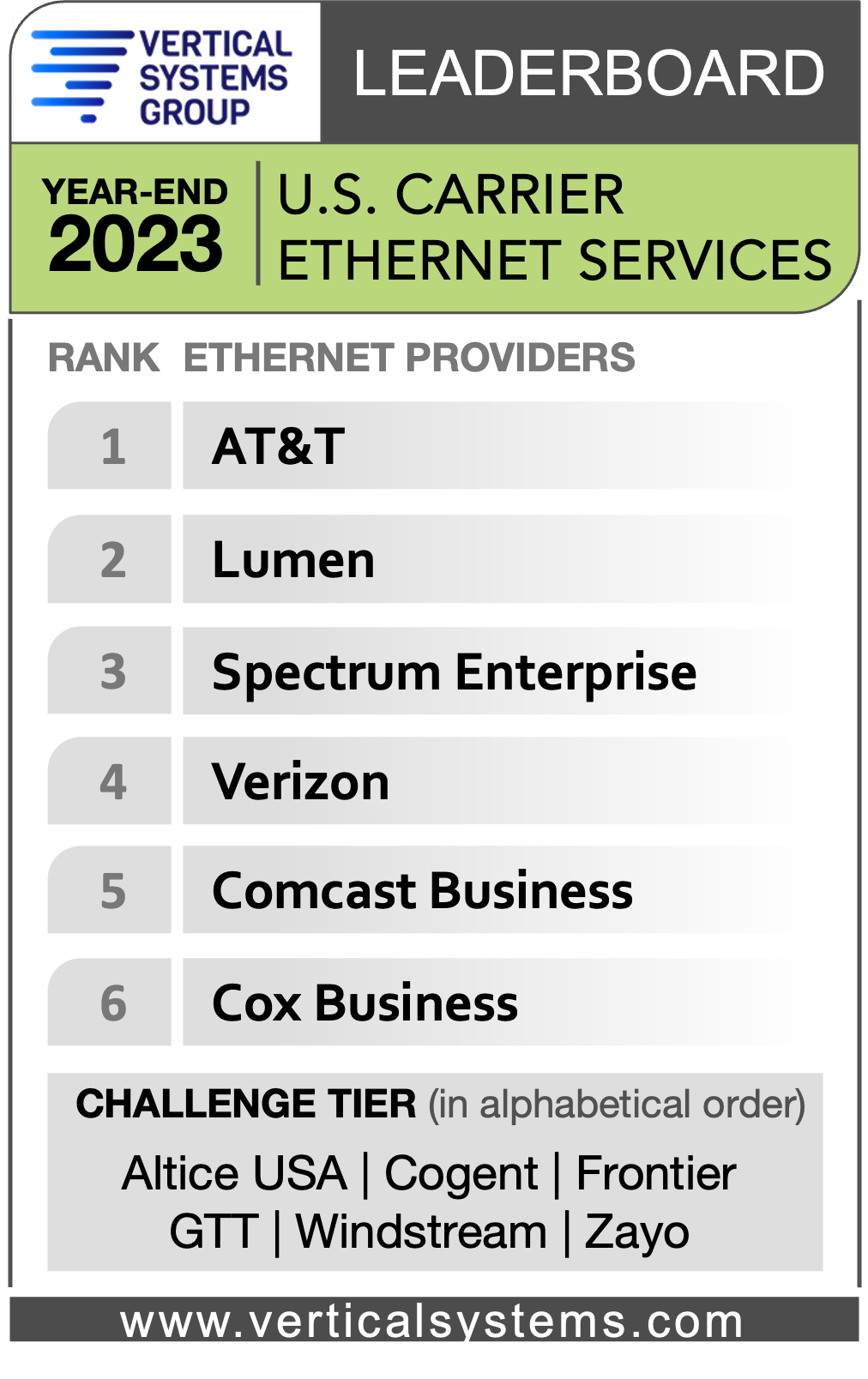

The research firm just revealed its year-end U.S. Carrier Ethernet leaderboard, which AT&T led for the second year in a row. The rankings did not change at all from 2022. Lumen and Spectrum continue to trail AT&T in terms of installed, billable retail customer ports. VSG did note, however, that market share is "tightening" between the leading companies.

The study concluded that dedicated internet access (DIA) is growing more popular as more customers use it to power SD-WAN and SASE architectures. In the meantime, switched Ethernet services are seeing a decline amid widespread copper retirement.

DIA Rise a Sign of the Times

Vertical Systems Group said dedicated internet access (DIA) is growing faster than other Ethernet services. Alternatives include Ethernet private (and virtual private) lines, metro local area networks (LAN), and wide area networks virtual private LAN services (WAN VPLS).

Eclipse chief technology officer Kirk Armstrong pointed to trends at both the customer and vendor level.

First is the maturity of SD-WAN, and now secure access services edge (SASE), are making the public internet a more leveraged source of connectivity in the network.

"As the market for SASE and SD-WAN passes from early adopters and visionaries into the pragmatist or early majority enterprise organizations are continuing to reduce their overall private networking/MPLS requirement in favor of dedicated internet," Armstrong told Channel Futures.

Eclipse's Kirk Armstrong

Accelerating those migrations is the Federal Communications Commission granting forbearance to carriers to retire copper assets. Armstrong said large telcos have been "threatening to do so" to forcibly migrate customers off legacy switched infrastructure for more than a decade.

"With the large telecoms being able to shed their copper assets in favor of Ethernet assets, it is putting an end to the ongoing client decision to kick the can on migration away from switched services," he said. "As this occurs, you are seeing organizations looking at this as a larger strategic initiative to incorporate and adopt new standards in technology both from a transport and network architecture."

Price Stabilization and Compression

VSG concluded that lower-speed Ethernet services have seen stabilized prices. However, gigabit-speed offerings continue to see price compression, according to the research firm.

Nick Enger, president and chief technology officer at ATC, said his consultancy has seen the cost of lower-end bandwidth solutions stabilizing over the past year. He agreed that price compression is occurring and will continue at speeds over 1 gigabit per second.

Josh Mitchell, partner at Arkitech Group, said he still sees competitive pricing for 1 Gbps DIA circuits.

"ISPs frequently share their 'lit building' lists where they promote aggressive discounting for DIA services in buildings where their network already exists," Mitchell said.

Arkitech's Josh Mitchell

Enger pointed to the rise of overlay networking solutions that leverage bandwidth.

"The shift to SD-WAN and SASE products have been more of the focus of the IT buyer as DIA and broadband access have become more commoditized through these products," Enger told Channel Futures. "ATC’s focus has been providing greater efficiency and security in the network through SD-WAN and SASE, compared to simply 'throwing more bandwidth at it.' Further, we are analyzing where applications are housed and how end users are accessing them to ensure the greatest efficiency and security.”

Armstrong also sees technologies like SD-WAN and SASE enabling major changes in companies' networks.

"Organizations are continuing to retrofit their global networks to fit their application lay out within SaaS, cloud, and premise/colocation data center," Armstrong said. "In this migration, enterprises are moving towards SD-WAN/SASE architecture, giving them the ability to not only absorb the current footprint, but the next one and the next one to make their network agile enough to fit their needs."

V1 Datacom president and CEO John Griffin said the study's findings confirm Datacom's experiences.

"Large capacity in data centers continues to compress from a cost standpoint while lower internet bandwidth speeds in business parks and branch locations seems to be stabilizing," Griffin said. "We're also seeing the uptick in DIA vs. private types of connections, and this correlates with the growth in hosted services for both voice and data. We expect this trend will continue to accelerate as more and more businesses adopt a SASE topography."

About the Author(s)

You May Also Like