PC Market Struggles, with Lenovo on Top and HP the Biggest Faller

The party’s over: Shipments of PCs are now in line with the pre-pandemic levels of demand.

The global PC market is struggling as organizations tighten their belts, reports analyst firm Canalys.

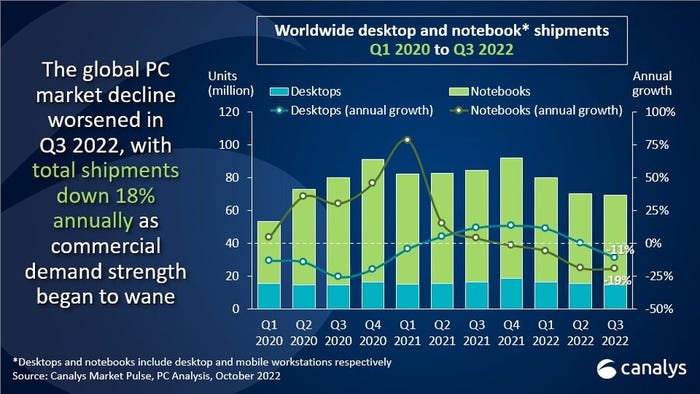

Total shipments of desktops and notebooks fell 18%, to 69.4 million units, in the third quarter.

Canalys’ Ishan Dutt

“It’s quite a large decrease,” said Ishan Dutt, senior analyst at Canalys. “It’s in line with the pre-pandemic levels of demand we saw back in 2019.”

He stressed that supply chain problems aren’t a contributing factor. Instead, the drop-off over the last few quarters was due to falling consumer demand caused by rising inflation and interest rates.

“People just have to spend more money on other stuff because of inflation. They’re pushing back on when they would normally get a new device in order to save up and buy other things.”

Dutt was speaking last week at the Canalys Forum 2022 in Barcelona.

Notebook shipments suffered the most, posting a year-on-year decline of 19%, with 54.7 million units shipped. Desktop shipments proved more robust due to less reliance on consumer spending. Sales dropped 11% year-on-year for a total of 14.7 million units.

Notebook shipments suffered the most, posting a year-on-year decline of 19%, with 54.7 million units shipped. Desktop shipments proved more robust due to less reliance on consumer spending. Sales dropped 11% year-on-year for a total of 14.7 million units.

Lenovo maintained the No. 1 position in the global PC market but suffered a 16% year-on-year drop to 16.9 million units. For the second quarter in a row, HP had the largest decline out of the top five vendors. It posted 12.7 million units, a 28% year-on-year fall. Both Lenovo and HP shipped their lowest totals since the onset of the pandemic in the first quarter of 2020.

Third-place Dell also posted a significant decline of 21% in shipments, posting just under 12 million units. Apple enjoyed a better quarter than its competitors as it fulfilled orders from Q2 delayed due to supply disruptions in China and launched new M2 MacBook. It sealed fourth place with 8 million units, a modest year-on-year increase of 2%. Asus rounded out the top five with 5.5 million units, an annual decrease of 8%.

However, Canalys said despite the current environment, the importance of PCs to support new workstyles and digital transformation goals remains high. Older devices in the installed base will need to be replaced and the market is expected to see recovery by the second half of 2023.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email Christine Horton or connect with her on LinkedIn. |

About the Author(s)

You May Also Like