Why Cloud Service Providers Are Fundamentally Changing and IT Vendors Need to Do The Same

Vendors are part of a broader system that requires compatibility, transportability, integration and technology choice.

July 10, 2019

By Rory Duncan

Rory Duncan

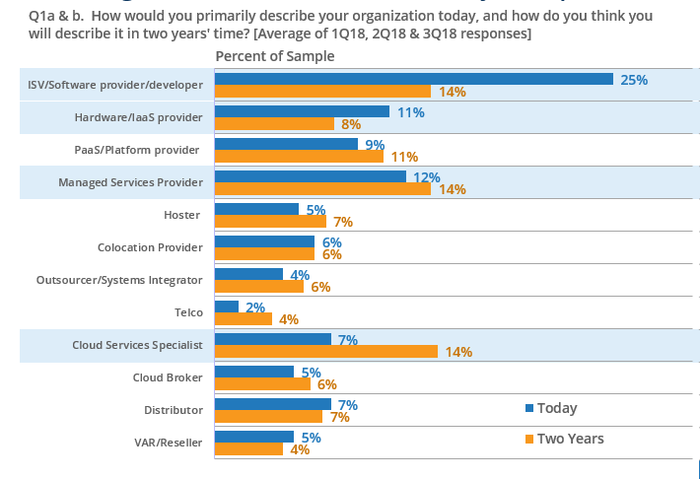

Over the last year, IDC‘s Service Provider Pulse surveys have shown the increasing shift in service providers’ business models as more firms pivot to address the opportunity for cloud in the infrastructure, application, managed and professional services space. But the shift is not being seen equally: As pure infrastructure service provision loses its status as the key revenue-generating activity, other services become more attractive.

There has been a gradual move away from pure infrastructure service provision to PaaS, managed services and specialist cloud services. Much of this has been led by ISV’s, but also by VARs and distributors moving into cloud service brokering. The rise of cloud service specialists has also created further dynamism — whether via digital archiving, managed cyber disaster recovery as a service or a whole host of industry applications. Managed services attain higher profitability, application services address vertical needs and professional services bridge the gap left by vendors. Service providers are also becoming less clearly defined by type, associating more with what they offer — effectively blurring the lines between types of provider. The steady move to offering solutions that are multivendor and multicloud is apparent, reflecting the stated preferences of their clients.

The service-provider market globally is large, diverse and growing. While technologies and the vendors behind them have come and gone, many providers have maintained a presence in the IT market, while others have emerged to fill the gaps left by vendors’ inability to address go-to-market requirements and skill sets. Cloud is no longer a “special case”: It represents a burgeoning opportunity for service providers, while creating skill-set and delivery challenges across the supply chain.

Service providers are aware of this opportunity. IDC’s Service Provider Pulse surveys have shown that providers are increasingly optimistic about their business performance, with 64% of those surveyed in 2018’s fourth quarter expecting to exceed their plan in 2019. This is a small, but significant increase on 2018, where the 2,000 companies surveyed saw incremental cloud services revenue of around $3.2 billion globally.

Courtesy IDC

The financial benefits are reflected in the current global economic cycle that continues to favor new service investment by service providers as a response to demand from their enterprise clients. IDC’s 1Q19 Cloud Pulse survey shows that IT spending by firms is diverse and encompasses many different technology areas. Research across IDC continues to show that we inhabit a multicloud, multivendor, hybrid-inspired world — one where vendors are expected to adapt their approach to cloud service ecosystem development if long-term partnerships are to flourish.

There are good reasons for some of these demands:

Regulatory requirements — industry standards and regulations often require cloud vendor platforms and services to be certified for specific industries e.g. ISO, HIPAA, Basel III, G-Cloud and others in order to provide cloud services to that industry at all. Not every technology or platform can offer compliance, reducing choice of vendor and/or service provider.

Location and privacy requirements — national, regional and federal privacy laws may require data hosted on a vendor’s cloud platform to be physically located in-country. If this is not explicitly available, vendor or platform choice may not be possible. For example, Google doesn’t have a Google Cloud region in France (it does have PoPs though), while Amazon Web Services and Microsoft Azure do. At the same time, Google has a region physically located in Switzerland, while the other vendors do not. Elsewhere, Spain, Eastern Europe and North Africa have a lack of dedicated data-center presence by most of the key cloud platform vendors except for IBM.

Service Availability — application workloads requiring a specific cloud service are not available to all customers in all regions. For example, Google’s App Engine is not available as a service in its asia-southeast1 (Singapore) region, but it can be accessed via its asia-east2 (Hong Kong) region providing you don’t need to use Cloud Composer in that region. Other cloud vendors have similar variations in infrastructure service availability.

While it is understandable that not all cloud services will be available in-country to all customers in all regions, it does shed light on …

… some of the decisions that end-users make — often in conjunction with the service providers. Questions about practicality, latency and data residency – not technology – will often determine service choices and the “mix” of vendors used.

Embracing the need for multicloud and multivendor should not be controversial. A growing market for cloud services fueled by end-user demand and delivered by profitable service providers sounds like a win-win-win, but it creates a dilemma for technology vendors. With more choice than ever, many enterprise firms and service providers have moved workloads to an opex model for IT — but generally not via a single cloud model, rather buying into multiple services from multiple vendors. Perhaps too much choice can be a bad thing, but it means vendors that are used to competing, now must embrace cooperation — at least when it comes to interfacing with end users and their workload requirements.

This vendor collaboration is reflected in the increasing focus on service provider “sell with” strategies. Solution selling is the most important sales strategy that providers will employ over the next 12 months, according to the IDC 2Q18 Service Provider Pulse survey of 500 companies. Rather than offering a solution incorporating service X with product A, many service providers are looking to craft more complex, industry-specific and/or niche offerings that may require a combination of service X and Y with product A, B and C. This is particularly the case with the infrastructure management requirements of cloud workloads, incorporating managed security, backup, performance management, etc., as well as emerging technologies such as artificial intelligence/machine learning and the internet of things (IoT).

Advice for the Technology Supplier

The burgeoning opportunity for cloud services, combined with the desire to create multicloud, multivendor solutions, is a reality for service providers and their customers today. However, market dynamics can change, and as a supplier of cloud platforms and technology to the service provider market, there are two potential medium- to long-term scenarios to consider.

The first scenario is that political and economic uncertainty could change the opportunity profile for service providers. Potential trade wars and tariffs (US/China), the U.K. leaving the European customs union, GDP at a historic low in the EU, Japan’s slowing economy and declining export levels could – should they continue – potentially stall investment and put cloud service spending on hold. Even if the financial crisis of the late 2000s is not repeated, the potential to disrupt is strong.

Ironically, a global downturn – or slowdown – may benefit many vendors. Static or reduced budgets will result in tough choices — less money for fewer services, potentially from fewer vendors (i.e., a narrowing of focus). Service providers will again need to work hard to survive, with many reducing their vendor bandwidth due to resource and budget restrictions. Less vendor choice will focus minds on the global cloud vendors with the widest portfolios. Bundling and upselling will become competitive and impact generic service integrators and others. This in turn may result in …

… enterprises re-investing in physical infrastructure — slowing the gradual move away from on-premises IT.

Were this to happen, established vendors and platform providers may benefit from inward investment in data centers (servers, storage, networking) and related services (colocation, interconnect, etc.) at a regional level. “One stop shop” vendors will be able to attract service providers looking to optimize their spend in order to supply services more efficiently to clients.

The other scenario is that any geopolitical, economic or regulatory factors will have little (if any) effect on the growing market for cloud services. The desire for deeper solution creation with multiple vendors in a more complex, multicloud world will enhance the need for collaboration and coopetition among vendors.

Vendors may need to follow the business model pivot that the cloud service providers are undertaking — service integration, technology transparency, architectures and APIs that are much more open and encourage solution creation and platform coexistence. What if it were relatively easy for a service provider to, for example, run Google Analytics on data hosted on a client’s Microsoft Azure website, or if they could seamlessly deploy Amazon Web Services virtual machines without a full-scale migration to another platform? There have always been strategic partnerships between formerly competing vendors and such collaborations are still being announced; for example, VMware cloud running on Amazon Web Services EC2, or even Microsoft’s increasing move away from enforcing the Universal Windows Platform to embrace open-source collaboration with competing operating systems.

Many believe it is naïve to suggest that this should be possible with every cloud platform and vendor technology, but it might not even be a requirement if moving workloads from one platform to another (and back again) were easy and transparent. Platform and technology vendors often see themselves as the “endpoint” of cloud. That all workloads and data streams should connect to – and ultimately culminate in – their product or service environment. This largely monotheistic view of technology may have been appropriate in the past, but in a multicloud world, it is much less so — and even off-putting to many enterprises and their service providers.

Following the example that service providers have set, technology vendors and platform providers should acknowledge that they are part of a broader ecosystem that requires compatibility, transportability, integration and technology choice based on in-situ customer requirements. This will help significantly in realizing the growing opportunity for cloud service partnerships.

Rory Duncan is research vice president for cloud service providers, responsible for the business growth of IDC‘s panel-based syndicated service provider research. Rory’s role involves the building of insights for, and relationships with, IDC’s strategic service-provider clients and vendors in the associated ecosystem. This includes conducting primary research, developing written reports and client presentations as well as leading consulting projects. See what he’s up to on LinkedIn.

You May Also Like