A Simple MSP Trick to Fund Infinite Growth with Cloud Services

Nearly every small business is faced with a cash flow shortage at one point or another. For many MSPs, it is a common recurring problem.

May 19, 2016

Sponsored Content

Nearly every small business is faced with a cash flow shortage at one point or another. For many MSPs, it is a common recurring problem. The irony is that a cash flow crunch is often due to the success of the business, rather than its impending demise. According to FinPacific Treasury Systems, “70% of businesses which go bankrupt are profitable when they close their doors.”

How does this happen? Often, a business begins to grow at a rapid pace while having payment terms with their suppliers that are less favorable than the ones they have with their customers. For example, an MSP may owe its supplier 15 days after purchase, while its customer pays them 30 days after purchase. In that case, exponential growth will stress their cash flow quickly because the business has to pay for purchases in advance of its customers’ payments.

While there are numerous ways to raise cash one of the most favored (but not necessarily preferred) ways is to do it with other people’s money. This can be done by:

Seeking venture capital

Soliciting private equity

Funding traditional debt

Getting a small business loan

Floating a cash balance on a credit card

All of these are fraught with potential downsides, including giving away equity and paying huge interest payments.

The Road to Infinite Growth

What if there were a better way? Well, there is when it comes to MSPs growing their business with cloud services. These partner-friendly service provider models allow MSPs to pay their bills in arrears. That is, they are charged at the end of the service term rather than the beginning.

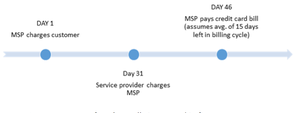

Take Workspace-as-a-Service, for example. In the WaaS model, as with many other MSP services, the MSP can charge for its service in advance. That is to say, the MSP can charge for a full month the day the service is initiated and continue this every month thereafter.

What will following this financial model do for the MSP? Well, it guarantees that the MSP will end its cash-flow problem for WaaS and any other cloud services it bundles. This provides MSPs the opportunity to infinitely grow a cloud services portfolio without any concern for cash flow. Why? Because the MSP is receiving customer payments 30 days in advance of having to pay for these services.

Essentially, the service provider is funding your growth. No matter how many new subscribers you add, the service provider is getting paid after you receive payment from your customer. If you are able to charge your payment to the service provider, that provides you, on average, an additional 15 days in which to cover your credit card payment with cash.

FINANCE NERD ALERT: If you’re really interested in finance or accounting, let me keep you out of a terrible debate. If you’re not, please skip to the next paragraph. Some have called the situation described above as “negative working capital”. Nope, it can’t be. Working capital is defined by Investopedia as “Current Assets – Current Liabilities”. Now, what is a current asset or current liability? “Current assets are balance sheet accounts that represent the value of all assets that can reasonably expect to be converted into cash within one year.” Current liabilities are defined similarly. The important aspect to note is the comment about “one year.” In this scenario, both the asset and the liability will be converted within the year so they offset. Furthermore, your assets (that is, your charges to customers) should be more than what you owe the service provider for the WaaS service, making the equation positive, not negative

So, what do you have? A smart business model creating tremendously positive cash flow that infinitely funds your cloud services growth.

You can avoid the cash-flow problem and add recurring revenue to your portfolio by bundling cloud services like WaaS. Ready to get started on the road to recurring revenue and increased cash flow? Click here to find out how to get started.

Larry Hart is SVP Marketing and Cloud Solutions, Artisan Infrastructure. Guest blogs such as this one are published monthly and are part of MSPmentor’s annual platinum sponsorship.

Larry Hart is SVP Marketing and Cloud Solutions, Artisan Infrastructure. Guest blogs such as this one are published monthly and are part of MSPmentor’s annual platinum sponsorship.

You May Also Like