The Man Behind CloudStack: How Citrix Became Strategic

How exactly did Citrix Systems (Nasdaq: CTXS) go from super-boring software (multi-user code and the ICA protocol) to extremely strategic (desktops as a service, virtualization, mobile computing, collaboration and cloud computing)? The VAR Guy has the oft-overlooked answer.

April 12, 2012

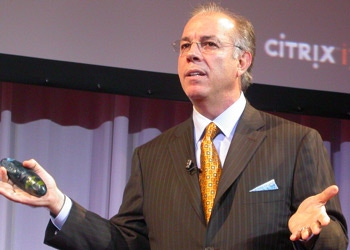

citrix systems ceo mark templeton

How exactly did Citrix Systems (Nasdaq: CTXS) go from super-boring software (multi-user code and the ICA protocol) to extremely strategic (desktops as a service, virtualization, mobile computing, collaboration and cloud computing)? The VAR Guy has the oft-overlooked answer.Led by former marketing executive Mark Templeton, Citrix has acquired roughly 30 companies since 1999, including today’s Podio purchase. The Citrix evolution is a two-decade story worth reviewing — especially for channel partners that are seeking to push far beyond traditional product reselling.

Right now most folks are focused on Citrix CloudStack, a cloud computing platform that could wind up competing with OpenStack in some areas. But CloudStack is a very small piece of the Citrix story.

To see how the bigger picture developed, rewind to the 1990s. Citrix had a hot multi-user software technology for Windows NT Server. Ah, good old WinFrame. But every few months, Microsoft threatened to end a licensing relationship with Citrix. Alas, Citrix stock rose or fell based on the perceived health of its Microsoft relationship.

The VAR Guy Missed the Mark

Around 1997, a Citrix “marketing” executive visited The VAR Guy on Long Island. The discussion, held at Windows Magazine’s offices, focused on how Citrix planned to expand its business while maintaining the Microsoft relationship.

Always skeptical, The VAR Guy was convinced the Citrix marketing executive’s plan would fail and Microsoft would crush — or buy — Citrix.

Boy, was The VAR Guy wrong.

CEO In the Making

That Citrix “marketing” executive was VP Mark Templeton, who went on to become Citrix president in 1998 and CEO in 2001.

What does a marketing guy know about building and running a channel-focused software company? Plenty.

Back in 2001, Citrix annual revenues were $591.6 million and net income was $105.3 million. By 2011, annual revenues topped $2.2 billion, and net income was $356 million.

So how did Templeton and Citrix blow past the $2 billion annual revenue mark over a 10-year period when so many software companies — Borland, Novell, PeopleSoft, Siebel — struggled to remain (A) independent or (B) relevant?

The answer: Citrix used small, targeted, highly strategic acquisitions that kept pushing the company — and its channel partners — into emerging markets rather than mature markets.

Small Deals, Big Results

Indeed, Citrix has acquired roughly 30 companies since 1997. The latest such deal — involving Podio, a social media company — surfaced today. Many of the other deals were below-the-radar acquisitions. But the results have been startling. According to Citrix’s standard presentation from investor relations, the company now serves:

99 percent of the Fortune 500

230,000 customers

80 percent of public clouds

1,000 customers with more than 1,000 licenses each

75 customers with 10,000 licenses

Four Areas of Focus

The Citrix business is now organized into four product categories:

Desktop Virtualization: Such as Xen Desktop, XenApp, VDI-in-a-Box and GoToMyPC

Networking: Including the NetScaler product line for performance and security

Data Center and the Cloud: XenServer, CloudStack, and more

Collaboration and Support: GoToMeeting, GoToManage and more

That product portfolio means Citrix is striving to compete with everyone from Cisco and Microsoft to VMware. Yet Citrix also manages to partner with some of its rivals — such as the Cisco-Citrix partnership involving XenDesktop.

Where to Next?

So where is Citrix heading next?

Turn your attention to the Citrix Synergy conference (May 8-11, San Francisco). Look at the agenda closely enough and you’ll find a related partner summit on May 7-8. Surprises are coming, folks.

Citrix certainly isn’t the highest-profile software provider or cloud company in the world. And Citrix Stock — at around $74 — still trades below its all-time high in 2000 (of around $105.44, according to Yahoo Finance).

Still, Citrix keeps growing. Partners keep selling. And Mark Templeton keeps finding new M&A targets…

About the Author(s)

You May Also Like