Partnerships Accelerate as Enterprises Embrace Hybrid Clouds

AWS, Azure and Google Cloud are hooking up with SAP, Red Hat and VMware.

May 10, 2019

IT vendors increasingly are partnering with hyperscale cloud providers to give enterprises easier onramps into the hybrid cloud, simplifying the planning and deployment of their environments and ensuring a single place to call for support and service.

Such partnerships have been going on for the past few years, but they are accelerating, as seen over the last couple of weeks. Late last month during the Dell Technologies World show, the company announced a cloud strategy – Dell Technologies Cloud – that relies on tighter integration between VMware Cloud technologies and Dell EMC hardware. At the same time, it was announced that VMware Cloud – which also runs on Amazon Web Services (AWS), Alibaba Cloud and other cloud environments – will now run natively on the Microsoft Azure, enabling customers to access VMware Cloud Foundation through Azure.

This week saw a number of similar announcements. Red Hat, which is IBM is on the verge of buying for $34 billion, said its OpenShift container platform – which already can run on most public clouds – is now available as a service on Azure, again enabling organizations to get the technology directly from Azure rather than having to buy it from Red Hat and deploy it in the Microsoft cloud.

AWS tightened its partnership with VMware, announcing that VMware Cloud can now be bought through AWS and partners in the Amazon Partner Network (APN). At the same time, the companies said they are expanding the services available to enterprises, including AMD Epyc-based Amazon EC2 R5 instances and Outposts for VMware, which will become available in the second half of the year.

AWS’ Sandy Carter

The new purchasing option “allows customers the flexibility to purchase VMware Cloud on AWS either through AWS or VMware, or the AWS Solution Provider or VMware VPN Solution Provider of their choice,” Sandy Carter, vice president of AWS’ Windows and Enterprise Workloads business, wrote in a blog. “When purchasing through AWS, customers can also take advantage of AWS field promotional programs like the AWS Migration Acceleration Program (MAP), which allows you to reduce operating costs and gain greater agility, global scalability and resiliency options for IT workloads when migrating to AWS.”

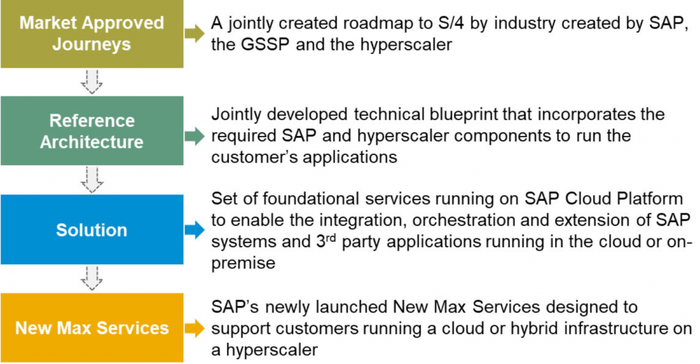

For their part, officials with SAP – the enterprise software vendor that has been making an aggressive push into the cloud, particularly with its HANA in-memory platform – announced its Embrace program, created in collaboration with AWS, Azure, Google Cloud Platform and various service partners as a way to help customers move their HANA workloads into the cloud. The program is designed to help enterprises through the entire process, from planning, to the selection of the infrastructure, platform, software and service they’ll use to deploy and support via SAP’s New Max Services offering.

SAP’s Stefan Hoechbauer

“When migrating SAP landscapes to a hyperscaler cloud, SAP is in a unique position to offer a portfolio of differentiating services,” Stefan Hoechbauer, global president of digital core and global customer organization at SAP, wrote in a blog. “Above all, SAP’s choice of on-premise[s], cloud and hybrid scenarios is quite unique. While it’s undebatable that the future is in the cloud, customers want to choose their own pace.”

In addition, Google Cloud is making SAP’s HANA Enterprise Cloud a fully managed service in the public cloud, expanding the two-year partnership between Google Cloud and SAP.

This acceleration of partnerships isn’t surprising, particularly given …

… the rush to the cloud by enterprises and the desire of tech professionals to make an increasingly complex IT world a bit simpler, according to Rob Enderle, principal analyst with The Enderle Group.

Enderle Group’s Rob Enderle

“IT is increasingly looking for one throat to choke, meaning they don’t want to be their own general contractor,” Enderle told Channel Futures. “They want a firm to own the deployment and the related risk given it is the firm promising to accomplish the task. No firm can do it all and this means a fight to see who can have the most relevant partners and best execution.”

For those IT staffs that own the project at their companies, “this takes the target off them for execution and puts it back on the vendor who won the bid. Users do get systems that are more likely to go in timely and run as anticipated, though, so there clearly is a user benefit,” the analyst said.

Enterprises are pushing to adopt multicloud and hybrid cloud strategies, which increase the complexity of their environments and cause more management headaches. According to the latest RightScale cloud report released earlier this year by Flexera, 84% of organizations are embracing multicloud and 69% are adopting hybrid clouds.

All of this opens up opportunities for channel partners that are prepared to take advantage of them, according to Enderle.

“For those that know how to partner, do so well and have well-regarded products, this is a huge sales boon as they become the favorite dance partner at the prom,” he said. “However, for more obscure firms [that] don’t have these advantages, they could increasingly find themselves locked out of the market. This makes it significantly tougher for new companies with solutions that are very different from the norm because they’ll need to find a way to displace a working partnership relationship.”

One way for a channel player to do that is to “go into the firm that is the general contractor through their [venture capital] arm so that the firm invests in them; then the investment arm will push them into the logistics chain.”

About the Author(s)

You May Also Like