MSP Analysis: Which is the Best RMM and PSA?

Consulting firm Clarity Channel Advisors conducted an independent review of the top MSP platforms to give service providers an objective perspective of this dynamic marketplace.

October 7, 2016

By Jim Lippie 1

The RMM/PSA ecosystem is in the midst of consolidation and the competition is getting fiercer by the day. With all the marketing rhetoric from vendors, it can be difficult to determine which platforms offer MSPs the greatest advantages. As the war of words has escalated over the last several months, Clarity Channel Advisors thought it would be beneficial to conduct an independent review of the top MSP platforms to give service providers an objective perspective of this dynamic marketplace.

Who is Jim Lippie from Clarity Channel Advisors?

Clarity Channel Advisors (Clarity) works with MSPs and the vendor community to develop comprehensive and successful cloud strategies for the channel. We are also the official data-aggregation partner for the MSPmentor 501 and serve as a Penton Media expert contributor. Jim Lippie is the founder and CEO of Clarity and knows what it’s like to be an MSP. From 2005 – 2012, he was the president and CEO of an MSP called Thrive Networks located in Boston. Thrive Networks was sold to Staples in 2006 where Lippie continued to grow the business into a national provider before leaving the organization in 2012.

Market Context

The industry has certainly changed a lot since Thrive Networks started its managed services practice in 2003. Managed services were initially built on RMM tools, then they needed a PSA to better manage client operations and now MSPs need seemingly dozens of tools to address the evolving needs of the SMB community they serve. However, over the last few years the vendor community has started to consolidate with PSA vendors acquiring RMM capabilities and vice versa. Vendors have created “platforms,” instead of specific one-off applications in the quest to provide MSPs with a “one stop shop” for all of their needs.

If architected correctly and with the needs of the MSP at the forefront, Clarity believes that the vendor platform approach can be very beneficial for service providers. However, vendors in this space have taken different approaches to creating their platforms – with some weighted towards automating the internal business processes of an MSP (PSA-centric) and others focused on broadening the service portfolio of MSPs (growth-centric) in order to expand their revenues. What’s the best way to evaluate these MSP platforms? This is the task that Clarity has decided to take on for the benefit of the MSP community in a “Consumers Report” approach to the “MSP Platform.”

There are a number of fantastic vendors in the MSP ecosystem, but we couldn’t review them all, so we decided to select the top 4 vendors who have integrated RMM/PSA suites. Those vendors are:

Autotask

ConnectWise

Kaseya

Solarwinds MSP

Disclosures:

Over the last decade, Jim Lippie has worked with all four vendors. At Thrive, he was an early adopter of ConnectWise (ConnectWise CEO Arnie Bellini actually performed Thrive’s implementation). Lippie also used N-able (now Solarwinds MSP) to monitor all clients’ servers, and Kaseya to monitor client end-user devices. Thrive still uses both vendors to this day. In addition, LogicNOW – now Solarwinds MSP – was a sponsor of one of Clarity’s recent advisory groups, and Lippie has hosted webinars with and/or spoken at every one of these vendors’ annual user conferences. So, in short, going into this exercise, the reviewer was not partial to any of the vendors and has, in fact, had positive experiences with all of them.

Methodology:

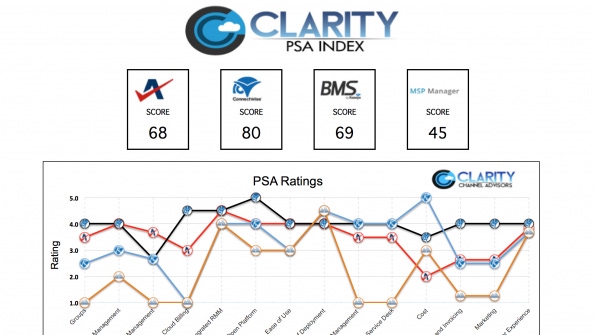

Clarity developed the evaluation methodology based on the general needs of the typical service provider and performed our own independent analysis based on those criteria. We approached this exercise as if we were an average-sized MSP looking to scale our business. The four platforms evaluated all have integrated an RMM/PSA offering, which was a requirement. A grading scale was used for each vendor’s offering and placed into a line graph with a score of 1 – Poor, 3 – Average, and 5 – Exceptional.

In the final analysis, vendors were given extra credit for having additional important components within their platform. We also factored in industry trends that should be considered by service providers when evaluating new products. Clarity hired an independent consultant to analyze the four platforms and Jim Lippie from Clarity reviewed the data, considered trends, accounted for the extra components and authored the final analysis.

When evaluating the RMM capabilities we reviewed the following 16 core capabilities:

System Security

Scale

Admin Productivity

Technician Productivity

Discovery / Monitoring

Asset Inventory

OS and Software Patching

Policy Management

Automation

Reporting / Dashboard

Integrated PSA

Open Platform

Endpoint Security

Backup

When evaluating the PSA capabilities, we reviewed the following 14 core capabilities:

Groups

Contract Management

Sales Management

Cloud Billing

Integrated RMM

Open Platform

Ease of Use

Ease of Deployment

Project Management

Service Desk

Quoting and Invoicing

Marketing

User Experience

RMM Commentary

As indicated by the total index score, Kaseya was the outright winner when evaluating the RMM capabilities of each platform and was ranked first or second in core capabilities. Kaseya excels in the area of automation and technician productivity which is highly critical in a competitive landscape where fixed fee engagements have become the norm and MSPs need to drive employee efficiency to realize satisfactory profit margins. Kaseya also offers better scale around its functionality and gives service providers more features to impress clients, which is the most important aspect of any MSP platform.

Click here to view the full RMM evaluation.

PSA Commentary

ConnectWise is the most mature and feature-rich PSA for service providers, as their index score indicates. While a portion of the functionality within ConnectWise is essential to operating a quality service provider business, there are also a fair number of features that the average MSP will never use, despite paying a premium for the product. In addition, the ConnectWise interface feels more and more crowded and the web version fails to impress because it’s a client server application that has been “shoe horned” into SaaS. So, while ConnectWise beats out its competitors in the PSA race based on overall maturity and quantity of features, it’s a much closer race for those who prefer a more cost effective, web based solution with a cleaner interface like Autotask and Kaseya BMS.

Click here to view the full PSA evaluation.

Extra Credit

The extra components of each platform is where the companies really start to separate themselves. Autotask has added file/sync/share capabilities to complement a very solid PSA and a subpar RMM tool. Based on the LogicNow acquisition, Solarwinds MSP now has machine learning (Logic Cards) and their own back up solution to accompany a robust RMM package. However, their PSA is very immature. So when reviewing the “extra components” to each platform, it really becomes more of a two-horse race.

Both ConnectWise and Kaseya have made significant additions over the years to go well beyond RMM/PSA. ConnectWise boasts the attributes of the “ConnectWise Business Suite” and Kaseya has packaged all of their products into a bundle called �“IT Complete”. With ConnectWise’s investments in Quosal and ScreenConnect, they have incorporated two mainstay functions of every MSP, quoting and screen share/remote control. In addition, they’ve added functionality around Office 365 administration and cloud billing with “Cloud Console”.

Kaseya, backed with the resources of their private equity firm owner (Insight Venture Partners), has added AuthAnvil (two factor authentication security, which many MSPs use for themselves or provide as a service to their customers), 365 Command (Office 365 administration) and Traverse (enhanced performance monitoring for complex data center and hybrid cloud networks) to round out their portfolio of services.

When it comes to the “extra credit” components, ConnectWise and Kaseya really separate themselves from the pack in the “MSP Platform Wars”

Looking Ahead

An important variable for MSPs looking ahead will be the interoperability between all of their tools, which is why it’s important for MSPs to select vendors that have a clearly stated “open” roadmap that includes integration with all the software providers in the ecosystem. In the years to come, it will be even more critical for service providers to keep their costs down in order to stay competitive and keep margins healthy. One of the ways to keep costs to a minimum is by ensuring MSPs are keeping their vendors honest with the real threat of migrating to another vendor.

Service providers can maintain this threat by working with vendors that are open and integrate with all relevant third party solutions. However, if an MSP finds themselves in a relationship with a vendor that starts to “freeze out” competitive products and 3rd party applications, they need to question the intentions of that vendor to avoid being locked into a “closed platform”. Clarity certainly sees the value and efficiency associated with a single platform, however, that platform needs to be open to other vendors; otherwise, the MSP loses leverage in future pricing negotiations or the ability to take advantage of future innovations.

Labor efficiency has always been important for MSPs. However, with SMB clients pushing for more fixed fee engagements, labor management will become even more critical going forward. Labor management can be tackled from two fronts; first by making employees more efficient, and second, by hiring less expensive resources. Both objectives are achievable with better automated tools.

Clarity believes IT documentation applications (example: IT Glue) will take on added significance in the years to come because a quality documentation tool creates prescriptive “run books” for technicians to follow when troubleshooting client issues. There is also a “search” function in documentation applications that can save technicians a tremendous amount of time when dealing with client issues. The combination of these benefits will allow MSPs to hire less expensive technicians and make them more efficient, thus improving the bottom line.

Lastly, Clarity believes that MSPs will need to move upstream to broaden their service portfolio and manage the needs of larger companies as their 10 to 20 person SMBs clients turn to more self-service solutions. So, when evaluating platforms, it’s essential to identify products that will help drive revenue opportunities with larger sized clients.

Ultimately, the aforementioned trends and factors are important to consider when evaluating MSP growth platforms.

And the Winners are……

After conducting our independent analysis, matching the vendor data points to our criteria, evaluating overall platform strategies and looking ahead to the future of the industry, if Clarity were to select an MSP platform today to scale a service provider practice, it would be with Kaseya.

Kaseya was the clear winner in the RMM/growth-centric competition, especially excelling in the important area of automation. They also have AuthAnvil, their own security product which is important since MSPs and their SMB customers consistently highlight security as a top priority. In addition, Kaseya has an enhanced monitoring product called Traverse, which goes far beyond traditional RMM and allows MSPs to move upstream to capture larger sized clients and bigger recurring revenue contracts. These are both important areas that ConnectWise has yet to appropriately address and in the end Kaseya helps MSPs drive more potential revenues.

ConnectWise won the PSA-centric platform competition with a more mature feature set, but their web based solution still leaves a lot to be desired. More importantly, in a world where IT documentation becomes essential for labor management, the overall role of the PSA becomes less important. This trend makes a lower cost PSA with core capabilities (ticketing/CRM) and a better interface that integrates with the leading IT documentation applications a much stronger play.

Lastly, each of the four platforms evaluated integrate with many of the other key MSP applications, however, ConnectWise is starting to signal signs of a more closed approach when dealing with the other competitive vendors. Based on the importance of interoperability, ConnectWise, while a comprehensive platform, receives negative points for their stated future integration roadmap with their competitors.

Unfortunately for Autotask, while they have a strong PSA tool, their RMM and extra capabilities fall well short of both ConnectWise and Kaseya. On the other side of the equation, Solarwinds MSP has a solid RMM product, but a very lackluster PSA component.

Again, when reviewing the criteria, adding up the extra platform components and looking ahead to the future, Kaseya becomes the clear winner in the MSP Platform war.

Parting comments:

This analysis and ultimate finding isn’t meant to be critical of the other platforms or the thousands of service providers who have chosen those vendors over the years. Rather, this analysis is intended to be an open and honest assessment of where the marketplace stands today. Of course, there will be those who agree, disagree and/or are critical of this exercise — perhaps because they have been successfully using other products for years or they have been drinking gallons of vendor “Kool-Aid” for as long as they have been in business, all of which is fair, everyone has their own perspective.

However, the one thing we can all agree on, is that the managed services industry has changed over the last several years and will evolve even more over the next several, so every service provider needs to focus on selecting and leveraging platforms that will allow them to maximize revenue opportunities and drive down costs.

You May Also Like