LinkSource and The Monaco Group, both successful partners in the Intelisys ecosystem, are joining forces with Upstack.

Berkshire-backed Upstack has announced the purchase of two award-winning channel partners.

The technology advisor company unveiled its acquisitions of LinkSource Technologies and The Monaco Group (TMG). The deals, whose financial terms Upstack did not disclose, bring two of Intelisys’ top partners into the Upstack family. At a high level, buying LinkSource gives Upstack a pathway into hardware sourcing, and The Monaco Group gives enterprise-focused advisory services. Moreover, both agencies bring Upstack deep customer bases that the partners have developed over the years.

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

Leaders at both acquired companies stated that the resources and people at Upstack would help them grow their businesses. Upstack boasts more than $50 million in private equity funding from Berkshire Partners as well as more than $100 million in financing from MidCap Financial and Morgan Stanley Private Credit.

LinkSource

The Upstack-LinkSource deal brings Kelly Moore, LinkSource vice president of client services and operations, vice president of sales Frank Mastro and other LinkSource employees to Upstack.

LinkSource’s Jason Newbold

LinkSource/Upstack’s Frank Mastro

Meantime, LinkSource CEO Curt Lewis and president Jason Newbold remain what they call invested owners in LinkSource Technologies. Upstack, in addition to buying LinkSource’s network and cloud business, has formed a strategic partnership with LinkSource’s hardware services arm. Lewis and Newbold will oversee that arm – LinkSource Systems – and the relationship with Upstack.

“We’re excited about our partnership with Upstack, which has the wherewithal to help LinkSource Technologies in its next phase of growth,” Newbold said. “Upstack has the resources to serve the growing needs of our global customers as well as provide greater career opportunities for our employees.”

Choosing Upstack

Lewis said other potential investors approached his team, but they saw Upstack and its backers as the best fit.

Moore pointed to dedicated customer experience resources at Upstack. Lewis said the people at Upstack and their business philosophy helped solidify the decision.

LinkSource/Upstack’s Kelley Moore

“It wasn’t just the dollar figure; we wanted a go-forward plan for growth and opportunity, and Upstack delivered,” Lewis said.

LinkSource’s Curt Lewis

Evolution and Intelisys

LinkSource evolved over the years to add hardware services such as IT asset disposition (ITAD) and equipment sourcing. It won Poly’s 2021 best new partner award. Many members of the channel have dubbed the partner a poster child of the “hybrid distribution” strategy Intelisys parent company ScanSource has championed. Technology advisors in that hybrid posture source cloud software and carrier services through the traditional agent/broker model while also sourcing hardware and physical infrastructure through a resale model.

LinkSource also provides managed services, including telecom expense management and bid management.

Upstack’s Christopher Trapp

“Curt and Jason have built LinkSource into a unique and impactful technology management business that combines a traditional commissioned agency with a direct-billed managed services provider,” Upstack founder and CEO Chris Trapp said. “The combination has earned loyal customers among some of the most well-known enterprise brands. We’re excited to bring those capabilities and customers under the Upsatck umbrella.”

25-year-old LinkSource’s ties with Intelisys run deep. LinkSource in 2019 reached $1.5 million in monthly recurring revenue billed with Intelisys, earning platinum plus partner status.

The Monaco Group

The Monaco Group (TMG), a Boca Raton, Florida-based partner, represents a major feather in Upstack’s consolidation cap. Though only a three-person shop, the technology advisory firm has built a strong enterprise footprint in its 14 years of business.

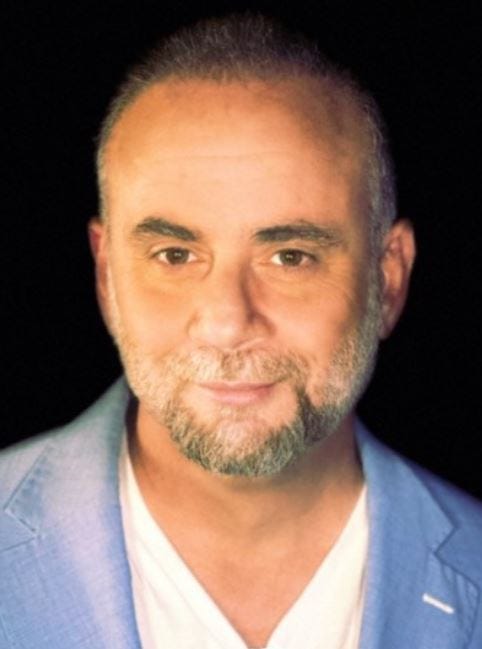

TMG founder and CEO Joe Monaco is joining Upstack as partner and managing director. According to a news release, Monaco had not actively sought out purchasers. Conversely, he had considered hiring in order to give TMG’s enterprise customers more resources. But Upstack had proven the best place to find those resources, Monaco said.

TMG/Upstack’s Joe Monaco

“The decision came down to the customer experience. By joining Upstack’s established team of people and processes, we could continue to grow TMG while maintaining our high level of customer support,” Monaco said. “Upstack is well-positioned in the market to deliver on customer experience. They have proven leadership and expertise from more than 25 partner acquisitions, which drives project management, implementation, account management and support. That means the TMG team can focus more on advising our enterprise customers on strategic technology investments.”

TMG also boasts a deep relationship with Intelisys. It is an eight-time Club TPC member and a platinum partner honoree. Joe Monaco won the prestigious Chuck Mache award at the recent ScanSource/Intelisys Channel Connect event.

It also carries a footprint outside of the Intelisys ecosystem. The consultancy in 2021 earned Avant’s top new partner award. In addition, TMG has won RingCentral’s premier partner recognition four straight years as well as platinum partner honors from 8×8.

TMG Background

Monaco worked at multiple carriers before officially joining TMG in 2015, according to his LinkedIn profile. He served in vice president roles at DeltaCom, Level 3 and EarthLink.

“As a longtime telecom sales leader, Joe Monaco saw a gap in the market for providing large enterprises with unbiased advocacy and consistent support with technology sourcing and management,” Trapp said. “The Monaco Group has filled that gap, becoming one of the country’s largest and fastest-growing technology advisory firms. We’re thrilled to welcome Joe and the TMG team to the Upstack family.”

Other top-producing Intelisys partners have joined Upstack. They includes platinum partner RDS Solutions and Subsidium, Intelisys’ first platinum plus partner. Moreover, Intelisys co-founder Rick Dellar joined Upstack’s board of directors in late 2022, with a stated intention of providing mentorship to Upstack CEO Chris Trapp.

Channel Futures recognized both TMG’s Joe Monaco and LinkSource’s Curt Lewis as Technology Advisor 101 honorees last year.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author(s)

You May Also Like