Even small and midsize businesses, which have fewer workloads and thus tend to have smaller cloud bills, are putting money into the cloud,

February 27, 2019

By Jeffrey Burt

Organizations continue to rapidly embrace multicloud and hybrid cloud strategies while struggling to manage cost optimizations and governance, according to a new survey of enterprises and small businesses.

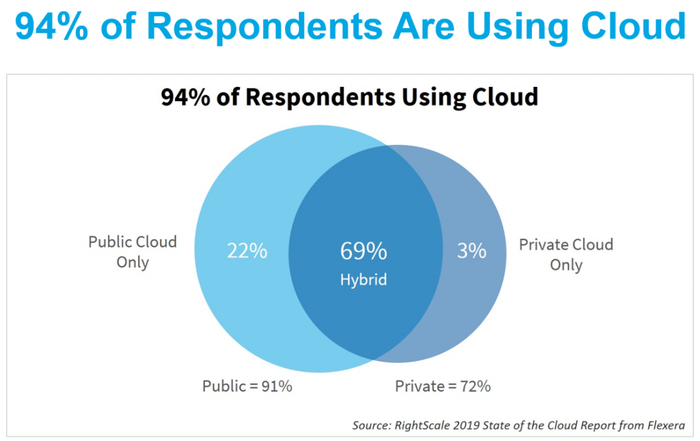

The RightScale 2019 State of the Report from Flexera reveals that 84 percent of enterprises have a multicloud strategy, up from 91 percent last year, while 94 percent of survey respondents are using cloud computing in some form — public (91 percent), private (72 percent) or hybrid (69 percent). Overall, enterprises will spend 24 percent more on public cloud this year than in 2018, with 8 percent spending more than $12 million a year and half spending more than $1.2 million annually.

Even small and midsize businesses, which have fewer workloads and thus tend to have smaller cloud bills, are putting money into the cloud, with 11 percent of SMBs spending more than $1.2 million on the cloud every year.

Even small and midsize businesses, which have fewer workloads and thus tend to have smaller cloud bills, are putting money into the cloud, with 11 percent of SMBs spending more than $1.2 million on the cloud every year.

Spending on public clouds is growing three times faster than on private clouds, according to the survey.

Flexera, which bought RightScale – a multicloud management and cost optimization company that launched in 2007 – in September, released the results of the survey this week. It’s the eighth year of the survey, which touches on a wide range of subjects, from the ongoing competition between the top public cloud providers – Amazon Web Services, Microsoft Azure and Google Cloud Platform – to the adoption of key technologies like Docker containers, the Kubernetes container orchestration platform and configuration tools like Ansible, Puppet and Chef.

The survey results come from responses of nearly 800 tech professionals from large and small companies. They come from a range of industries, including tech services, financial services and telecommunications.

Overall, the results show a business world that is moving rapidly into the cloud – on average, organizations are leveraging almost five public or private clouds – and various tools needed to leverage the computing model. At the same time, they are facing considerable challenges in terms of taking advantage of the cost efficiencies presented by the cloud, corralling spending and managing their multicloud environments.

It dovetails with what other industry observers are seeing. Gartner analysts predict the global public cloud services market will grow to more than $206 billion this year, up more than 17 percent over 2018, with particular increases coming in infrastructure as a service (IaaS) and platform as a service (PaaS). Analysts at Synergy Research Group found that spending on cloud infrastructure services in the fourth quarter last year grew 45 percent over the same period the year before and 48 percent overall in 2018.

While the spending is going up, so are the workloads running in the cloud. According to the RightScale survey, companies are now running the majority of their workloads in the cloud — 38 percent of the workloads in the public cloud and 41 percent in private clouds. Enterprises are running more of their workloads in private clouds, while SMBs have more in public clouds.

While the spending is going up, so are the workloads running in the cloud. According to the RightScale survey, companies are now running the majority of their workloads in the cloud — 38 percent of the workloads in the public cloud and 41 percent in private clouds. Enterprises are running more of their workloads in private clouds, while SMBs have more in public clouds.

But while adopting the cloud, organizations are making cost optimization and cloud governance key priorities. Eighty-four percent of enterprises say cloud costs and governance are growing challenges, according to the survey. The numbers also indicate that businesses leveraging the cloud are underestimating the amount of cloud spend that’s being wasted. Respondents estimate that waste will reach 27 percent this year, though Flexera officials say that they have measured actual waste at 35 percent.

In addition, those using the cloud are not taking advantage of discounting options offered by cloud providers. Among those using AWS, less than half (47 percent) use the provider’s Reserved Instances, which can provide as much as 75 percent in discounts over on-demand pricing. In addition, organizations using Azure only use Reserved Instances …

… 23 percent of the time.

Flexera’s Kim Weins

“Getting cloud costs under control requires new capabilities for IT organizations,” Kim Weins, vice president of cloud strategy at Flexera, told Channel Partners. “They need to shift the mindset and processes from one of discrete purchases of IT assets to one of continuous management of IT resources. In addition, they need new tools to analyze the huge volume of data associated with cloud spend and they need automated policies that can continually optimize these fast-changing environments.”

Enterprises also are creating more cloud “centers of excellence” to improve cloud governance, according to the survey. Two-thirds (66 percent) of enterprises now have a central cloud team or center of excellence, while another 21 percent are planning them.

In addition, they’re also adopting tools like containers, Kubernetes and configuration products that are important for operating in the cloud.

“The growth of containers has been astronomical over the last several years and Kubernetes is winning as a container scheduler,” Weins said. “The adoption of containers is becoming a common strategy for both new cloud applications and migrating existing workloads to cloud. Combining containers with DevOps tools for continuous configuration and continuous integration provides the critical set of capabilities needed to succeed in the DevOps-oriented world of cloud.”

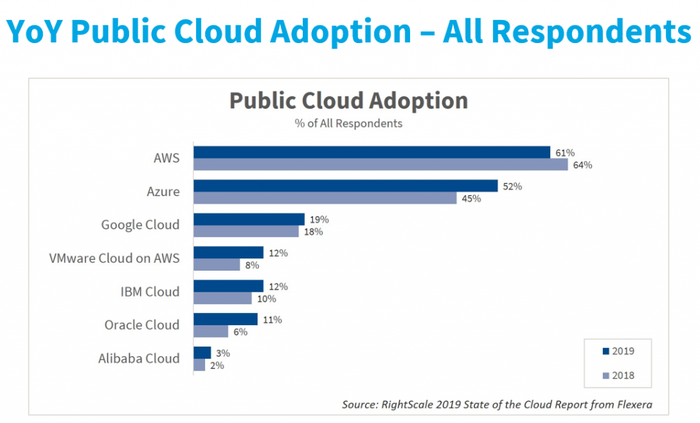

The survey also touched on the competition among public cloud providers, a market that has been dominated by AWS. According to Synergy Research analysts, AWS has a market share that is more than the next four providers combined, but they noted that during 2018, Microsoft, Google and Alibaba all saw revenue gains.

The RightScale report found that Azure is chipping away at AWS’ lead, particularly among enterprises. Seventy-seven percent of respondents said in 2019 they are using or experimenting with AWS, with another 7 percent saying they plan to use the cloud provider. For Azure, those numbers were 68 percent and 9 percent; however, compared to last year, Azure saw a bump in the percent of respondents who said they are using Azure, from 45 percent, to 52 percent in 2019. For AWS, that number fell from 64 percent to 61 percent. Among enterprises, Azure’s numbers increased slightly, with Azure adoption now at 85 percent of AWS adoption, up from 70 percent last year. Wein said Microsoft has been gaining ground over the past few years, adding that Google also is seeing momentum.

“This has been driven by Microsoft investing in rapid improvements and expansion of the Azure capabilities, as well as their deep relationships with businesses,” she said. “The most interesting statistic from Google is their higher level of adoption by more experienced cloud users. We see that as organizations gain more experience with cloud, they start to get more interested in some of Google’s advanced technologies as well as their competitive pricing.”

Read more about:

AgentsYou May Also Like