Google’s Yansouni: G Suite 'A Very Rich Fishing Ground'

What does Google's cloud channel chief think about partners, and balancing innovation and repeatability?

June 15, 2017

Channel Partners just caught up with Bertrand Yansouni, managing director, global partner sales and strategic alliances at Google Cloud, as he marked six months in the job.

Yansouni has deep channel and enterprise experience thanks to a stint as director of channel sales for VMware, and that insight should help Google position Google Cloud Platform as an alternative to AWS and Microsoft Azure – and Office 365 – for business workloads.

Managed support deals with the likes of Rackspace can’t hurt, either.

Google’s Bertrand Yansouni

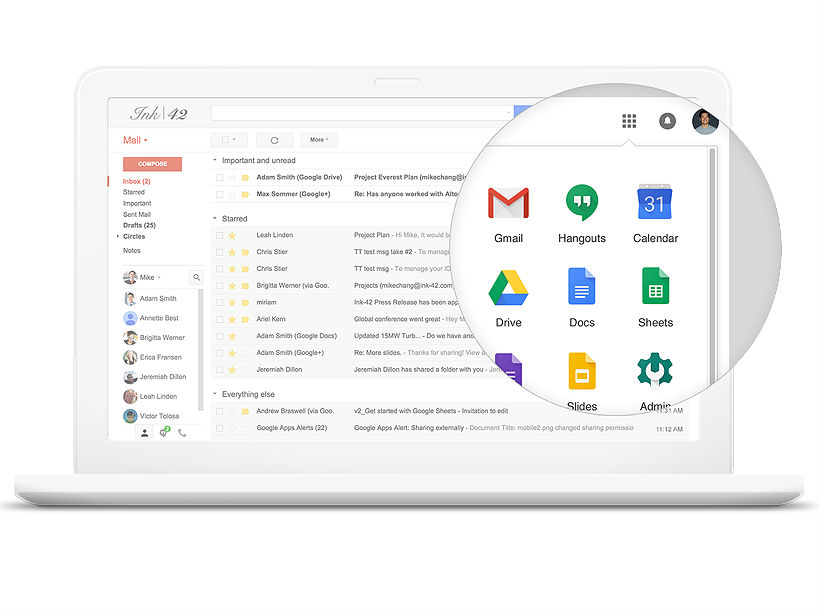

Partners are seeing success selling G Suite in particular. Just before press time, Google announced a new app called Backup and Sync, due by month’s end, that will make Drive a much more usable backup tool. Once installed, files won’t need to be placed inside of the Drive folder; Google will monitor and back up any folder, and it will work with any current Drive for Mac/PC settings in the admin console. While Google says that business users should stick with the existing Drive app for now, updates to Vault and a new certificate authority indicate maturity in G Suite to justify the Enterprise SKU pricing of $25 per user, per month. That buys extra security and management features, including data loss prevention for Drive, Gmail log file analysis, and more.

Not that Yansouni thinks G Suite is necessarily the tip of the arrow for all sales; in fact, he insists that selling a variety of products bundled with partners’ IP and consultative services is the path to profits.

“When you have a solution that a partner has crafted that addresses a specific business problem and leverages several of our products, those solutions tend to be of higher value,” he said. “And therefore, they tend to be more sticky than just a point solution.”

Channel Partners: Can you give us an update on the Google Cloud Platform partner program — new sales and certification requirements, type of partners that are succeeding? You’ve no doubt heard a lot of feedback from current and prospective partners. Any unifying themes or surprises?

Bertrand Yansouni: It’s been a really fantastic six months. It’s certainly been a pretty frenetic pace. I guess if there’s one surprise, it was that I did not fully appreciate just how vibrant an ecosystem of partners already existed through the long history that Google Cloud has had, starting with the search appliance, moving into the collaboration suite and Maps and Chrome and so forth. That’s been really great to see — a really passionate set of partners who have a lot more history here than I have. I’ve been able to learn a lot from them.

CP: Can you give us a quick update on partner-program changes you’ve made recently or that you are planning?

BY: We made a pretty significant number of changes, what I would call a first wave of changes, to the partner program, as we announced at our Cloud Next conference, our partner summit. Those were focused around a couple of areas.

For one, historically, our partner program has been a bit siloed, sort of per product, and we really wanted to bring to the partners a much more unified experience of what it means to be a Google Cloud partner.

Part of this was triggered by the fact that at the end of last year and coming into this year, we’ve made some changes to our overall sales go to market, in the way that our sales team was organized, whereas again, last year, if you were a client you would have been talking to one sales team if you wanted to talk about collaboration suite and to a different sales team if you were going to talk about GCP – Google Cloud Platform. Coming into this year we rationalized all that and made it a much more customer-centric approach, which also ends up being a more partner-friendly and partner-centric approach. We now have sales teams that are responsible for a certain geography and a certain set of named accounts in their territory, and they will present the entire portfolio.

That’s been much more convenient for our partners, because in the past our partners had the same experience as our customers, having to deal with multiple sales teams and not always knowing who to call on for a given account. Now that’s much more streamlined.

We wanted to reflect that also from an overall partner program perspective, so we simplified and streamlined the program so that instead of having different requirements and different benefits depending on which products you’re part of, it is really all about having unified requirements that you can meet across the entire portfolio, and making that a lot easier for our partners.

CP: Simplification is always welcome.

BY: It’s been well received by the partner community; they saw the need and have been providing input, and I think they were happy.

That’s more of an overall program structure change. There were several other improvements and investments that have also been very well received. One is around technical enablement, driven by the fact that as the market matures, we’re seeing that our customers have more complex use cases. And the bar for what they expect from us and from our partners in terms of technical expertise just keeps getting higher. We felt we needed to make investments internally – and help our partners make investments – around technical enablement and expertise, so we’ve created a new partner engineering team. We have presales engineers, we have solution architects, a whole bevy of technical resources dedicated to working with our partners and really helping them understand and adopt all of the best practices that are used by our own presales technical organization as they are out there working with customers.

We’re building that team out constantly, and having that set of resources dedicated to working with partners has been, I think, a big added bonus.

Coupled with that, we recognize the need to update and upgrade the foundational technical training that we provide to our partners, as well as the certification program that allows them to demonstrate that they have taken the training, have retained the critical information and have the technical expertise that our customers expect. So we announced a number of new training classes — several-day deep-in-the-weeds technical training classes; revamped our certification training program; and introduced two new certifications: one called data engineer, the other called cloud architect.

Those got rolled out right around Next or in the weeks following Next, so it’s only been a couple of months and we already have hundreds of people going through the training and getting technically certified. There was clearly pent-up demand from our partners to get that foundational training, because, again, they’re seeing a lot of demand and interest from customers for Google Cloud, and they want to be able to address the questions, implement the products correctly and make sure they have the technical expertise their customers expect from them.

So, again, unifying the overall program, making investments around technical enablement, and then the third big area was all-around partner profitability. Because ultimately our partners care about two things, right? They care about making their customers successful, and they care about making sure they’re able to build a profitable business out of doing that. We help in terms of the incentives we provide up front, the funding that we provide to do POCs and workshops, and then by rewarding partners through rebates and bonuses and so forth for growing their business quarter over quarter, year over year.

At the end of Q1 we wrote a set of very nice rebate checks to partners who have been meeting these targets, and we’re getting ready at the end of Q2 to do the same. It’s great; it’s an exciting time to be here and an exciting time for our partners, and we know that these rebate checks we’re writing to our fastest-growing, successful partners — we know they’re going to take that money and reinvest it in the business and hire more technical resources that they can get trained and certified and hire more people to helps us reach into new accounts, develop new specializations and expertise.

That’s all really great stuff.

CP: You’ve added a specialization program as well, right?

BY: Yes. This is key because one of the things that our partners care about is how to differentiate themselves … and how to let both our sellers and their customers know about those areas where they have extremely deep expertise or maybe even specific IP that they’ve developed.

So we created this specialization program with four categories: infrastructure, app development, data analytics and machine learning. And we announced in each one of those a handful of partners that have already met the requirements.

We’re going to continue developing and enhancing specialization programs and introducing, over time, new product- and solution-specific specializations.

CP: You’ve gotten a lot done.

BY: It was a lot. I have to express a lot of gratitude toward my team — people worked hard and fast on this because it was only a couple of months after I joined that a lot of these things came out. A lot of our partners were involved in providing feedback, so we developed this in conjunction with a number of partners. It was a lot of fun.

CP: Those handful of initial partners, they weight toward big SIs, your Accentures, your PWCs. Have you seen smaller SIs and even resellers getting any traction with those specializations?

BY: Yes, absolutely. When we announced this it was really a mix of big and medium and small. I don’t have the list in front of me but, for example, I know that Cloud Technology Partners was one of the partners on the application development side. I’m quite certain that Pythian was one of the partners on the big data and data analytics, with a couple great partners in Europe – Claranet and Reply – who are also MSP partners; I should say they act as MSPs, they were part of the infrastructure; and on the machine learning we definitely had a couple of smaller partners — I want to say Quantiphi on the East Coast, and Datatronic, a pretty small shop in Europe.

It was really a mix of the two, and that’s what we continue to see. Obviously, our large-level consulting partners want to show that they have the breadth of offering as well as the specialization, but it’s equally key for our medium, regionally sized and reselling partners. Because, again, for us, a reseller partner is a regional consulting firm [that] also happens also to resell. There isn’t really the concept of somebody who just resells. It’s more, our regional partners are systems integration/consulting firms; some also have it in their business model to resell and others, it’s not in their business model to resell, and we’re very flexible either way.

We like to fit into how they work as opposed to the other way around.

CP: You do stress selling the entire GCP stack, but for the majority of enterprises, G Suite’s going to be pivotal for adoption; that’s where the foot gets in the door, right? Sort of like Office 365 is seen as the gateway to getting shops into Azure. Would you say that’s true or do you see a lot of leads with, say, Maps or Chrome?

BY: We see it all over the place. What I mean by that is, we see Maps customers becoming very interested in GCP. We see GCP-first customers becoming then very interested in G Suite or Maps.

As you can imagine, our large installed base of G Suite customers is a very rich fishing ground for us and for our partners in terms of becoming GCP customers. If they’re using G Suite, they’re already sort of buying into the cloud, they are fans of Google in general.

Interestingly enough, though, I don’t feel that there’s one particular product that ends up being the “tip of the arrow” more than the others. Now obviously, we have a very significant G Suite install base, so it just makes sense to go talk to all of those customers and make sure they’re aware of GCP and so forth. And vice versa with the Maps customers. Any customer using Maps has an application that’s pretty key to them that leverages the Maps APIs. That application, it’s running somewhere, either on premise, very often, or it might be running on one of our competitor’s products. Running that application on GCP and having it in sync with Maps and zero latency and so forth — it’s just a natural fit there.

All of the products, if they’re already installed on a customer, naturally become the tip of the arrow.

In terms of brand-new prospects, people who aren’t using any of the technologies, I think any of the products in our portfolio can have an equal shot at becoming then the tip of the arrow. It’s really more about the customer’s initial interest, what is the specific pain point, and then we want to make sure that we help them solve that initial problem but also make sure they’re aware of the entire portfolio.

And similarly, we want to make sure that our partners – and this goes back to the unification of the partner program that I talked about at the beginning – are equipped to position the entire portfolio.

CP: Amazon has been talking about its own productivity suite based on Chime. Do you think Maps is going to the killer argument against that?

BY: I will be the first to confess that I think it’s important to be aware of the competitive landscape, whether it’s a productivity suite that AWS announces or the program rollouts that our competitors do. It’s important to be aware — but that isn’t what we use as our guiding principles. We have our own strategy, we know what we’re trying to do, and we take a lot of input from our partners — and a lot of our partners also work with our competitors, so they tend to be great at helping us understand what we need to be doing better and what they like about what we’re doing.

I think it’s going to be difficult, frankly, for a new entrant in the collaboration-suite space, but in general we’re more focused again on taking the input of our customers and our partners and continuing to enhance the product. If you look at G Suite, half the product announcements that we made at Next were around the enhancements that we’re bringing to G Suite, and many of the big customers we had on stage, from Colgate to Verizon and so forth, are rolling G Suite out to thousands, tens of thousands, of users.

So again, I think we need to stay focused on those things we need to do and stay aware of what our competitors are doing but not let that be what drives our overall strategy.

CP: We do notice an emphasis on continual improvements.

BY: One of the wonderful things about cloud technology is that improvements can be rolled out continuously and just sort of show up, which is great.

One of the areas where I hear a lot of positive feedback from our partners is around innovation — both the product excellence and the rate of innovation. That’s some of why they want to partner with us. We recognize we’re not – especially in terms of the cloud technology, in terms of GCP – the largest market shareholder. I’m always questioning, frankly, our partners about why [they] want to work with us, and what’s unique, and what’s working and what’s not working?

And this should not have been a surprise, but until I was here I did not fully again appreciate a) the heritage of product excellence in the company, just creating amazing products that people want to use — that runs very, very deep in the company and it runs very deep with our partners. If you think of our partners, they care about making the customer successful, and they care about being profitable in the process of doing that.

In terms of making their customers successful, they know they need to represent the best products; otherwise, their relationship with their customers, which is what they care most about, will be harmed. So by partnering with us they know – they all do, as you can imagine, thorough reviews of our technology side-by-side with our competitors – and our partners feel deeply that we have the best product, the best performance, and the most secure, the most open cloud platform — and that’s key to them.

Then combine that with the rate of innovation. That’s important because these are long-term bets that these partners are making. They see all the work, the innovation, whether it’s around open technologies such as Kubernetes, or we just announced we’re the first ones to have the Skylake technology from Intel, aand they see what we’re doing around machine learning, and they see how AI is being worked into it every angle of G Suite.

All of these things really get them super excited — just as excited as those of us who are here working for the company. So I think that’s a great reflection of what you just mentioned in terms of seeing continuous improvements. All of our partners see that; they know their customers see that, and that’s exciting.

CP: The flip side of continuous improvement is continuous change, and we hear from partners is they don’t want to deal with snowflakes anymore; they have to have repeatability. But on the flip side, there’s the tension with, as you said, partners who want that special sauce to keep customer stickiness. The end customers want to be unique. There seems to be a growing dichotomy right there.

BY: I agree. I think you have to balance the innovation you’re rolling out to your customers with the ability to have stability and so forth, but I don’t find our customers, at least in my few months here, feel that we’re shoving this stuff down their throat by any stretch.

For them it just translates into more functionality or more services that they can choose to adopt and roll out to their end users; now it’s available to them, whereas a few weeks ago maybe it wasn’t. I think it’s very well received.

For the partners, the challenge is keeping up with the rate of new things that are being rolled out. It’s the same challenge that we face in our sales organization. These are good challenges though, right?

CP: These are good problems.

BY: We spend a lot of time training our partners, and we do regular sessions to do training at scale. Whenever we make new product announcements or roll out new functionality, we record these sessions, and by the hundreds they come and they watch them after the fact.

So there [are] a lot of things we’re doing to make sure that our partners are aware of new stuff before it gets rolled out, so that they can talk about it with their customers, because they are the trusted source.

CP: Chromebooks are a foot in the door for partners that specialize in education. What other verticals do you see growth in?

BY: We’re definitely seeing success with our partners across a lot of different verticals. One of the wonderful things about these technologies is that, frankly, they’re fairly horizontal in terms of the market they address. We can sell to from the smallest customer all the way to the largest enterprises on Earth.

But in terms of verticals where we’re seeing particular traction and success, certainly financial services; health care, we’ve seen some very large deals; retail and consumer goods has been a very successful vertical for us and continues to be.

We’re not in the habit of naming all our customers. Some of those announcements have been made public, others not so much, but technology is certainly a great vertical for us.

We’re seeing some great traction and a lot of great opportunity for Chromebooks in government, in retail, even in financial services.

Read more about:

AgentsAbout the Author(s)

You May Also Like