Apple Buys Back $14B in Stock, Icahn Withdraws Proposal

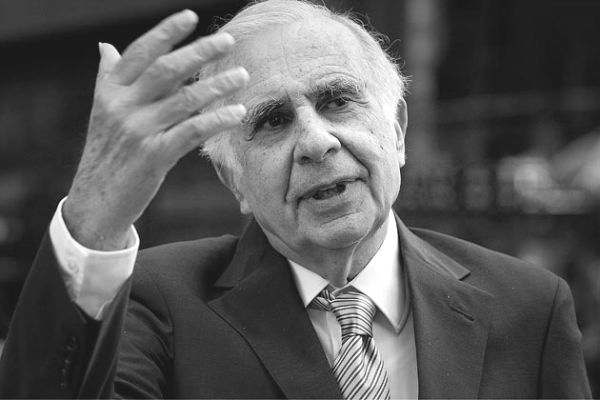

Apple (AAPL) late last week disclosed it bought back some $14 billion in stock, bringing its total share buyback to about $40 billion in the last 12 months and repelling for the moment activist shareholder Carl Icahn’s pressure to increase repurchases this year.

Apple (AAPL) late last week disclosed it bought back some $14 billion in stock, bringing its total share buyback to about $40 billion in the last 12 months and repelling for the moment activist shareholder Carl Icahn’s pressure to increase repurchases this year by $50 billion.

The vendor said it bought back $2 billion of its shares on the open market—taking advantage of a surprising plunge in its stock in the wake of recording Q1 iPhone sales of 51 million units, a company record but behind analysts’ 55 million unit forecast—and also gobbling up $12 billion shares in an “accelerated” repurchase program. The $12 billion in stock repurchases are tied to Apple’s running plan to buy back $60 billion of its own shares.

The buyback may have eased Icahn’s pressure on Apple chief Tim Cook to return more money to shareholders. Since August, Icahn has waged a campaign to get Apple to return more cash to shareholders, most recently demanding the vendor’s shareholders vote at the company’s Feb. 28 shareholders’ meeting on his non-binding proposal to increase repurchases by some $50 billion.

But he was stymied by recommendations from influential advisory firms Institutional Shareholder Services (ISS) and the smaller Egan-Jones, both of which cautioned Apple shareholders to reject Icahn’s demand. ISS warned Icahn’s proposal would “micromanage the company’s capital allocation process.”

On Monday the Financial Times reported that Icahn withdrew his demand, admitting in an open letter that he was “disappointed” at ISS’ recommendation but acknowledging that he did not “altogether disagree with their assessment and recommendation in light of recent actions taken by the company to aggressively repurchase shares in the market.”

Inasmuch as Icahn’s drum-beating is designed to bump up Apple’s share price, he’s unlikely to fully retreat, especially now that he’s amassed a $4 billion stake in Apple and can only benefit from repeatedly needling Cook to boost the company’s stock buyback program.

Cook has yet to respond directly to Icahn, with his most recent comments confined to a promise to provide more information on Apple’s share buyback plans in the next two months. He told the Wall Street Journal the buyback “means that we are betting on Apple. It means that we are really confident on what we are doing and what we plan to do. We’re not just saying that. We’re showing that with our actions.”

In a Jan. 23 open letter to Cook, Icahn called Apple “perhaps the most overcapitalized company in corporate history,” and dismissed the company’s contention that it lacks the excess liquidity a larger repurchase program requires. Considering the size of Apple’s cash war chest, he said, “We find its position overly conservative (almost to the point of being irrational).”

About the Author(s)

You May Also Like