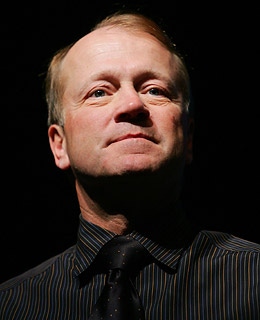

During the dot-com implosion, Cisco Systems CEO John Chambers took an unusual step that set the tone for appropriate, responsible executive leadership during bad economic times. Now, the executive leadership at Ford, General Motors and Chrysler should follow the example Chambers set back in 2002. Here's why.

November 21, 2008

During the dot-com implosion, Cisco Systems CEO John Chambers took an unusual step that set the tone for appropriate, responsible executive leadership during bad economic times. Now, the executive leadership at Ford, General Motors and Chrysler should follow the example Chambers set back in 2002. Here’s why.

During the dot-com implosion, Cisco Systems CEO John Chambers took an unusual step that set the tone for appropriate, responsible executive leadership during bad economic times. Now, the executive leadership at Ford, General Motors and Chrysler should follow the example Chambers set back in 2002. Here’s why.

Amid the dot-com fallout, Chambers received a $1 salary in 2002. That’s right: One dollar. Chambers also declined his bonus and gave back 2 million in stock options that year, according to CNet.

Alas, auto industry executives haven’t set a similar example.

GM CEO Compensation

According to The Wall Street Journal:

“GM CEO Rick Wagoner got “a 33% raise for 2008 and equity compensation of at least $1.68 million for his performance in 2007, a year for which the auto maker reported a loss of $38.7 billion. The salary increase puts Mr. Wagoner’s salary for this year at $2.2 million, compared with $1.65 million in 2007.”

Moreover:

Mr. Wagoner was awarded 75,000 restricted stock units valued at $1.68 million, based on GM’s closing stock price in March. He was also given stock options representing 500,000 shares.

GM told the Journal that Wagoner’s total compensation is down sharply from $8.3 million in 2006.

The VAR Guy’s take: Yada, yada, yada. Why is this guy still running GM when the company is on the brink of collapse?

Ford CEO Compensation

According to the Journal, Ford CEO Alan Mulally received $2 million in base salary, a $4 million bonus and more than $11 million of stock and options in 2007. His base salary was unchanged over 2006. Mr. Mulally has earned nearly $50 million in compensation since taking the helm of the auto maker, according to The Wall Street Journal.

The VAR Guy’s Take: Sounds like Mulally runs Ford about as well as Ford runs the Detroit Lions. Pathetic. Somebody sack this guy.

Chrysler CEO Compensation

Less is known about Robert Nardelli’s CEO package at Chrysler LLC because the auto maker is privately held. The VAR Guy’s Take: Somebody dial Lee Iacocca. Fast.

The Bottom Line

The VAR Guy doesn’t know much about the auto industry, but the situation is pathetic. According to the Associated Press:

“The leaders of the Big Three automakers have painted a grim picture of their financial position. They burned through nearly $18 billion in cash reserves during the last quarter — about $7 billion at GM, almost $8 billion at Ford and $3 billion at Chrysler. GM and Chrysler have said they could collapse in weeks.”

If Chambers was running one of those companies, he would have declined his paycheck months ago.

The VAR Guy is updated multiple times daily. Don’t miss a single post. Subscribe to his newsletter, RSS and Twitter feed.

About the Author(s)

You May Also Like