AT&T Leads Hughes, Verizon in Latest Managed SD-WAN Leaderboard

Some of the names on this leaderboard might surprise you.

AT&T leads Vertical Systems Group’s latest software-defined wide area networking (SD-WAN) rankings.

Courtsey of Vertical Systems Group

Vertical’s Carrier Managed SD-WAN Services Leaderboard lists Ma Bell atop its peers for number of managed SD-WAN customer sites in the U.S. at the end of 2018. AT&T has been partnering with VeloCloud since 2016 for its platform.

Hughes and Verizon rounded out the top three, followed by Windstream and CenturyLink. Aryaka, listed at sixth, pitches itself as an alternative to MPLS-centric carrier SD-WAN while offering its own private network.

Comcast is the only cable provider on the list at eighth. The company’s SDN platform has been enjoying strong traction in the partner community.

Rick Malone, principal of Vertical Systems Group, said carriers have established themselves as the ideal option for “delivering large scale, complex and resilient SD-WAN services end-to-end.”

Vertical Systems Group’s Rick Malone

“We believe that network operators with deep experience in MPLS, Ethernet and IP are most favorably positioned to support enterprise customers as they transition their networks to SDN,” Malone said.

2018 U.S. Carrier Managed SD-WAN Services LEADERBOARD released – leading providers ranked on the first SD-WAN services benchmark #SDWANhttps://t.co/LV1JEsoYCjpic.twitter.com/auugj6UP0K

— Vertical Systems Grp (@VerticalSys) May 22, 2019

The “Challenger” tier includes some more channel-friendly companies, including Bigleaf Networks, GTT Communications and TPx.

At least six of the companies on the leaderboard (AT&T, Windstream, GTT, Meriplex, Sprint, TPx) partner with VMware Velocloud, while at least three (Verizon, CenturyLink, Comcast) partner with Versa Networks. Verizon and CenturyLink also use Cisco Viptela.

The study does not count do-it-your-self solutions bought directly from the supplier or partner.

Vertical Systems wrote in a blog earlier this month that the most significant challenge for 82 percent of service providers doing managed SD-WAN is how the various device manufacturers lack standardized interoperability. The vendors also struggle with the unclear and open-ended definition of SD-WAN.

But at the same time, VSG notes that customers are now more appreciative of how difficult it is to migrate to SD-WAN. The newfound appreciation may lead them to choose carriers over “plug-and-play” offerings from pure-play vendors.

“Carrier-grade managed SD-WAN services in the U.S. began to generate notable revenue in the second half of 2018; prior to this, most providers supported customers with pilot SD-WAN services that were not substantively monetized,” Malone said in December. “For 2019, we expect a major boost in revenue with network operators fully ramped up to sell, deliver and support managed SD-WAN services.”

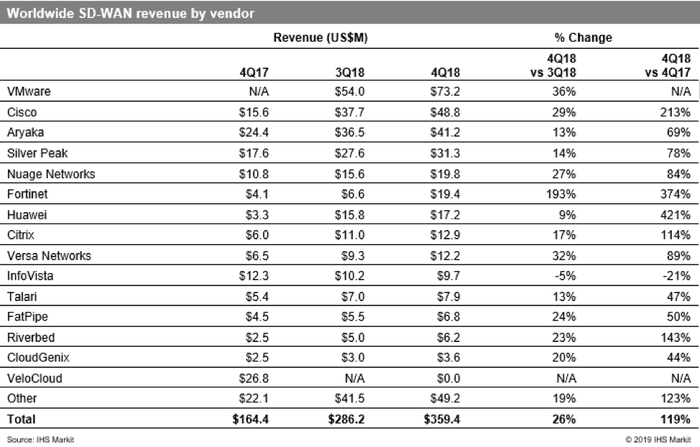

Source: IHS Markit Q4 SD-WAN Revenue

VSG estimated total managed SD-WAN revenue to be $284 million in 2018.

To see how the “pure-play” vendors ranked in the latest IHS Markit study (pictured left), check out our March SD-WAN column. Aryaka (third) is the only company that made it onto both leaderboards. VeloCloud, Cisco and Versa all scored well and attribute much of their success to their aforementioned partnerships with carriers.

Read more about:

AgentsAbout the Author(s)

You May Also Like