In the meantime, Dish is set to become the fourth largest U.S. wireless carrier.

T-Mobile‘s CEO claims that combining with Sprint will give both companies a clear 5G network advantage over their “clueless” and “lying” rivals, Verizon and AT&T.

T-Mobile’s John Legere

John Legere lambasted his competition in an earnings call Friday, on the same day the U.S. Department of Justice publicly approved T-Mobile’s $26 billion purchase of Sprint. He told investors that Sprint possesses “midband” spectrum that AT&T and Verizon lack, according to The Verge. Legere characterized Verizon as using only high-band frequency, also known as mmWave, to build its network. That approach will fail, Legere said.

“It’s fake. It was a first mover play. It would cost $1.5 trillion to do, and they’re kind of dead in the water without a strategy right now. I think the world’s starting to catch on,” he said.

Legere described AT&T as understanding the midband problem but lacking any alternative.

“The difference for AT&T – although they get the vision – they don’t have the midband. So there’s a hole in their strategy. But at least I think they get the template,” Legere said. “Verizon: clueless, no strategy, nowhere to go. AT&T: not clueless, lying, confusing people about 5GE, which is really just 4G Advanced, and a big hole in their template, which is the middle, and where are they going to get the midband to lay this up?”

An AT&T spokesperson laughed off the criticism.

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

“Oh, look, Legere is back,” the spokesperson said in a statement to The Verge. “They were last to 5G, but he’s already the expert.”

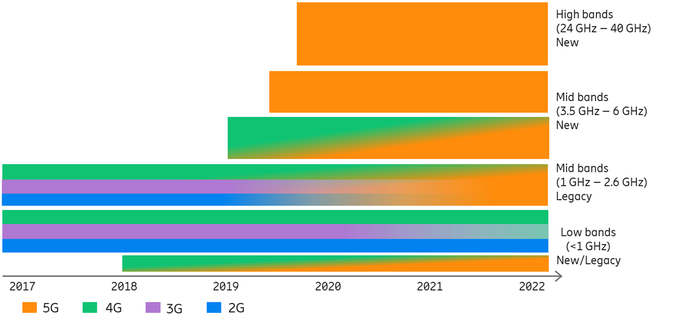

According to the wireless industry trade association CTIA, midband helps bridge the gap between adequate coverage and the ability to transmit plenteous data. And the midband spectrum is U.S. wireless providers’ biggest deficiency, CTIA CEO Meredith Attwell Baker said.

Source: Ericsson

Sprint stands out in the crowd for its 2.5 GHz spectrum that under-girds its 5G network. It’s the “largest nationwide block of sub-6 GHz 5G spectrum in the U.S.,” according to Sprint.

Legere’s brash comments met their fair share of opposition.

Verizon’s vice president of network and technology characterized his company’s 5G strategy as “multispectrum” in a statement to The Verge. Other commentators have criticized T-Mobile for building a 4G LTE network that is inferior to Verizon’s.

Legere is being super fun and feisty (of course! he won!) about taking it to AT&T and Verizon, but reminder that he only has this job and T-Mobile only exists in this moment because AT&T was blocked from buying it

— nilay patel (@reckless) July 26, 2019

The deal between T-Mobile and Sprint still requires Federal Communications Commission (FCC) approval and must face a lawsuit from several state attorneys general, but Sprint CEO Marcello Claure said he anticipates the FCC to go along with the plan.

The Justice Department’s antitrust division loomed large in the last three months for T-Mobile. Several reports concluded that the department would not approve the deal unless the companies significantly altered their structure.

Enter Dish.

We reported last week that Sprint was likely to divest several of its assets to Dish Network, which would essentially become the fourth major U.S. wireless carrier. Dish confirmed on Friday that it will buy Sprint’s prepaid business and 14 MHz of Sprint’s nationwide spectrum. The combined T-Mobile entity will allow Dish to access its network for seven years. The total bill rounds up to about $5 billion.

Dish said its facilities-based 5G broadband network will cover …

… 70 percent of the U.S. population by 2023.

“These developments are the fulfillment of more than two decades’ worth of work and more than $21 billion in spectrum investments intended to transform Dish into a connectivity company,” Dish co-founder and chairman Charlie Ergen said. “Taken together, these opportunities will set the stage for our entry as the nation’s fourth facilities-based wireless competitor and accelerate our work to launch the country’s first standalone 5G broadband network.”

Rolando Hernandez, vice president for the mobile solutions provider Valid, praised the merger as a win for end users.

“Together, T-Mobile and Sprint can compete with AT&T and Verizon in more fair conditions given all of them will now be a similar size. Standing on their own, the two carriers were treated almost as equals, forcing them to offer similar services, coverages and prices,” Hernandez said. “They couldn’t have grown or developed much further trying to compete in an unfair market. Now, that’s all changed. With the addition of Sprint’s assets, the new T-Mobile can focus on its technology initiatives, like expanding 5G across the country and increasing IoT connectivity.”

The combined company would operate under T-Mobile’s name.

Now, we can’t wait to get to work for bringing this pro-consumer, pro-competition, REAL nationwide 5G network to American consumers! https://t.co/jEoO85NeeT Key info: https://t.co/Ioa23FUBQe

— John Legere (@JohnLegere) July 26, 2019

Verizon bested T-Mobile in all six U.S. regions of J.D. Power’s latest wireless network quality leaderboard.

Read more about:

AgentsAbout the Author(s)

You May Also Like