Data Center Hardware Market Booming for Variety of Reasons

Telcos, smaller cloud providers, enterprises are increasingly turning to OCP hardware.

May 14, 2020

By Yevgeniy Sverdlik

The business of selling data center hardware designed to Open Compute Project specifications is booming — and not simply because of the insatiable demand from the handful of hyperscale cloud platforms that are this type of gear’s biggest consumers.

Omdia, the research firm the OCP Foundation has turned to for taking the pulse of the market for its hardware outside the companies that sit on its board, estimates that the market grew 40% last year, reaching $3.6 billion in revenue, or nearly 2.3% of the total market for servers, storage, network, rack, power, peripherals, and so on. (Servers represent the bulk of the revenue.)

This post originally appeared on Channel Futures’ sister site, Data Center Knowledge. |

Again, that’s the estimated size of the “non-board OCP” market. It doesn’t include all the iron Facebook, Microsoft, and (to a much smaller degree) Rackspace have wheeled onto the concrete floors of their computing facilities.

Omdia expects the market to grow another 46% this year, to $5.3 billion. The firm projects it to more than double by 2023, to $11.8 billion. That’s average annual growth of 36% a year for the next three years.

Until this year, Facebook, Microsoft and Rackspace were the only companies that operate their own data centers and don’t sell gear with seats on the board. The foundation announced this week during its virtual summit that Google has joined the board, becoming a fourth.

Even though there are non-board hyperscalers – such as Amazon, Baidu, and until this week, Google – this is not a scenario where a few big buyers are responsible for ballooning total market numbers. (Omdia considers a company “hyperscale” if it has 3 million square feet of data center space or more.)

Omdia’s Vladimir Galabov

“The non-board category is exactly where there are many small purchases from different companies that are accounting for the total market value,” Vladimir Galabov, principal analyst, data center compute, at Omdia, told Data Center Knowledge. (Disclaimer: Omdia and Data Center Knowledge are sister brands under the Informa Tech umbrella.)

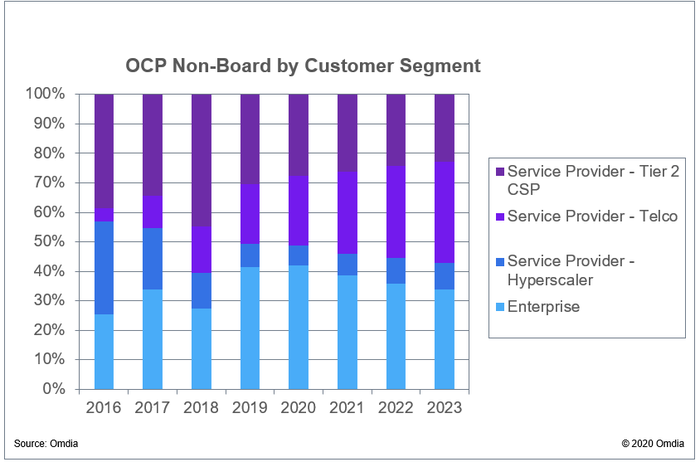

The three non-board hyperscalers mentioned above started deploying OCP hardware in their data centers only recently, he said. The verticals responsible for most of the non-board OCP market are tier-two cloud service providers, telcos, and private and public sector enterprise IT shops.

Tier-two cloud companies were responsible for about 45% of the market in 2018. Last year they drove about 30% of revenue, and Omdia expects them to drive slightly less than 30% in 2020.

Omdia says telecommunications will grow its share of revenue the most between now and 2023. Telcos are investing in edge computing infrastructure, much of it going into their central offices to support virtualization of network functions.

Telco investment in 5G infrastructure is also driving some investment in edge computing for applications 5G is expected to enable. So says Cliff Grossner, senior director, research, and technical fellow at Omdia. But a big portion of the telco spend, he told us, has nothing to do with 5G. For example, in the U.S., 5G is not a big factor for telco investment in OCP hardware, he said.

As you can see from the Omdia chart (right), non-board hyperscalers’ role within the overall market has shrunk substantially since 2016 and 2017, and it’s not expected to grow much into the foreseeable future. Enterprises, telcos and tier-two cloud providers are the big non-board OCP buyer categories going forward.

COVID-19 Headwinds and Tailwinds Likely to Balance Each Other Out

The Omdia analysts said they did not expect the COVID-19 pandemic to have a meaningful impact on their forecast because of the wide variety of user verticals represented in the total numbers.

Tier-two cloud providers and telcos have seen an increase in demand as a result of the pandemic-driven lockdowns, Galabov said. He expects them to invest in equipment to satisfy that demand, not cut back on orders.

But pullbacks are very likely in the enterprise category, especially by government agencies, which have had to spend huge resources to address the crisis while seeing tax revenue decline sharply. As far as the public sector is concerned, it’s safe to assume that “any refresh of equipment that can be delayed will be delayed,” he said.

These are very uncertain times for many private-sector industries, and …

… “it’s not very clear that they’ll be doing any investment whatsoever — in any type of equipment,” Galabov said.

But he expects the headwinds some are experiencing and the tailwinds others are experiencing to balance each other out overall.

Telcos’ Drive to Disaggregate and Innovate Fuels OCP Momentum

Servers have and continue to be responsible for most of the overall OCP hardware volume acquired each year. But the variety of technologies developed within the OCP framework is growing. That’s especially true in the telco category. It’s partly the reason Omdia expects the category to continue playing such a big role going forward, Grossner said.

There is a lot of activity within OCP around cell-site network gateways, routers and servers. That activity aims to specifically address telcos’ needs at the edge.

“It’s a market that’s looking for brand new solutions,” he said. “And that’s the time when new vendors and innovators can jump in.”

Telcos are drawn to OCP partly because of the innovation in the ecosystem and partly because the disaggregation that’s been a big design goal across its many projects helps them avoid vendor lock-in, Galabov explained. The next thing telcos want to disaggregate is core routing, Grossner said.

Telecommunications equipment is notorious for big and expensive proprietary solutions, where all the components in a single box (both hardware and software) are designed to work together. Open specifications required by OCP allow different vendors to design different components that are interchangeable and can all enable a single solution. They’ve also allowed for new vendors to enter the space.

More Enterprise Types Interested

Last year, the non-board OCP market’s enterprise portion jumped substantially, from below 30% to above 40%. And that’s because more government agencies, gaming, e-commerce, and energy companies are buying the gear. There is also a modest increase in automative and industrial users deploying the gear.

Many of the companies told Omdia they were deploying OCP to enable high-performance computing infrastructure. Automotive and industrial users have deployed OCP proof-of-concept installations to support edge computing for connected-car and internet of things initiatives, respectively.

Access Remains an Issue

While the non-hyperscale market for OCP equipment is growing, the equipment continues to be relatively difficult for smaller-scale buyers to source. Most of the big players on the vendor side have traditionally focused on hyperscalers. They haven’t built the supply chain and support infrastructure smaller companies look for in their hardware suppliers.

Access has improved over time, but it’s still an issue.

“That barrier is still there today, but to a lesser degree,” Grossner said. “It’s not a totally solved problem.”

Some vendors have started offering server orders as small as one or two servers. And in some locations there are already solid networks of OCP resellers and integrators, Galabov said.

“I tried to order myself a couple of servers, and I was able to do that,” he said. (Galabov is based in London.)

Omdia has also identified “circular economy” as a new, potentially major growth driver for non-hyperscale OCP adoption. ITRenew, which specializes in decommissioning and reselling used equipment from hyperscale data centers, has been reconfiguring some of it into broad market-friendly solutions, certified for traditional software platforms, such as VMware. The company has seen a lot of interest in these solutions, especially by tier-two cloud providers, its president, Ali Fenn, told Data Center Knowledge.

You May Also Like