Channel Futures compared data from Q1 through Q4 2021 to gain insight into MSP mindsets and company direction.

March 10, 2022

In April 2021, Channel Futures launched its first benchmark survey to get a pulse of the top trends and opportunities in the industry during the first quarter of last year. We wanted to know what market patterns look like, where profit outlooks stand, and the challenges partners face. We have now released a total of four surveys. Each has uncovered unique data reflecting these shifts – the significant and the insignificant – in the industry.

It’s clear from our latest survey, covering 2021’s fourth quarter, that overall, MSPs were still able to grow their businesses. This was despite respondent-cited pitfalls, such as tightening capital spending, hiring difficulties, supply chain issues, cybersecurity challenges and more. Even with these hurdles, it appears MSPs are in a unique position to thrive in economic shake-ups, and drive value to customers.

Market Patterns a Mystery

Businesses continue to adopt new technologies to adapt to the changing landscape. But our data from the fourth quarter indicate that things seem to be settling down a bit. This survey didn’t show much movement on the data points when compared to quarter three; and, more broadly, across the results from the first and second quarters.

Be counted among your peers as one of the top managed service providers in the world. Click here for the 2022 MSP 501 application. |

The sentiment among the MSP professionals we surveyed always points overwhelmingly to security. When we asked in which sectors MSPs added vendors in 2021’s first quarter, more than one-quarter (29%) cited backup and disaster recovery (BDR). In the fourth quarter, that number rose only slightly, to 34%. Managed security came in at 29% in the first quarter, falling to 28% last quarter after a sharp rise (38%) in the third quarter. Other notable mentions have historically included cloud storage; data analytics; data center and IaaS and managed email and help desk — none of which had any significant blip.

Why So Static?

We wanted to know why the data in this survey, when stacked up next to the others, was fairly static. Is it because there are just not a lot of shifts in the nuts and bolts of a business over the course of a year? Are market patterns becoming more consistent in the pandemic “new normal?”

360 SOC’s Chris Ichelson

“I think that most of the reason for the flattening of the data sets “models” is because in 2020, we had a significant shift in how businesses use technology,” said Chris Ichelson, CEO, 360 SOC. “I think that now in 2021/2022, organizations have/are spending a lot of money on these advancements, and we are starting to see the aftermath. This will likely shift once again, and you will see an adoption of some sort of hybrid technology experience.”

So, is this lack of needle-moving fairly unsurprising? Have partners mostly settled into their new rhythm since the pandemic? Or perhaps some technologies and solutions have yet to really make waves?

“Spending has begun to slow, and the shifts have started to settle,” added Ichelson. “I do see spending picking up, but I am not sure if that is a correlation between increased cost and inflation, or if it is actually technology advancements. Customers were forced to make capital purchases and I think they are exhausted at the thought of spending more. The word sustaining comes to mind here.”

While we know that MSPs are weathering mounting security and compliance requirements, the M&A frenzy, supply chain challenges and skill shortages, the needle seems to be staying put.

Simplex-IT’s Bob Coppedge

“I’m fully of the belief that a majority of MSPs are …

simply doing what they did last year,” said Bob Coppedge, CEO, Simplex-IT. “Maybe with only a couple of minor shifts — for example, ‘we added two new cybersecurity products, but are still figuring out how to configure and sell them.'”

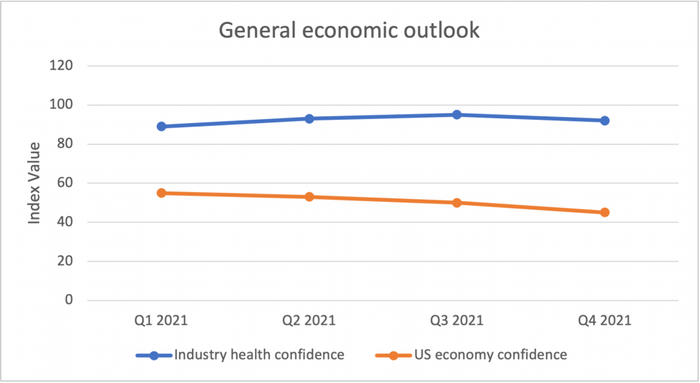

Economic Outlook

Over the course of last year, there was a marked decline in the general economic outlook among respondents. There seems to be a gradual erosion with regard to partners’ confidence in the U.S. economy. This is due to a large number of factors, likely including reimposed mobility restrictions, higher inflation, rising workloads and the continued supply disruptions.

Over the course of last year, there was a marked decline in the general economic outlook among respondents. There seems to be a gradual erosion with regard to partners’ confidence in the U.S. economy. This is due to a large number of factors, likely including reimposed mobility restrictions, higher inflation, rising workloads and the continued supply disruptions.

It’s true, the global economy entered 2022 in a weaker position than previously expected. Global growth is expected to moderate from approximately 6% in 2021 to 4.4% in 2022 — a half-percentage point lower for 2022 than in the October World Economic Outlook (WEO).

This lack of confidence also likely correlates with political polarization and the creation of “echo chambers.” It will be interesting to see how these results are further affected by the current war in Ukraine.

Looking Ahead

So, what are the trends and market patterns that may happen yet in 2022 that might cause the needle on some of these data points to move?

“I think the move back to the office will be huge,” Ichelson speculates. “The work from home (WFH) bubble is starting to thin and fade. Companies are seeing positives and negatives to the WFH and hybrid experience. I myself am seeing major shifts in these processes. I think companies will go through a technology shift to support both types of working environments. This will require purchasing and methodology shifting, especially with cybersecurity and how cybersecurity/policy will be applied to this scenario.”

Forrester’s Jay McBain

Jay McBain, principal analyst at Forrester, speculates that year over year data will yield more telling results.

“The standard deviations are pretty close here,” said McBain. “So, likely, the multiyear results will end up bearing more fruit.”

Given the ways in which the world is quickly developing, it will be interesting to see how these sentiments and the corresponding data change moving forward.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email Allison Francis or connect with her on LinkedIn. |

About the Author(s)

You May Also Like