Lumen Sells ILEC Assets in $7.5 Billion Deal; Apollo Launching Standalone Company

Apollo, which bought a Utah-based fiber carrier last week, is forming a new telecommunications company.

Lumen Technologies is doubling down on its “core enterprise business” by selling a large portion of its incumbent local exchange carrier (ILEC) operations to Apollo Global Management.

The private equity firm will buy the CenturyLink-branded assets, which primarily serve consumers and small businesses, for approximately $7.5 billion. Those assets include fiber and copper networks, tower site connectivity and central offices in 20 states. As a result, Apollo builds upon a goal of meeting “accelerating demand for high-bandwidth connectivity and fiber technology.”

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

“The team at Lumen has built a great business and we see an incredible opportunity to provide leading edge, fiber-to-the-home broadband technology to millions of its business and residential customers,” said Aaron Sobel, private equity partner at Apollo. “Our investment will help accelerate the upgrade to fiber optic technologies, and we are excited to have such a high-caliber management team ready to bring faster and more reliable internet service to many rural markets traditionally underserved by broadband providers.”

Caveats

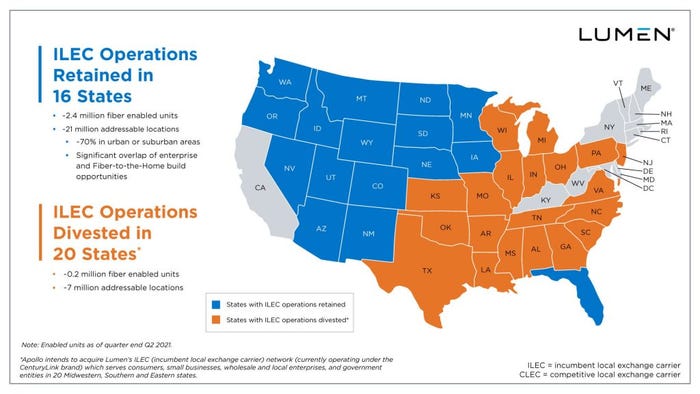

Despite selling its ILEC operations in 20 states, Lumen will keep those operations in 16 states. According to Lumen’s website, the company will keep 687,000 fiber subscribers while Apollo gets 59,000. You can view the geographical breakdown in the graphic below.

Source: Lumen

Lumen will keep the competitive local exchange carrier network it operates in 36 U.S. states and its national fiber routes. An FAQ notes that Lumen can now accelerate its market offerings around digital products and services. That includes SD-WAN, cloud and security offerings.

Lumen’s Jeff Storey

“This transaction is an important step in our continued efforts to transform Lumen and drive future growth for our company,” Lumen president and CEO Jeff Storey said. “We are pleased with the attractive valuation we received for these assets, which highlights the overall value of Lumen’s extensive asset portfolio. Apollo Funds will receive a great business with a strong customer base, dedicated employees and a platform for future growth.”

The parties suggested that the deal will close in the second half of 2022 after getting regulatory approval.

Background

Rumors swirled last month that Apollo might buy Lumen’s consumer unit. Storey had told investors that Lumen was pursuing selling “non-core assets.”

However, at the the time pundits estimated the price tag at around $5 billion, not $7.5 billion.

A week ago Lumen announced its plans to sell its Latin American business to an investment firm for $2.7 billion. At around the same time, the company announced its plans to expand its fiber network in three European countries.

Lumen has been on a selling spree – @lumentechco to sell local incumbent carrier operations in 20 states to Apollo Funds for $7.5 billion. Transaction will sharpen Lumen’s enterprise focus, and drive growth on the Lumen Platform. https://t.co/3juZBaxSOC

— Blair Pleasant (@blairplez) August 3, 2021

Apollo’s Play

Apollo is creating a company for now called …

… NewCo, whose platform will touch residential and business customers in the Midwest and Southeast. Apollo sees an opportunity to “bridge the digital divide” between rural and suburban areas through internet connectivity.

Bob Mudge, Chris Creager, and Tom Maguire – all former Verizon executives who helped build Fios – will lead the company. Keep in mind that this is the same Apollo Global Management that recently sold Tech Data and bought Verizon’s media unit.

Earlier this week, Apollo announced a $200 million investment in FirstDigital Telecom, a Utah-based fiber-based carrier. That funding announcement came at around the same time that FirstDigital publicized its acquisition of fellow Utah provider Veracity Networks.

Infrastructure Bill

Demitri Diakontonis of Mergers&Acquisition said the developing U.S. infrastructure bill incentivizes private equity firms like Apollo to invest in broadband.

“Infrastructure isn’t just roads and bridges anymore. Even a slimmed-down version of a federal infrastructure bill would incentivize private investment in companies,” Diakantonis wrote. “The FirstDigital investment … builds upon the firm’s 30-year track record in which Apollo funds have invested more than $20 billion in infrastructure-related opportunities. Apollo is currently investing out of its second dedicated infrastructure fund, which focuses on communications, power and renewables, transportation and midstream energy.”

Keep in mind that Lumen (then operating as CenturyLink) sold Tucson, Arizona-based metro network assets to FirstDigital back in 2018. The U.S. Department of Justice mandated that CenturyLink sell certain Level 3 Communications metro fiber network assets in New Mexico, Idaho and Arizona to merge with Level 3.

Apollo’s Andrew Kirby told Capacity Media that FirstDigital represents a “substantial market opportunity.”

“This investment underscores our belief in the leading role that fiber operators will play in providing critical connectivity to enterprises and communities alike,” Kirby said.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

Read more about:

AgentsAbout the Author(s)

You May Also Like