Verizon Top, Frontier Bottom of ISP Satisfaction Rankings

AT&T, Verizon, Windstream, CenturyLink, Comcast — all the big ISPs are here, most with bragging rights for improvement.

June 1, 2016

Verizon Top, Frontier Bottom of ISP Satisfaction Rankings

After two years of going in the wrong direction, internet service providers are making their customers a little happier. That’s according to the American Customer Satisfaction Index.

The ACSI’s report, which covers the telecommunications and information sector as a whole, says satisfaction is up nearly 2 percent across subscription TV service, ISPs, fixed-line telephone service, wireless service and cellphone manufacturers.

ISPs in the report were up 1.6 percent, to an average ACSI score of 64. Yes, the increase is great, but internet service providers still rank dead last among the 43 industries that ACSI covers.

Our gallery shows you the 13 companies ranked in this year’s ACSI index, from first to worst. Mergers and pending mergers no doubt played a role in how the 2016 numbers turned out. AT&T, Verizon, Windstream, CenturyLink, Comcast — all the big ISPs are here, most with bragging rights for improvement. But a few took a dive.

Follow senior online managing editor Craig Galbraith on Twitter.

ACSI’s ISP Rankings: #1 — Verizon FiOS

Among the large ISPs, Verizon FiOS jumped into first place after spending a year in second – up 5 points (7 percent) to an ACSI score of 73.

ACSI’s ISP Rankings: #2 — Cablevision

Cablevision’s Optimum was the second-biggest gainer on a percentage basis, up 13 percent (8 points) to a total of 69. That was good enough for second place — a big leap from a sixth-place tie a year ago.

The cableco recently reported its lowest quarterly customer churn in more than eight years.

ACSI’s ISP Rankings: #3 — Bright House Networks

Bright House saw a nice jump of 6 percent, from 63 points to 67. That was good enough for third place.

The timing of the improvement is great for Charter Communications (which also improved significantly year over year), which just closed on its purchase of Bright House and Time Warner Cable last week.

ACSI’s ISP Rankings: #4 — Time Warner Cable

Time Warner Cable gets this year’s “Most Improved” award, jumping 8 points (14 percent), from 58 to 66. The cableco’s score last year was only two points above the bottom of the heap; this year, TWC is in fourth place.

This is more excellent news for Charter, TWC’s new parent. More reason for celebration is Time Warner Cable’s addition of 314,000 high-speed Internet subscribers in the first quarter of 2016.

ACSI’s ISP Rankings: #5 — AT&T U-verse

The news isn’t good for AT&T’s U-verse, which had the second biggest drop (down 7 percent) compared to last year’s numbers, falling from 69 points (then-first place) to 64 points (fifth place) in 2016.

AT&T, of course, is going through a significant transition on the video side of the business, after closing on its purchase of DirecTV in 2015. Such mega-mergers often impact negatively on satisfaction scores, at least in the near term.

ACSI’s ISP Rankings: #6 (tie) — CenturyLink

While still only in the middle of the pack, CenturyLink had nice growth in the latest ACSI report, up from 60 points in 2015 to 63 this year (an increase of 5 percent). That put the telco giant into a tie for sixth place.

ACSI’s ISP Rankings: #6 (tie) — Charter Communications

Charter, now the second-largest cable company in America following its purchase of Time Warner Cable and Bright House Networks, hit the trifecta.

Not only were ACSI scores up for TWC and BHN, Charter itself posted the biggest gain of the three, up 11 percent, from 57 points to 63. That moves Charter up from the cellar in 2015 to only one point below the industry average — a nice leap.

ACSI’s ISP Rankings: #6 (tie) — Cox Communications

Cox Communications also saw nice improvement, up 9 percent (5 points), good enough to tie its cable cousin, Charter, with 63 points.

ACSI’s ISP Rankings: #9 — Suddenlink

ACSI included St. Louis-based Suddenlink Communications in its customer-satisfaction evaluation for the first time.

Suddenlink scored 61 points, good enough for ninth place out of the 13 companies that were ranked.

ACSI’s ISP Rankings: #10 (tie) —Comcast Xfinity

A three-point improvement by Comcast’s Xfinity service was enough to bring it out of last place in 2015. The 5 percent gain landed Comcast, the nation’s biggest cable company, in 10th place.

ACSI’s ISP Rankings: #10 (tie) —Windstream

Like Suddenlink, Windstream made its first appearance this year on ACSI’s list, coming in tied with Comcast for 10th, with 59 points. So there’s room for improvement.

ACSI’s ISP Rankings: #12 — Mediacom

Mediacom ranked lowest among the cable companies on this list (12th overall). The New York City-based company was one of the few that didn’t make gains in ACSI’s latest research, remaining flat year over year (57 points).

ACSI’s ISP Rankings: #13 — Frontier Communications

Frontier Communications brings up the rear this year for ISP customer satisfaction. The company fell five points (8 percent), to 56 points overall.

Frontier has received some tough press over the past few months thanks to the “steady pace” of complaints that former Verizon customers in California, Texas and Florida have made since Frontier took over the carrier’s wireline operations in those states earlier this year.

ACSI’s ISP Rankings: By the Service

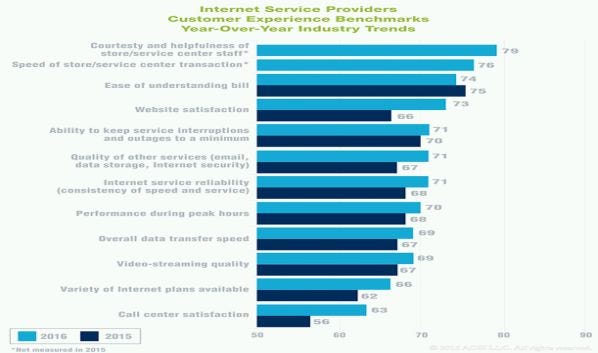

Breaking it down, Internet users report improvements in overall data speed and video streaming, along with many other aspects of the customer experience. Quality of email, data storage and security are all up, and customers are more pleased with choices of Internet plans.

Billing, though, is still a problem, with many customers having trouble understanding their statements.

Customers generally are more satisfied with ISP websites and call-center performance is up a little bit; however, this remains the weakest category among telecommunications services.

Go into a store and it’s a different story. Store and service-center staff get high marks for being courteous and helpful in regard to Internet service.

Verizon Top, Frontier Bottom of ISP Satisfaction Rankings

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author(s)

You May Also Like