Office 365 vs Google Apps: Microsoft, Google Set to Trade Blows

When Microsoft launches Office 365 cloud updates Feb. 27, watch for Google Apps to be ready with its own competitive messaging. It's time for partners to take sides.

February 21, 2013

By samdizzy

The Office 365 vs. Google Apps war will escalate next week. Microsoft (NASDAQ: MSFT) is set to update its cloud suite for business on February 27. Everybody has circled the date — including Google (NASDAQ: GOOG). It’s a safe bet the search giant is planning a few surprises to counter punch Microsoft’s launch day.

The good news for Microsoft partners: Those that choose to do so will be able to manage end-customer billing and pricing for the new Office 365 release. That partner-centric effort is known as Office 365 Open.

Many Microsoft partners have been requesting that capability since Office 365 launched in June-July 2011. Google Apps has allowed partners to manage end-customer billing for several years.

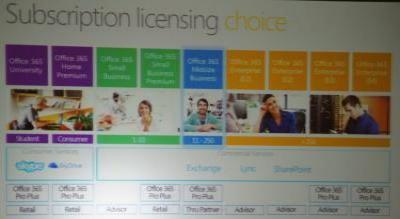

According to a Microsoft presentation delivered at Tech Data‘s TDCloud conference in January 2013, there will be nine Office 365 SKUs. (I took the photo below during that conference.) In stark contrast, I think Google essentially has three or fewer SKUs (education, government, business) but it may actually be a single SKU — I’m double checking.

But the essense of my point remains unchanged: Microsoft may be complicating the conversation with so many SKUs, which will include:

Office 365 University: I don’t have further details.

Office 365 Home Premium: At $99.99 per year, this includes Office 2013 (Word, Excel, PowerPoint, OneNote, Outlook, Access, and Publisher) on up to 5 different devices. It also offers 20GB of SkyDrive Plus storage and 60 minutes of free international landline calls per month on Skype.

Office 365 Small Business: This is for small businesses of up to 10 employees. Featuring Lync Online, Exchange Online, and SharePoint Online. I’m checking pricing on this.

Office 365 Small Business Premium: Also for up to 10 users. It includes everything in SKU #3 plus the desktop Office suite, I believe.

Office 365 Midsize Business: This is for 11 to 250 users. I believe it’s the same offering, for the most part, as #4.

Office 365 Enterprise 1: Not sure of details but for 250 users or more.

Office 365 Enterprise 2: Not sure of details but for 250 users or more.

Office 365 Enterprise 3: Not sure of details but for 250 users or more.

Office 365 Enterprise 4: Not sure of details but for 250 users or more.

Disclaimer: The list above is from that Microsoft presentation I saw in January 2013. It has been a few weeks and I suspect Microsoft has made a few small tweaks. Check back on Feb. 27 for an updated look at the list above and what it means for partners.

In the meantime…

On the upside: I suspect Microsoft will offer clear guidance to partners in terms of which cloud suite is most ideal for most SMB customer engagements. On the downside: Does the world really need nine SKUs? Especially in the age of cloud computing, customers and partners are seeking simplicity.

Over at Google, the message is quite clear: For about $50 per user per year, customers can leverage Google Apps. There isn’t a complex Excel spreadsheet (er, Google Doc) for customers and partners to navigate during the buying process.

Still, I’ve got to give Microsoft credit. Over the past year, channel partners have been warming up to Office 365. In our recent MSPmentor 501 report, roughly 50 percent of the world’s top MSPs were now offering Office 365 to customers, compared to about 20 percent for Google Apps.

But Google has 6,000 channel partners. And if I was a betting man, I’d wager that Google is planning some big Google Apps surprises just in time for the new Office 365 launch.

Count on it.

You May Also Like