Autotask to be Acquired by Private Equity Firm

Professional services automation platform provider Autotask Corp. will be acquired by a private equity firm, CEO Mark Cattini announced at the start of his keynote address at the Autotask Community Live conference in Miami this morning. Here are the details.

June 9, 2014

UPDATED — Professional services automation platform provider Autotask Corp. will be acquired by private equity firm Vista Equity Partners. CEO Mark Cattini announced the deal at the start of his keynote address at the Autotask Community Live conference in Miami this morning. Here are the details.

No financial details were released. The largest selling shareholders were early stage VC firm First Albany Tech Ventures (FA Tech Ventures) and JMI Equity, the company that just sold Eloqua to Oracle. Autotask will remain a private company, Cattini said.

“We are still private and still independent,” he said. “That allows us to continue our mission of delivering smart IT to you. If you liked Autotask version 1 you will love Autotask version 2. Expect to see an accelerated product roadmap and more innovation…a bigger and better Autotask.”

Cattini told MSPmentor that the acquisition will mean a new board of directors for Autotask made up of Vista Equity Partners members and Cattini and perhaps an independent board member, too. No management or other personnel changes are planned in conjunction with the deal, he said.

Vista Equity Partners has had more than 100 investments in software companies and Pat Burns told MSPmentor that the PE firm does take a collaborative approach with its portfolio companies, but it is unclear which of those in Vista Equity Partners’ portfolio would be likely to work closely with Autotask at this point. A partial list of the company’s investments can be found here. It appears Vista Equity Partners specializes in software-as-a-service and other management solutions for specific vertical industries.

The Autotask announcement follows a raft of deals by managed services platform companies over the couple years as AVG acquired Level Platforms, Solarwinds acquired N-able, private equity firm Insight Venture Partners acquired Kaseya, to name a few.

Cattini said that Vista Equity Partners has made approximately $11.5 billion in cumulative capital commitments in software, data and technology-enabled services companies.

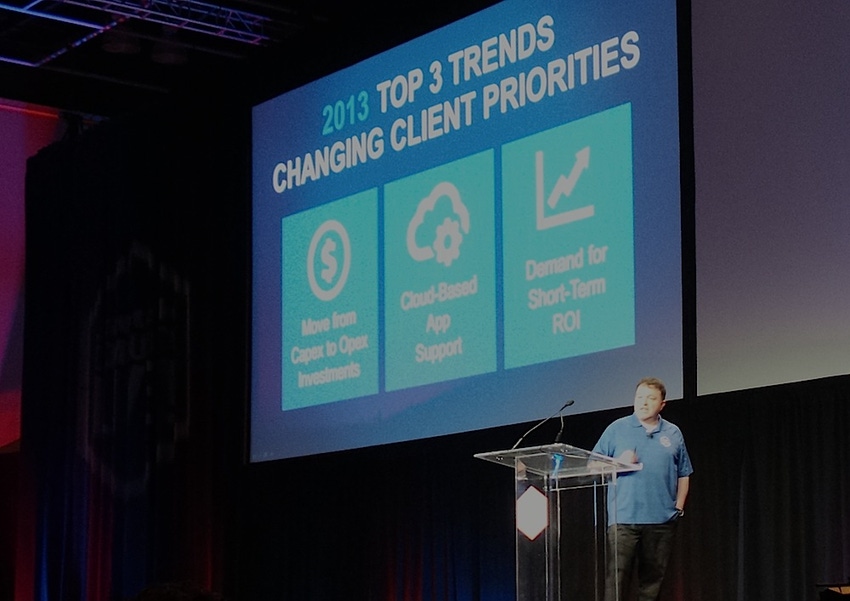

Vista Equity Partners had this to say about the Autotask acquisition: “Autotask has a long history of dedicating itself to customer-centric solutions and has built a strong foundation for sustained, long-term growth,” said Alan Cline, principal at Vista Equity Partners. “We are very pleased to be working with the Autotask team to expand and enhance the company’s solutions to help IT service providers more efficiently and effectively meet their clients’ changing needs.”

Jefferies LLC acted as financial advisor to Autotask. The transaction is expected to close this summer.

Updated with additional details from interview with Autotask’s Mark Cattini, CEO and Pat Burns, VP of product management.

Read more about:

MSPsAbout the Author(s)

You May Also Like