How to Get to the Bottom of Employee Profitability

It pays to calculate the fully loaded cost of employees to get an accurate picture of business operations.

November 13, 2019

By Harmony PSA's Steve Duckworth

In part one of this series designed to explain what it takes to truly understand your business, we outlined how to determine how much money your business is actually making. In part two, we explored ways to help you better understand your staffing costs.

Now that you have the relevant insights you need, how do you actually go about calculating contributions to your bottom line?

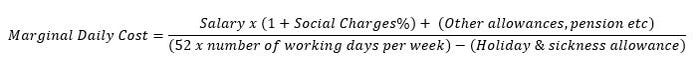

At first glance, the calculation for ‘Marginal Daily Cost’ looks quite simple. Each employee has a known salary and plans to work a set number of days or hours per year:

This number is a reasonable approximation of an individual’s direct, incremental or marginal cost per day. However, to calculate the fully loaded cost that should be used in profitability calculations, you need to take more items into account.

(Note the divisor in this equation is the Effective Working Days per full-time equivalent (FTE), generally between 220 and 230 days. It is referred to as such in the equations that follow.)

Method 1: Blended Cost Rate

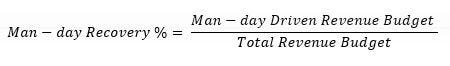

To decide how to incorporate your overhead costs via your man-day cost, you first need to decide which of your revenue streams assume man-days as key overhead costs. For instance, you may decide that software license sales are not man-day dependent but the rest of the business (support and services streams) is.

So, to calculate the percentage of overheads that must be recovered via man-days:

The second key decision is which of your staff contribute to revenue. Normally, this would exclude management, sales and marketing, finance and administration staff, but include all others. We will call these people Delivery Stream Staff. The FTE value of this group takes into account part-time workers and any phased head count that your budget assumes during the year.

The final decision is whether you expect your contractors (who are, in effect, under cost of goods employment) to contribute to overhead recovery. This will depend on what percentage of your staff they represent. For this example, we will assume they don’t make a budgeted contribution to overhead recovery since they are a fully variable income stream.

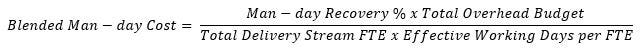

With these assumptions, the fully loaded blended man-day cost is calculated as:

(Note: The total overhead budget here includes all salaries, burden and other non-sales related costs.)

Method 2: Fixed Overhead Recovery

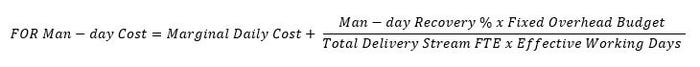

The Blended Cost Rate method gets you a good working number and will ensure profitability calculations are at least meaningful. However, it doesn’t take into account individual salaries. If you have customers, projects or products that don’t conform to a normal mix of staff, the result can be misleading and may lead to bad decisions.

To improve the granularity, we need a new cost definition, which is the Annual Overhead Budget less the direct cost of the Delivery Stream Staff. We’ll call this cost group the Fixed Overhead Budget. So, the individual cost rate for the Fixed Overhead Recovery (FOR) method is calculated as:

This will give you a personal cost rate, but it may be too much detail and/or too much maintenance. A common middle road is to group staff into “cost bands” in the same way you may group them into charge bands. Replacing the marginal daily cost with group averages in the equation above will get you very accurate profitability numbers and eliminate the possibility of someone reverse-engineering salaries from cost reports.

Method 3: Variable Overhead Recovery

Fixed Overhead Recovery, especially by bands, is accurate, practical and meaningful, but some would argue that …

… it flatters high-charging staff and undervalues the contribution of lower paid employees since they earn less, but all carry the same overhead cost allocation. The answer to this is the Variable Overhead Recovery (VOR) method.

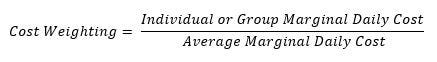

VOR weights the share of overhead costs applied to each individual or band by their direct cost; thus, more expensive staff (who presumably charge out at a higher rate) carry more overhead. This number is calculated using the equation above, but with a cost weighting applied to the overhead recovery function as:

Note: If banding is applied, the average marginal daily cost should be calculated on totals, not as a straight average of the band numbers or an “average of averages” effect will take place. Clearly, using this same thinking, we can incorporate billable targets.

Getting the fully loaded labor cost rates right is key to instant profitability analysis. If you are accurate in this calculation, at year’s end, the revenue numbers — where labor is the distribution key — will show all your overhead costs fully recovered and you will know where you made the money and how much. This calculation is vital to tuning your business and maximizing returns.

For many this process may seem a step too far. However, by getting this depth of insight into your business, you will be able to grow and develop in a way that you previously wouldn’t have been able to realize.

Greater insight into the contribution of projects and staff to your bottom line ultimately leads to a much clearer understanding of your organization’s operations. In a time when we’re all looking to be as competitive as possible in the marketplace, attaining this insight can only be good for business.

In a career that began in offshore engineering, migrated into investment banking and ended up with the co-founding of a software company 10 years ago, Steve Duckworth, CEO of Harmony PSA, has devoted his career to developing solutions solving project, accounting and business process problems. Follow him on LinkedIn or @HarmonyPSA.

You May Also Like