Google Eyes Cloud Growth with Data Center, Sales Investments

There's $13 billion in data centers and offices, and more sales people too.

February 15, 2019

Google is taking some big swings as it looks to accelerate the growth of its public cloud business, planning an investment of $13 billion in data centers and offices in the United States while at the same time promising to put more money and people behind their sales efforts around the cloud.

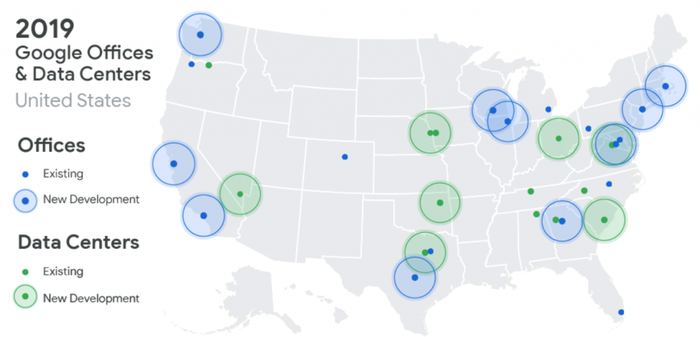

The new data centers will serve the vast array of online services the hyperscale company offers, including its Google Cloud business. In a blog, Google CEO Sundar Pichai wrote that the $13 billion that will be spent this year follows $9 billion invested in 2018 to grow the company’s footprint in the U.S. This year, the goal includes major expansions in four states: Massachusetts, California, Virginia and Illinois.

With those investments, Google will have a presence in 24 states, with data centers in 13 communities. The expansion plans include new data centers in Nevada, Nebraska, Texas and Ohio, and added infrastructure in current data centers in Oklahoma, South Carolina and Virginia.

With those investments, Google will have a presence in 24 states, with data centers in 13 communities. The expansion plans include new data centers in Nevada, Nebraska, Texas and Ohio, and added infrastructure in current data centers in Oklahoma, South Carolina and Virginia.

“This growth will allow us to invest in the communities where we operate, while we improve the products and services that help billions of people and businesses globally,” Pichai wrote. “Our new data-center investments, in particular, will enhance our ability to provide the fastest and most reliable services for all our users and customers.”

At the same time, new Google Cloud CEO Thomas Kurian told attendees at the Goldman Sachs Technology and Internet Conference in San Francisco this week that the company is increasing its investments in sales as it looks to better challenge Amazon Web Services and Microsoft Azure in the booming global public cloud market.

According to CNBC, Kurian – the former Oracle executive who took over his new job in November, replacing Diane Greene – said at the conference that “you will see us accelerate the growth even faster than we have to date. … We are hiring some of the best talent from around the industry to grow our sales organization, and you will see us competing much more aggressively as we go forward.”

Kurian, who is in charge of not only the Google Cloud Platform – its public cloud offering – but also the G Suite of business applications, also talked about the push to grow the number of channel partners it works with.

In the worldwide public cloud race, Google is in third place behind AWS – whose market share of almost 40 percent is more than that of the next four competitors (Azure, Google, IBM and Alibaba) combined – and Azure, according to analysts at Synergy Research Group. In the fourth quarter, four of the top five – excluding IBM – saw their market shares grow at the expense of small and midsize cloud providers, the analysts found.

In all, global spending on cloud-infrastructure services last year grew 48 percent over 2017, Synergy reported.

In the fourth quarter, both AWS and Azure saw sharp revenue gains. Over the final three months of 2018, AWS generated $7.4 billion in revenue, a 45 percent jump year-over-year. Azure’s revenues increased 76 percent, and while Microsoft doesn’t break out Azure revenue, Canalys analysts estimated it at about $4 billion. Google said earlier this month that its cloud business is one of the fastest-growing within parent company Alphabet and that the company last year doubled the number of …

… Google Cloud Platform deals of more than $1 million and of multiyear contracts signed, and that it now has more than 5 million paying G Suite customers.

At the Goldman Sachs event, Kurian noted that Google Cloud in the past had focused on young “digital native” companies as customers, but that he intended to aggressively pursue older and more established firms in such areas as telecommunications, health care, retail and financial services. Already the company has such clients as Home Depot and KeyBank, and Google Cloud will look to grow in various verticals.

Enderle Group’s Rob Enderle

More data centers will give Google Cloud greater capacity and Kurian will have a larger salesforce to work with. Whether all that will help Google grow its public cloud business as fast as it wants or attract the larger and older businesses it wants is unclear, according to Rob Enderle, principal analyst with The Enderle Group.

Google Cloud delivers a lot of value for the money, but there also is “a lack of focus, fundamental distrust with using a firm that sells customer information, and very weak marketing and brand management,” Enderle told Channel Futures. “The biggest problems that Google Cloud has aren’t with competition; it is with Google.”

Google’s brand and identity don’t attract the larger, more established class of customers he said, adding that it would be in Google’s best interest to spin out the cloud business as a wholly owned subsidiary that carries its own identity.

“The [European Union’s General Data Protection Regulation] risks alone with using a service from a company that sells customer information are huge and few mature companies are likely willing to take that kind of risk,” Enderle said.

Read more about:

VARs/SIsAbout the Author(s)

You May Also Like