These vendors are clearly using the indirect sales channel.

VMware continues to lead the IHS Markit SD-WAN vendor rankings ahead of Cisco.

The Palo Alto, California-based company, which acquired VeloCloud Networks two years ago, scored first in SD-WAN market share on IHS Markit’s Data Center Network Equipment Market Tracker.

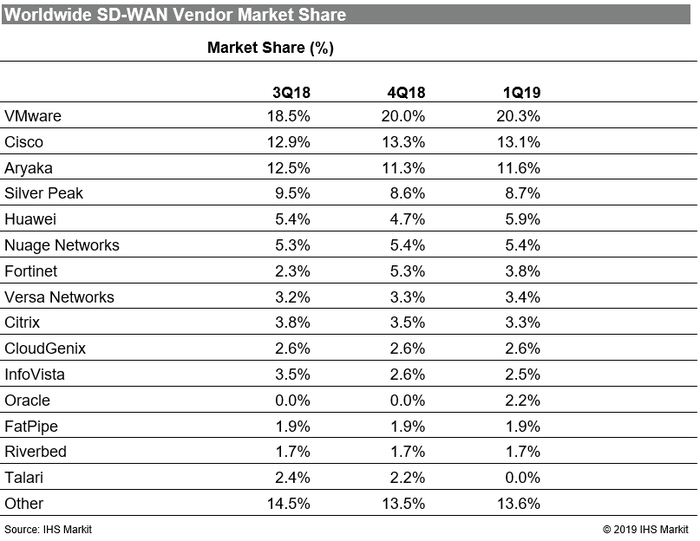

The first-quarter rankings concluded that VMware owns 20.3% of the market, followed by Cisco (13.1%), Aryaka (11.6%) and Silver Peak (8.7%). The four companies have maintained the same order for the leaderboard’s last four quarters.

Source: IHS Markit

Oracle entered the leaderboard for the first time, slotting into 12th (2.2%). The company acquired Talari Networks late last year. The new rankings only show percentage of market share, unlike previous versions that showed total SD-WAN revenue.

IHS Markit’s Josh Bancroft

IHS Markit offered several interesting trend observations. The financial vertical is taking off, with larger enterprises signing up for SD-WAN. One customer maintains almost 4,000 total sites globally. Financial institutions are known for adopting the technology at a slower rate due to concerns about sensitive data. But Josh Bancroft, senior research analyst at IHS Markit, said the technology is catching up.

“In our discussions with vendors, it’s becoming apparent that financial enterprises are rearchitecting their legacy WANs with SD-WAN to utilize traffic-routing segmentation features,” Bancroft said. “This ensures that traffic containing sensitive customer data is separated from other network traffic, increasing data security and aiding in demonstrating payment card industry (PCI) compliance.”

The study also touched on remote workforces. An IHS Markit survey earlier this year found that 43% of workers are based outside of their company’s offices. According to IHS, vendors are responding by creating compact SD-WAN appliances that work in homes and even function inside backpacks.

“Enterprises want to ensure that employees who are remote or mobile still have high levels of connectivity for SaaS-based applications,” Bancroft said. “Application traffic is required to traverse over multiple links to ensure failover for voice and video sessions where constant connectivity is essential, such as for home office-based customer service agents or medical first responders. If SD-WAN vendors have not added compact appliances to their offerings already, they should continue to invest in compact SD-WAN appliance development to ensure they seize this market opportunity.”

The vendors are clearly using the indirect sales channel, as they “reap the rewards of partnering with multiple telcos, systems integrators and managed service providers.”

Masergy this week shared a study on SD-WAN adoption’s common drivers and challenges. The survey indicated that customers are more concerned than ever about securing their branch offices.

Read more about:

AgentsAbout the Author(s)

You May Also Like