Enterprises are getting into the SD-WAN craze.

VMware-owned VeloCloud leads the software-defined wide area networking (SD-WAN) industry’s latest revenue rankings.

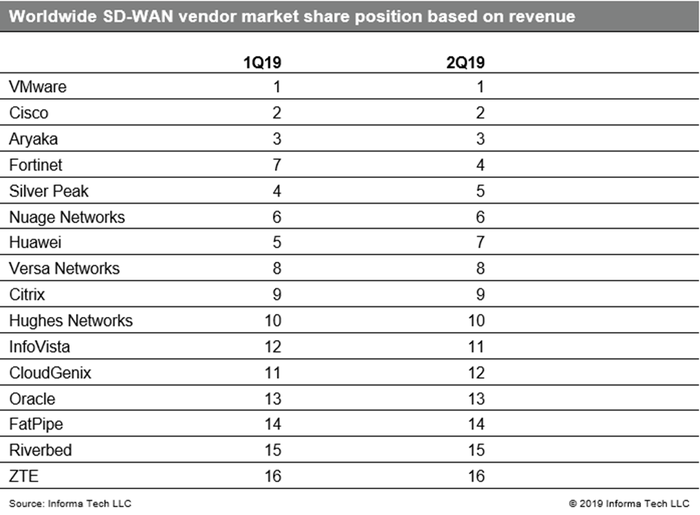

Research firm IHS Markit unveiled its second-quarter market share results for SD-WAN. VMware, Cisco and Aryaka took the top three for the fifth straight quarter, but Fortinet leapfrogged into fourth place over Silver Peak, Nuage Networks and Huawei. IHS ranked the companies based on revenue generated from SD-WAN “appliances and control and management software.”

IHS Markit’s Josh Bancroft

The market rose 23% in the second quarter, and IHS Markit cites growing enterprise adoption. Large companies – some reaching as many as 5,000 offices – are replacing their routers in favor of equipment that works with SD-WAN technology.

“In our discussions with vendors, it has become apparent that most recognize SD-WAN as a mainstream technology,” said Josh Bancroft, senior research analyst at IHS Markit. “As a result, larger enterprises have begun to refresh their legacy, router-centric WANs with SD-WAN. Vendors are capitalizing on the refresh opportunities with customers that have large bases of aging router equipment.”

The study also projected total SD-WAN revenue to reach $4.4 billion in 2023. The SD-WAN results are part of IHS Markit’s Data Center Network Equipment Market Tracker.

Source: IHS Markit

Fortinet is “benefiting from large enterprise security appliance refresh,” according to IHS Markit. The cybersecurity vendor began appearing on the IHS Markit tracker last year and recently said it was betting big on its updated Secure SD-Branch solution to combine the best of SD-WAN, security, switching and other features.

“We’re hearing from an increasing number of customers who are concerned about the security risks associated with SD-WAN exposing branch offices to the internet,” said John Maddison, Fortinet’s executive vice president of products and chief marketing officer. “We believe our growing market share validates the need for Fortinet’s unique security-driven networking approach, which tightly integrates security and SD-WAN functionality into a single offering.”

Fortinet also signed a partnership with Windstream to become its second SD-WAN vendor alongside VeloCloud. Gartner listed Fortinet as a top three SD-WAN equipment market share holder several weeks ago.

ICYMI: According to a recent Gartner report, #Fortinet is among the top three vendors in worldwide market share for #SDWAN equipment by revenue. Learn why customers like Banco Votorantim select our innovative SD-WAN and SD-Branch solutions: https://t.co/W5G7BH6Aqp pic.twitter.com/htxjajUTZg

— Fortinet (@Fortinet) October 8, 2019

Bancroft said the increasing number of remote workers is driving SD-WAN demand. North American radiologists installed about 200 SD-WAN appliances in their home offices in the second quarter, according to the study.

“In the future, we anticipate further deployments of SD-WAN appliances in the homes of remote employees, with either compact or more traditional appliance form factors being used,” Bancroft said. “Bonding LTE and broadband links ensure session failover for unified communications (UC) users. It also promotes the security of sensitive patient data through security policies that can be established at the device level by health care providers in orchestration portals.”

Mobile workers are also drawing the industry’s eye. Bancroft said vendors are still investing to make traffic steering available for …

… LTE mobile devices.

“During discussions and keynotes, vendors said they are already testing the performance of appliances bonding 4G LTE links from differing providers in vehicles,” Bancroft said. “A number of vendors are also in discussions with car manufacturers, preparing for autonomous vehicle deployments.”

Global #SD-WAN market rose 23% sequentially in Q2 2019 as corporations ramp up purchases to replace installed base of routers with SD-WAN-enabled equipment: https://t.co/8Igkr4tjZ0@VMware @Cisco @AryakaNetworks @Fortinet

IHS Markit | Technology is #NowPartOf @InformaTechHQ pic.twitter.com/nFt4nY7WBI— IHS Markit | Technology Cloud & Data Centers (@IHSMarkitCloud) October 11, 2019

IHS shared first-quarter results back in the summer, and the results were similar. VMware led with a market share of 20.3%, over Cisco, 13.1%. The study also made note of how companies see SD-WAN as a way to accomodate mobile workforces who are more and more often using SaaS applications.

“Application traffic is required to traverse over multiple links to ensure failover for voice and video sessions where constant connectivity is essential, such as for home office-based customer service agents or medical first responders,” Bancroft said in July. “If SD-WAN vendors have not added compact appliances to their offerings already, they should continue to invest in compact SD-WAN appliance development to ensure they seize this market opportunity.”

Read more about:

AgentsAbout the Author(s)

You May Also Like