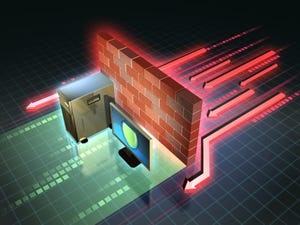

New EDR XDR product line from Kaspersky

Cybersecurity News

New Kaspersky Product Line Combines EDR, XDRNew Kaspersky Product Line Combines EDR, XDR

Plus, Malwarebytes integrates with ConnectWise and SecurityGate launches a new partner program on a day chock-full of cybersecurity news with channel impact.