As the company’s fiscal Q3 draws to a close today, Barracuda MSP is seeing great momentum in sales of security software. But executives at the vendor insist that’s only part of the story.

The announcement this week that tech investment firm Thoma Bravo reached a $1.6 billion deal to purchase Barracuda Networks and take the company private offered yet another clear signal that the “smart money” is betting on MSPs to profit big from the growth of cloud.

At first glance, the purchase of the data protection vendor looks like a play for a bigger share of the booming cybersecurity market – which it most definitely is.

But a deeper examination of Barracuda’s strategy following its September 2015 acquisition of Intronis suggests a strong conviction that recurring revenue models are poised for significant growth – not in spite of cloud adoption – but because of it.

That view was reinforced a day after the deal was announced, when 451 Research unveiled new data during Tuesday’s session of the AWS re:Invent 2017 conference in Las Vegas.

The report points to a potentially rosy future for MSPs, VARs and other channel players that effectively bundle, resell and manage the already dizzying and wildly expanding assortment of products offered by major cloud providers.

“AWS alone has 320,000 different SKUs, and 53,000 of those were added in the first two weeks of November alone,” tech journalist Mike Vizard wrote in a new Barracuda blog post, citing the new study.

The disparate and complex products and pricing should mean big opportunity for channel firms.

“As the number of cloud services organizations consume increases, the more likely it becomes they will rely on MSPs to navigate a byzantine number of options,” the post argues.

Margin Growth Projected in Cloud

Indeed, the cloud pie is getting much bigger very quickly.

The new research projects cloud computing revenue will grow from $28.1 billion this year to $53.3 billion by 2021 – a 19 percent compound annual growth rate.

Workloads run in some form of hosted cloud are expected to grow to 60 percent by 2019, up from 45 percent today.

Nearly 70 percent of organizations will be operating some form of hybrid environment, 451 Research estimates.

The bulk of 2017’s cloud computing as a service (CCaaS) revenue (57 percent) is projected to come from lower-profit infrastructure as a service (IaaS) products.

But the fastest growth during the next half decade (27 percent CAGR) is expected to come from high-margin offerings like integration platform as a service (PaaS) and infrastructure software as a service (ISaaS), which includes IT management software and cloud storage (21 percent CAGR).

To make money, MSPs will need to deftly navigate the impact of price wars by public cloud vendors.

End customers are already coming to expect that when they buy PaaS offerings, the cost of the underlying IaaS will be bundled in.

“The challenge MSPs will face is maintaining margins for the services they provide as the cost of the cloud services themselves decline,” Vizard’s blog states.

Intronis Purchase Bears Fruit

That brings us back to Barracuda’s strategy.

The Intronis purchase instantly gave the hardware-sales-reliant vendor a solid beachhead in the recurring revenue MSP space by bringing in Intronis’ nearly 2,000 MSPs.

That number has since grown to about 2,400 MSPs.

In addition, Barracuda’s bread had largely been buttered by resellers outside of North America.

Buying Intronis’ gave Barracuda an immediate and substantial footprint in the U.S. and Canada.

Last but not least, the deal gave Barracuda ownership of Intronis’ purpose-built platform for MSPs, which has since been retooled to include Barracuda’s data protection and security solutions.

During the first nine months of 2017, Barracuda has moved full speed to consolidate its foothold among IT services providers.

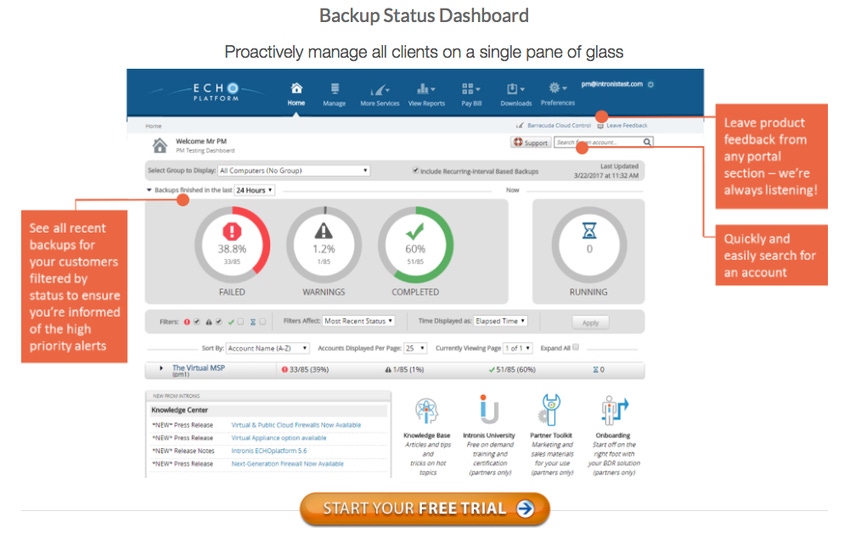

It rebranded Intronis MSP Solutions by Barracuda as Barracuda MSP, and rolled out the ECHOplatform, a white-label centralized management portal.

“Barracuda MSP partners can deploy end-to-end security and data protection solutions, and manage them in one place,” the product webpage states. “Partners can view products by customer account, enabling them to easily see what services are being delivered, what the costs are, and where there might be service gaps that could lead to new business opportunities.”

ECHOplatform was recently integrated for use with ConnectWise tools.

Turning Resellers to MSPs

But more than half of Barracuda’s roughly 5,000 partners are still resellers, and the latest phase of the vendor’s strategy is about helping those businesses, and legacy MSPs, adapt to more lucrative recurring revenue models.

“We’ve spent a good amount of resources enabling resellers and VARs to transition their business models,” Brian Babineau, senior vice president and general manager for Barracuda MSP, told Channel Futures during an interview last week.

In September, Barracuda launched SmarterMSP.com, a site dedicated to providing news and insights about the MSP space.

Perhaps more significant, the vendor also rolled out “Ready, Set, Managed!” a partners-only tutorial program billed as a shortcut to teaching companies how to build successful, recurring-revenue MSPs.

The program includes step-by-step guides, instructional events, quizzes and peer discussions.

As the company’s fiscal Q3 draws to a close today, Barracuda is seeing great momentum in sales of security products, Babineau explained.

But he insisted that’s only part of the story.

“The first thing that we commit to is, we are dedicated to providing business support for (our partners),” Babineau said. “Our goal is to provide the right technology on the security side…and then simplify the overall business relationship with our MSPs.”

Send tips and news to [email protected].

About the Author(s)

You May Also Like