SMBs and enterprises are on different pages with SD-WAN adoption.

Katalyst counts SD-WAN as a chief weapon for obtaining monthly recurring revenue.

The North Carolina-based company previously identified as an integrator but has transitioned into an MSP in recent years. The firm now derives approximately 60% of its revenue from products and 40% from services, according to Jesse White, director of solutions engineering and field chief technology officer.

Katalyst’s Jesse White

White said SD-WAN fit nicely into Katalyst’s quest to organically grow its managed services practice. He said a sizable networking technology skills gap makes SD-WAN an attractive value proposition. A brief LinkedIn search proves his point.

“There are literally 12,000-15,000 jobs open in this Southeast region that our customers can’t fill,” White said. “And they can’t fill them because there’s a major talent shortage. But there’s also an experience-level shortage with a converged WAN.”

White said his company can fill the gap, and more.

“We don’t just manage the WAN that connects their interoffice facilities. We connect and manage everything behind it as well. And that’s where I think we have a competitive advantage, specifically against the provider space,” he said.

White said provider-based solutions – such as those from AT&T, Windstream and CenturyLink – represent Katalyst’s biggest SD-WAN competition. And the providers see SD-WAN as a key battleground they’ll need to win in order to retain customers.

“They don’t want to lose the revenue — these big, meaty contracts that they’ve had customers paying for years,” White said.

But what exactly is Katalyst’s SD-WAN solution? The MSP included the providers when it reviewed the SD-WAN marketplace in search of a platform. But Katalyst picked neither the provider-based nor “virtualized stack” flavors of SD-WAN. It instead chose with Cisco SD-WAN powered by Viptela.

Katalyst was already serving a Cisco-heavy install base that, in White’s opinion, preferred to remain independent from the carriers. Other customers worried securing new internet connections.

“Why try to introduce something novel to a customer that only adds complexity and unfamiliarity?” he said.

White said further utilizing the Cisco platform helped Katalyst offer an end-to-end WAN service.

“Managed WAN great; managed SD-WAN is great, but our customers want more than that,” White said. “We have competitors out there that are slinging mud around: ‘Oh, we’ll manage your WAN end-to-end.’ Well, what about your SIEM? What about your security stack? What about your collaboration environment?”

Katalyst had been selling Cisco IWAN as of five or six years ago but is now in the process of converging IWAN users over to Viptela. The MSP has sold the quite popular Cisco Meraki solution, but White said the Meraki conversation focuses more on simplicity than SD-WAN adoption.

With only about 50 employees, Katalyst has also benefited from Cisco’s scale. Cisco has taken the MSP to its road shows, where Katalyst has tapped into the hefty demand for SD-WAN. White also praised Cisco for its openness to feedback. Security in particular has been an area where Cisco has rolled out new integrations and offerings in response to customer feedback passed along by Katalyst, according to White.

“We’re at a place where we feel like Cisco has rapidly adopted and supported some of the recommendations that some of the engineers have made, and brought it into market very, very quickly.”

Avant

SD-WAN is disrupting its predecessors faster than any other technology in the channel, according to Avant Communications. The Chicago-based master agent rolled out juicy SD-WAN data last week with the launch of its “SD-WAN 6-12 Report.”

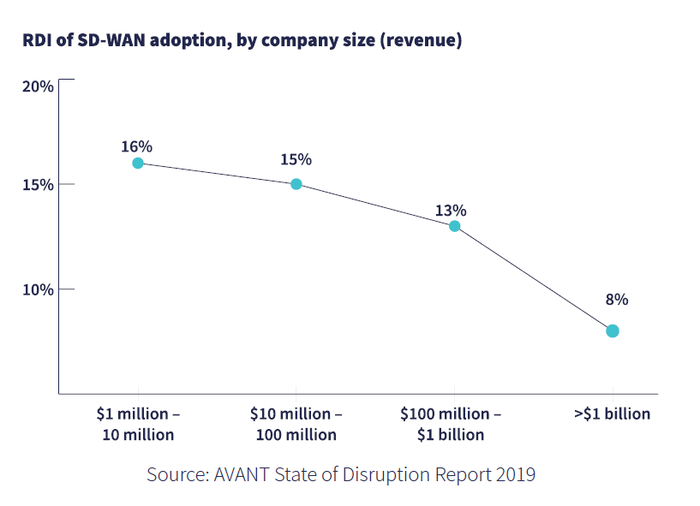

Avant surveyed 300 technology decision makers about how quickly they are replacing or supplementing incumbent technologies with new ones. SD-WAN’s “Rate of Disruption Index” (RDI) was 13%, which was a clear winner over UCaaS and cloud infrastructure (both 7%). As you might expect, smaller companies reported a larger RDI, with companies of more than $1 billion reporting only 8%.

Source: Avant SD-WAN 6-12 Report

The consulting and manufacturing industries reported the highest disruption rate for SD-WAN.

But SD-WAN disruption doesn’t necessarily equate to MPLS displacement. Sixty-two percent of respondents had MPLS, and 40% of respondents said they planned to…… keep their original network.

The enterprise in particular is hanging onto MPLS. The majority (53%) of respondents earning more than $1 billion said they plan to purchase MPLS.

Avant’s Ken Presti

“We’re seeing SD-WAN growing in the midmarket, and we’re seeing it growing at the edges of the enterprise and working its way in,” said Ken Presti, who joined Avant this year to lead its new analytics initiative. “At the core of the enterprise where it’s a much more difficult transition, you’re still seeing a lot of MPLS, and they’re actually still investing in MPLS.”

Avant CEO Ian Kieninger said a large portion of the Avant subagent base sells MPLS. But they’ll need to evolve. Either they’ll start conducting SD-WAN conversations with customers or concede those customers to companies that do talk about SD-WAN.

Avant’s Ian Kieninger

“Either you’re going to hold on to [MPLS], and you’re going to grow some of it because there’s just natural growth out there and more bandwidth is being consumed. At some point that’s going to start to change. And you either be the change agent, or you let the change change you in a negative way,” Kieninger said.

Our @DrewLydecker doing an “Interview with AVANT” with @Craig_Galbraith of Informa. Talking about the launch of AVANT Research and Analytics!! “The traditional research houses haven’t been disrupted yet, so we decided to aim our guns at them.” #CPEvolution pic.twitter.com/gPjB3jvM50

— AVANT (@Avant_CCC) September 11, 2019

Quick Hits

Curt Allen, Windstream’s president of strategic channels, credited SD-WAN (along with UCaaS) for creating new growth opportunities for partners. Check out Edward Gately’s interview with Allen.

SD-WAN provider Adaptiv Networks partnered with the UCaaS provider SkySwitch to serve SkySwitch’s reseller partners. Read the companies’ joint announcement.

Read more about:

AgentsAbout the Author(s)

You May Also Like