The next generation of our SD-WAN roundup is here to stay.

A report shows pain points around SD-WAN automation; plus, Comcast Business added machine learning capabilities to its software-defined networking platform.

Before the Channel Partners website fully integrated with Channel Futures, we ran a column called the SD-WAN roundup. The column tackled all things software-defined wide area networking (SD-WAN), voicing the perspectives of vendors, analysts and channel partners. However, many of us in the channel have come to the understanding that SD-WAN is not an end unto itself.

SD-WAN remains a useful tool to help businesses optimize and simplify their network connectivity, but it fits into a larger vision that Gartner calls the secure access service edge, more commonly referred to as SASE. SD-WAN functions as a component of SASE, which brings networking and security into the same conversation. Yes, customers want to talk about SD-WAN, but they also want to talk about how they can secure their network. Add to that a remote workforce that resides outside the typical branch office that SD-WAN traditionally supports, and you’re looking at a much more complicated conversation.

Thus, we’ll continue to discuss SD-WAN in this column while renaming it to reflect the pervasive trends of the last two years. We’ll pay more attention to the convergence of network and security as well as efforts to ensure secure connectivity for distributed workforces. Join us as we continue the conversation.

Service Providers Weigh In

For a service that prides itself on its ability to simplify the network, SD-WAN sure can be complicated. That sentiment stems from a report that Heavy Reading published. Accedian, Amdocs and VMware commissioned the study.

We recently compiled a list of 20 top SD-WAN providers offering products and services via channel partners. |

Heavy Reading surveyed 103 global service providers (44% of which held a U.S. headquarters) in order to ascertain the biggest struggles they face in delivering managed SD-WAN. Forty-four percent of the respondents worked for an operator that delivered both fixed and wireless assets.

A key issue is complexity. Although many of us tend to describe SD-WAN as a single service, in reality it compromises a great many pieces.

Accedian’s Jay Stewart

“A lot of people are taking their different services and rolling it up into SD-WAN. Sometimes that might be MPLS. That might be internet. The speed of SD-WAN came on, and they were trying to figure out how to best package this. And even if you have an end-to-end SD-WAN service, there could be multiple services that it rides over the top of,” said Jay Stewart, Accedian’s North American director of solutions engineering.

Thus, SD-WAN’s multifaceted nature can make SLAs difficult to articulate.

“It’s not as simple as, ‘What is my latency?’ You could do that for the transport layer, but if you want to get more into the SD-WAN service and create differentiators, SLA verification can be a big issue,” Stewart said.

Potential Sprawl

Keep in mind that many service providers partner with multiple pure-play SD-WAN vendors. For example, AT&T uses VMware and most recently Cisco for its SD-WAN services.

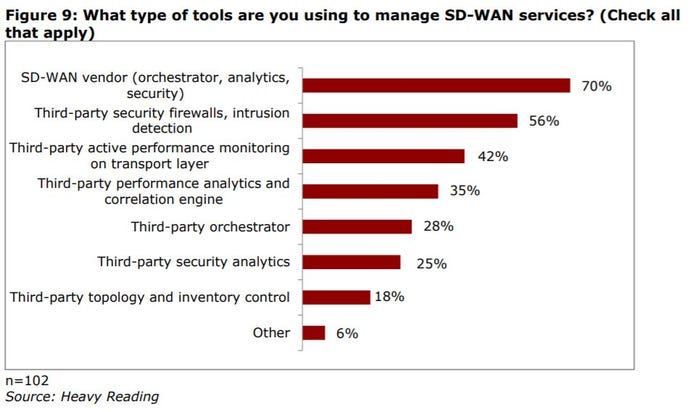

In addition, service providers are using multiple tools. Indeed, two-thirds of the of the respondents (65%) said they use three or more tools to manage their SD-WAN services. Sixteen percent of service providers use five or more. That could include firewalls, VNFs or WAN optimizers, for example.

“If you want to operationalize it and keep low costs, you can’t have a lot of different silos and tools,” Stewart said.

Underlay and Automation

Stewart said that although SD-WAN services tend to possess good tools for the network overlay, the underlay aspect is …

… another story. When multiple providers account for the underlay services, the SD-WAN provider might find it difficult to deliver an end-to-end service. The study found that operators need help automating the underlay. More than one in three (37%) respondents said the underlay network performance monitoring is the area where they need automation, just ahead of service activation testing (33%).

Automation already exists in many areas of the SD-WAN environment, such as in overlay network monitoring and service provisioning. However, other areas, such as the underlay network monitoring and SLA reporting, still require manual labor.

Comcast, Versa

Comcast Business and Versa Networks expanded their partnership around SD-WAN to better serve remote workers.

The update taps into artificial intelligence and machine learning improve Comcast’s traffic steering algorithm. As a result, Comcast’s SDN platform can prioritize applications and evaluate “real-time status of the network connections.”

Comcast Business’ Jeff Lewis

Versa provides the SD-WAN component of the Comcast Business ActiveCore SDN platform. They teamed up back in 2017.

Versa Chief Marketing Officer Mike Wood said the update is unique to Comcast, as it combines Comcast and Versa technologies.

Jeff Lewis, Comcast’s vice president of ActiveCore product and operations, said the update helps meet the demands of an “increasingly distributed world.”

“Organizations had to adapt quickly when faced with the sudden shift to a distributed and remote workforce last year. These changes drastically transformed the way businesses interact, collaborate and communicate,” Lewis said. “As a result, IT departments have continued to be tasked with meeting evolving security, access and bandwidth challenges brought on by the need to support a hybrid workforce model.”

Apurva Mehta, Versa’s chief technology officer, agreed.

Versa’s Mehta Apurva

“This algorithm provides Comcast Business with a powerful ability to steer traffic for any application — including real-time over optimal transport paths. Additionally, this enables them to help minimize down time and deliver the best application user experience with fast switchover when any transport degrades or fails,” Mehta said.

Quick Hits

Orange Business Services scored a big SD-WAN earlier this year with BNB Paripas. The French banking group will harness SD-WAN services at approximately 1,800 retail sites. Read the announcement.

Cato Networks has publicized statistics on the growth of its SASE business. For example, the company graduated the 600th member of its SASE certification program. It also reported significant year-over-year financial growth. Read the financial growth announcement.

We also recently wrote about a TeleGeography study that shows SD-WAN gradually but inevitably replacing MPLS.

About the Author(s)

You May Also Like