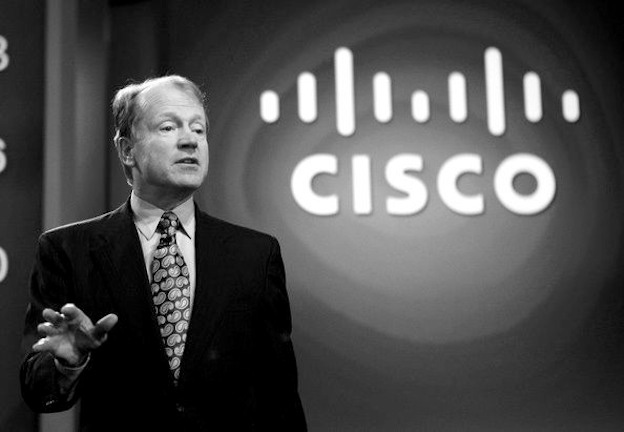

When Cisco Systems (CSCO) announces Q4 2013 earnings on Aug. 14, listen closely for clues about software defined networking (SDN) and six other technologies that may disrupt Cisco's business. And be sure to read this entire blog for the punchline...

August 14, 2013

Cisco Systems (CSCO) Q4 2013 earnings news is coming Aug. 14. Profits are expected to increase, but Wall Street is worried about software-defined networking (SDN) and six other disruptive technologies that might bury Cisco over the long haul. So what are the risks?

The list includes…

7. APPN vs. APPI: When it comes to networking with IBM's SNA architecture, the showdown involves Cisco APPI vs. IBM APPN. This battle will ultimately decide how information is routed across Global 2000 networks. Oh, wait: The APPI vs APPN war ended roughly 20 years ago. Who won? The VAR Guy can't recall. But Cisco is still a networking giant… And IBM is not.

6. Low-cost Networking: The Microsoft Broadband Networking Wireless Kit and Wireless-G product line could eventually stretch from home networks into the SOHO and small business markets — perhaps even into corporate branch offices. Microsoft wants to sell software and will push hardware at cost — kiling Cisco's margins. Oh, wait: Microsoft killed its home networking products in 2004.

5. Software-based Routers: Windows NT Server 4.0 includes Multi-Protocol Routing capabilities. You can set up NT servers to route Internet Protocol (IP) or Novell NetWare's Internetwork Packet Exchange (IPX), or both. This could become a wildly popular alternative to Cisco's more expensive hardware routers. Oh, wait: Microsoft never really did make a router push, and NetWare IPX routing largely died in the 1990s.

4. Router and Hub Mergers: SynOptics and Wellfleet are merging to form Bay Networks, which combines hub and router capabilities for complete internetworking solutions. That end-to-end business approach could put the squeeze on Cisco. Oh, wait: Bay Networks stumbled badly and got acquired by Nortel Networks — which went bankrupt.

3. Switched Ethernet: The classic shared Ethernet market is dead. Switched Ethernet and Fast Ethernet will deliver a new generation of high-speed networks. And increasingly, those networks will need no routing — destroying Cisco's core revenue stream. Oh, wait: Cisco wound up buying Kalpana Networks and a bunch of other switching companies. Routing never died. Threat averted.

2. Asynchronous Transfer Mode (ATM): ATM is a next-generation networking standard that supports data, voice and video at extremely high speeds. Senior VP Ellen Hancock has bet IBM's networking business on ATM. And ATM start-ups like Fore Systems could disrupt Cisco's core networking revenue stream. Oh, wait: The ATM market never really took off, Hancock ultimately left IBM, and FORE Systems imploded during the dot-com bubble.

1. Software Defined Networking: SDN will ease network management, and it will also allow IT managers to deploy routing on commodity x86 hardware. Cisco's margins will be distroyed. Oh, wait: Cisco has its own SDN strategy. And if you've followed the tone of items 7 through 2 above, you realize Cisco overcomes most of the "risks" it faces.

No Cause for Panic

The VAR Guy's key message: Threats come and go. Most don't live up to the hype. And when certain disruptive networking technologies actually take off (example: Switched Ethernet), Cisco is typically ready with market solutions.

So when Cisco announces earnings on Aug. 14, listen closely for new clues about the company's SDN strategy. The company will surely be in the game…

About the Author(s)

You May Also Like