Free Newsletters for the Channel

Register for Your Free Newsletter Now

From product releases to perspectives in the field, here's a recap of top headlines from the week of June 27-July 1.

July 5, 2016

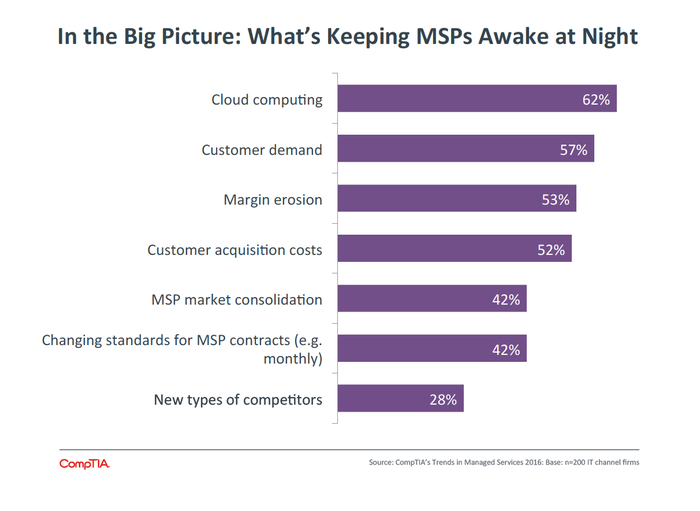

CompTIA’s 5th annual Trends in Managed Services report finds deep concern about the impact of cloud computing.

From product releases to perspectives in the field, here's a recap of top headlines from the week of June 27-July 1.

You May Also Like