The startup’s entry highlights important questions about disruption to technology solutions providers from software-as-a-service products.

When software developer Atera jumped into the market for managed services provider (MSP) toolsets in January, the Tel Aviv-based startup joined a crowded field with dozens of known players already competing for market share.

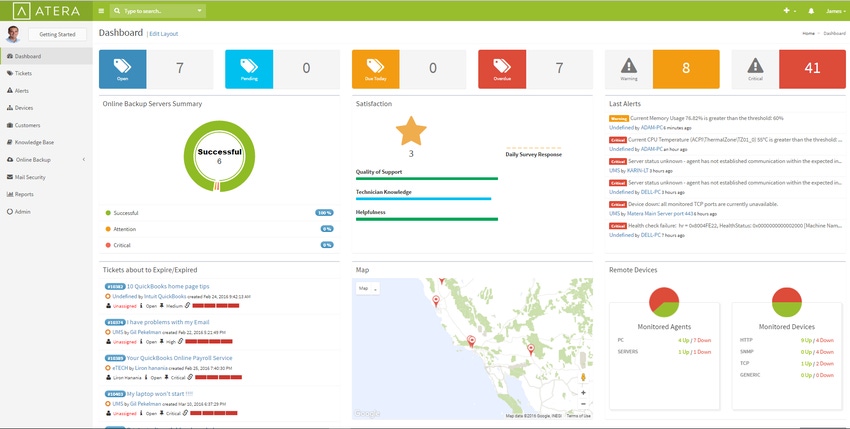

Nonetheless, in the months that followed, the firm reported stronger than expected adoption of its all-in-one software-as-a-service (SaaS) platform for MSPs, that includes professional services automation (PSA), remote monitoring and management (RMM), and remote control.

In many ways, the story of Atera’s entry highlights important questions about disruption to MSPs from the proliferation of SaaS products and growing importance of independent software vendors (ISVs).

“We bring value to MSPs of all sizes," said Gil Pekelman, CEO and co-founder of Atera.

To be sure, Atera’s born-in-the-cloud solution boasts a range of useful integrations, and was the subject of rapid iteration, adding a business intelligence portal and billing functionality in the first six months.

But the company’s pricing strategy is perhaps the most disruptive aspect of the new offering.

The model includes three tiers: Standard, Professional and Enterprise.

At the professional level, MSPs can pay $89 per month, per licensed technician. There is no up-front fee or long-term commitment, and the solution can be used to support an unlimited number of customers and endpoints.

Each engagement starts with a 30-day free trial, and to get started, an MSP need only visit the company’s website, enter credit card information and begin using the service.

“There’s no need for a consulting team to set it up for you,” Pekelman said. “It’s very simple.”

Therein lies the paradox for MSPs.

SaaS products from Atera and other ISVs are allowing MSPs unprecedented financial flexibility, dramatically reducing the cost of providing managed services and enabling a revolutionary shift, from an emphasis on capital expenditures (CAPEX), to operational expenditures (OPEX).

At the same time, the explosion of ISVs and cheap cloud computing could play out with dramatic growth in direct vendor-to-end user sales.

Jim Lippie, a principal at the consultancy Clarity Channel Advisors, refers to the trend as “channel eclipse.”

“It’s a term that I coined where most large direct players are starting to take market share from MSPs,” he said.

“A SaaS-based organization that sells an application that used to require a client-server relationship, the client can completely buy that online,” Lippie continued. “That’s one less (avenue) that the MSP can make money on.”

As in the case of cloud computing and storage, it’s still too early to tell precisely when or if the growth of SaaS products will significantly eat away at the bottom lines of providers of IT services.

What is clear is that for the time being, the tremendous market opportunity for ISVs will continue to drive competition among makers of MSP software, lowering costs for solutions providers.

An April report by Grand View Research estimates the PSA software market will reach $12.88 billion by 2022, up from $6.26 billion in 2014.

That sort of financial incentive will likely continue to lure new ISVs, like Atera, and their increasingly smart, innovative products into the pitched battle for differentiation.

“The demand for a modern, easy-to-use, and affordable platform inspired us to create Atera,” CEO Pekelman said. “When you look at the existing solutions being offered in the market today, they are expensive, clunky, and they don’t truly accomplish what MSPs require to maintain and grow.”

Send tips and news to [email protected].

About the Author(s)

You May Also Like