"To be clear, we intend to continue serving customers of all sizes," CEO Hock Tan wrote in a blog post.

Broadcom CEO Hock Tan is reiterating to VMware customers and partners that Broadcom won’t raise VMware product prices or neglect SMB customers.

Broadcom in May announced its monumental $61 billion acquisition of virtualization giant VMware. The deal, recently approved by shareholders to close in its just-started fiscal year 2023, has sparked the interest – and concern – of the channel. Those concerns stem mainly from Broadcom’s track record of acquiring companies such as Symantec and CA Technologies. That track record, partners have said both on- and off-the-record, involves heavy cost-cutting and layoffs, price increases and a narrow focus on enterprise customers.

VMware Pricing

Tan on Wednesday published a blog explicitly addressing “press reports” that say Broadcom will raise prices for VMware products. For example, Forrester senior analyst Tracy Woo wrote earlier this year that Broadcom enacted “massive price hikes” for CA and Symantec customers.

Keep up with the latest channel-impacting mergers and acquisitions in our M&A roundup. |

However, Tan denied any plans to raise prices.

Broadcom’s Hock Tan

“The answer is simple: No,” Tan wrote. That’s the second blog in one month making such a statement. Tan wrote on Oct. 26 to state that Broadcom’s methodology “was not based on taking existing products and raising their prices.”

“Following the close of the transaction, we will invest in and innovate VMware’s products so we can sell even more of them and grow the VMware business within enterprises, deepening and expanding the footprint instead of potentially raising prices,” Tan said.

Tan in his Nov. 30 column vowed to recruit more engineering talent to improve the VMware portfolio and offer more choices. That includes enhancing multicloud and cloud-native capabilities to make offerings more flexible for customers, Tan said.

“Post-close, we intend to apply this formula for success by investing in and operating VMware with a concerted focus on growth and innovation, while furthering our track record of delivering consistent, justifiable value with our fairly priced solutions,” Tan said.

Customer Segmentation

Tan also stated that Broadcom won’t leave its smaller customers out to dry in favor of large strategic accounts. Tan said his company is taking a “no customer left behind” strategy.

“Our business model is predicated on adding long-term value to our products and improving them over time. Following the transaction’s close, we’re going to focus on making VMware’s products better for all of our customers, including enterprise customers who want products that are even easier to use,” Tan wrote. “And, to be clear, we intend to continue serving customers of all sizes. VMware has a robust partner ecosystem that we will build upon to help us serve even the smallest companies.”

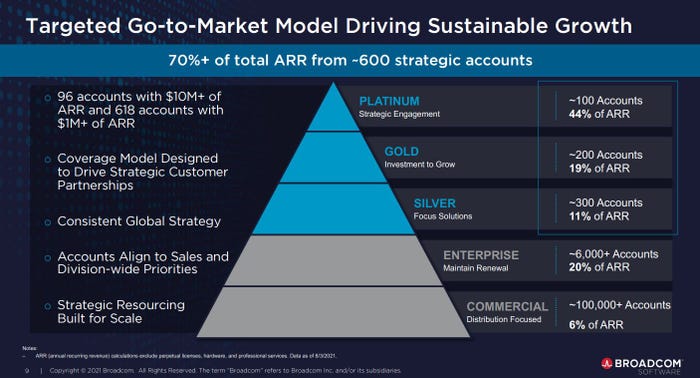

Broadcom at its November Investor day outlined approximately 600 large strategic accounts. Those reportedly account for more than 70% of Broadcom’s annual recurring revenue. President Tom Krause told investors the company was “totally focused on the priorities of these 600 strategic accounts,” the Register reported.

“Broadcom’s stated strategy is very simple: Focus on …

… 600 customers who will struggle to change suppliers, reap vastly lower sales and marketing costs by focusing on that small pool, and trim R&D by not thinking about the needs of other customers — who can be let go if necessary without much harm to the bottom line,” Simon Sharwood of the Register wrote.

The Channel and SMB

At the bottom of Broadcom’s go-to-market pyramid lies the commercial category, which Krause said distribution (read: the channel) would primarily serve.

KeyStone Solutions’ Richard King

Richard King, chief strategy officer, KeyStone Solutions, said Tan’s words give him hope for KeyStone’s VMware customer base, which includes SMBs.

“As an MSP and IT service supplier of the SMB market, we are always concerned and sensitive to price fluctuation — especially involving mergers that are, as in this case, large,” King told Channel Futures. “Looking toward the future, it appears that the Broadcom/VMware merger will just bring more value to the SMB market that is often overlooked in these transactions. I commend Broadcom and VMware CEO Hock Tan for stating this position clearly.”

Reactions

The CTO Advisor’s Keith Townsend

Tan’s column about not raising VMware prices and serving all customer sizes got mixed responses from the analyst and partner community.

For example, Keith Townsend, principal of The CTO Advisor, has expressed his reservations about the upside the acquisition presents for VMware customers. He noted that Wednesday’s blog still leaves concerns unaddressed.

More from @Broadcom on the VMware acquisition. No price increases and no cutting customers. More questions than answers for me. The devil is in the details on how Broadcom will achieve the aggressive profit goals. https://t.co/KSwZpqem3j

— Keith Townsend #VMwareExplore Barcelona (@CTOAdvisor) December 1, 2022

Matt Leonard, enterprise account executive at SHI International, expressed confidence in Broadcom’s approach to VMware.

SHI’s Matt Leonard

“The first impression that a lot of customers/channel partners had of the Broadcom VMware acquisition was negative — but as this article points out, Hock Tan has been very vocal about continuing to progress VMware’s multicloud strategy, and focusing on its entire portfolio, including Tanzu,” Leonard wrote on LinkedIn. “And, unlike some of Broadcom’s other acquisitions, VMware actually as a bleeding-edge, innovative product suite that Tan is not keen to disrupt.”

VMware Channel Updates

VMware recently named Tara Fine as the vice president of its Americas Partner Organization. She told Kelly Teal in an interview with Channel Futures that she expects partners to play an “even more important role” going forward.

VMware’s Tara Fine

“I get the same press. I read the same posts from Hock and our leadership team. But here’s what I believe, and here’s what I’m taking from everything I’m seeing: I firmly believe partners will be a critical area for us, with or without Broadcom. I don’t believe that changes and I don’t believe I would be sitting here today if I thought it did,” she said.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email James Anderson or connect with him on LinkedIn. |

About the Author(s)

You May Also Like