With Google (GOOG) rapidly taking on megalopolous stature, the search giant now has lined up some impressive acquisition and investment numbers to back it up.

With Google (GOOG) rapidly taking on megalopolous stature, the search giant now has lined up some impressive acquisition and investment numbers to back it up. Is Google the world’s newest M&A powerhouse? Maybe so, if you go by the numbers, according to a Bloomberg report.

Buoyed by a recent patch of blockbuster deals—including the $3.2 billion Nest purchase, a $400 million pickup of artificial intelligence developer DeepMind and a $1 billion deal for mapping developer Waze, to say nothing of a robotics haul that netted it Boston Dynamics and seven others—Google has completed 127 acquisitions, investments and sell offs in the past three years. And, let’s not forget its two-week old unloading of Motorola Mobility for $2.91 billion to Lenovo.

That makes it the worldwide leader in number of deals, surpassing chip giant Intel’s 121 transactions during the same period and second place finisher advertising firm WPP.

And, according to Bloomberg’s figuring, Google’s transactions numbers point to a burgeoning conglomerate, amounting to more than twice what it recorded from 2008 to 2011 at a value of some $17.6 billion, lagging only General Electric’s (GE) $19.9 billion and Blackstone Group’s $62.3 billion.

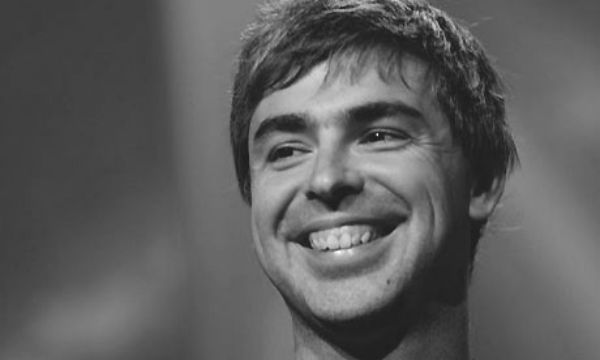

Bloomberg credits Google chief Larry Page’s aggressive use of the company’s $59 billion cash storehouse and the growth of its mergers and acquisitions group—which has seen 50 percent growth in the past two years—Google Ventures‘ investments in startups and Google Capital’s funding of mature companies with framing the company’s active posture. Don Harrison, who heads Google’s M&A unit, told Bloomberg last summer that the group closes a transaction about twice a month.

As for Google Ventures’ investments in new companies, the unit made 75 investments in 2013 along with 10 exits, a track record that includes three IPOs, according to Bloomberg’s data. And, Google Capital, the vendor’s financing arm, last year participated in a $444 million private funding of SurveyMonkey and a $361 million investment in Uber Technologies.

Contrast Google’s posture with that of its archrival Apple (AAPL), which has been far more conservative with its money, even though it sports a cashbox three times the size of the search giant’s. In the same three-year period, Apple has participated in a paltry 12 deals, Bloomberg said, and it has watched Google’s share price shoot up at twice the rate of its own.

Read more about:

MSPsAbout the Author(s)

You May Also Like