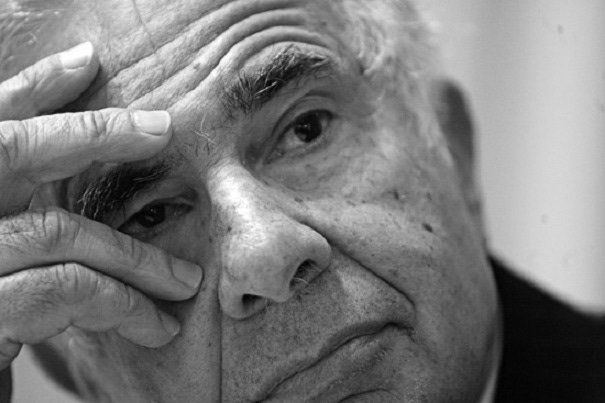

Not only has Carl Icahn not pulled his offer for Dell (DELL) from the table, as rumored two weeks ago, but now he's penned an open letter to the PC maker’s shareholders and the Special Committee saying he’s obtained the necessary commitments to finance the deal.

Not only has Carl Icahn not pulled his offer for Dell (DELL) from the table, as rumored two weeks ago, but now he’s penned an open letter to the PC maker’s shareholders and the Special Committee saying he’s obtained the necessary commitments to finance the deal.

With a July 18 shareholder up or down vote fast approaching on Silver Lake Partners’ and founder Michael Dell’s $24.4 billion offer to take the company private, time is bearing down on Icahn to make his case. Dell himself only 10 days ago offered an open letter to stockholders making his case to take the company private.

In addressing “Fellow Dell Stockholders AND Members of the Dell Special Committee,” Icahn said he has obtained “legal tender commitments for the $5.2 billion in debt financing,” including some $1.6 billion from Jefferies Finance. “With that we put an end to the unwarranted speculation by Dell that our money would not be available,” Icahn wrote.

“With the $5.2 billion in committed debt financing, $7.5 billion from cash on the Dell balance sheet and $2.9 billion to be derived from the sale of receivables, Dell will have the aggregate $15.6 billion necessary to conduct our proposed self-tender by Dell for approximately 1.1 billion Dell shares at $14 per share,” he wrote.

In mid-May, Dell’s Special Committee requested more details on Icahn’s proposal, complaining that it was unclear if Icahn intended to present his “transaction as an actual acquisition proposal that the Board could evaluate and potentially endorse or accept or rather to propose it as an alternative that the Board could consider in the event the pending sale to Silver Lake and Michael Dell is not approved.”

The Committee criticized Icahn’s offer for its lack of specific terms and structure, an operating plan and more information on the terms of the debt financing required to sustain his proposal. Then it went even further, issuing a lengthy report in which it rebuked Icahn’s takeover proposal, contending that his accounting left him about $4 billion short of the cash needed to consummate his shareholder dividend offer—a shortfall that would result in paring the figure to as little as $8.50 a share.

Icahn vs. the Special Committee

This latest open letter is nothing short of Icahn thumbing his nose at the Special Committee. Indeed, in a separate note to the Committee, Icahn called upon it “to engage in a direct, face-to-face sit-down meeting with us (not through its highly paid advisors as has occurred in the past). As always, it is our desire that our proposal be treated as a Superior Proposal made by an Excluded Person under the Merger Agreement, and thereby save stockholders $270 million in additional break-up fees that may otherwise be claimed by Silver Lake.”

Icahn and fellow activist investor Southeastern Asset Management have agreed not to participate in the $14 tender offer, a maneuver to supply stockholders with $14 per share for at least 72 percent of their Dell stock, “and an even higher percentage if other stockholders believe, like us, that Dell’s best days are ahead of it and decide to hold onto their Dell shares,” he said.

Icahn’s $14 tender offer is based on a number of contingencies, starting with the assumption that shareholders will vote down the Silver Lake/Michael Dell offer on July 18. In addition, Dell shareholders will have to elect a board as nominated by Icahn and Longleaf Partners to approve the $14 tender offer. None of those conditions, particularly the first, is an odds-on favorite to pass.

Icahn closed his open letter with an unbridled swipe at the Dell Special Committee: “It is mystifying to us how any independent Board which is charged with duties as fiduciaries can recommend to shareholders a $13.65 per share ‘freeze-out’ merger with Michael Dell/Silver Lake as superior to a proposal that provides stockholder the choice to receive $14 per share for at least 72% of their shares …” he wrote.

“We believe that it would be a sad outcome for stockholders and would, to say the least, reflect terribly on all who are involved in this process if, after purchasing shares at what we perceive to be a substantially undervalued price of $13.65 per share, Michael Dell and Silver Lake earned substantial returns on their investment while other stockholders are forced to sell.”

Not to leave the scuffle without its own parting shot, the Committee responded with this statement: “The Special Committee has reviewed Mr. Icahn’s open letter and will be pleased to review any additional information, including financing commitments, that it may receive from him regarding his recapitalization proposal. The Committee remains committed to achieving the best outcome for all Dell shareholders.”

Stay tuned … we’ll know a whole lot more about Dell’s fate in three short weeks.

Read more about:

MSPsAbout the Author(s)

You May Also Like