Hewlett Packard Enterprise Co. is combining some software assets with Micro Focus International Plc of the U.K. in a deal valued at about $8.8 billion.

September 8, 2016

By Bloomberg

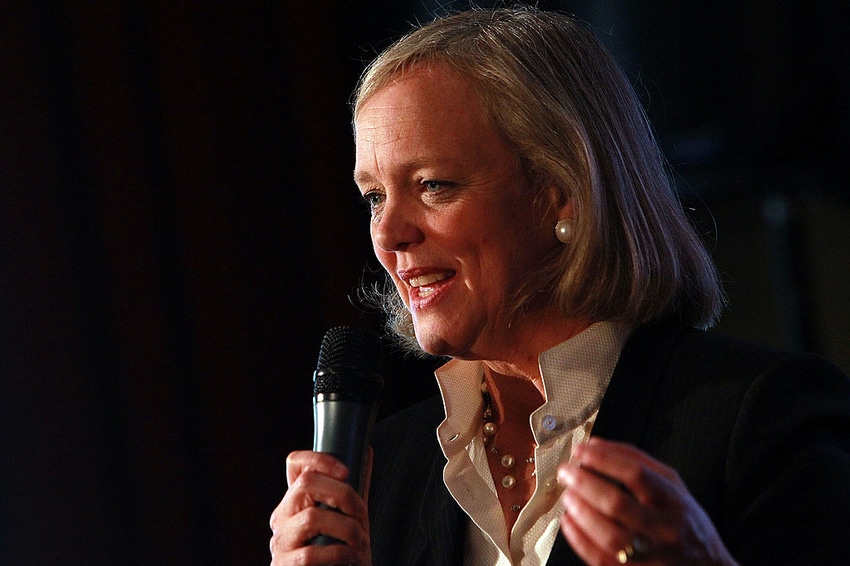

(Bloomberg) — Hewlett Packard Enterprise Co. is combining some software assets with Micro Focus International Plc of the U.K. in a deal valued at about $8.8 billion as Chief Executive Officer Meg Whitman takes further steps to slim down the U.S. company’s operations.

Hewlett Packard Enterprise will contribute its software businesses in areas such as application delivery management, big data analytics and enterprise security to Micro Focus, the Palo Alto, California-based company said in a statement Wednesday after U.S. markets closed. In return, HPE will get $2.5 billion in cash and its shareholders will own 50.1 percent of the merged company, it said. Micro Focus shares surged as much as 23 percent.

Whitman — who split HPE from sister company HP Inc. in November — is looking to make Hewlett Packard Enterprise nimbler to woo corporate customers with more options from cloud-computing providers such as Amazon.com Inc. and Microsoft Corp. The move follows the announcement in May that Hewlett Packard Enterprise would merge its technology-services division with Computer Sciences Corp. in a deal valued at about $8.5 billion.

“They are fantastic assets,” Whitman said in an interview. “They’re just not core to our strategy.”

The deal is the biggest announced acquisition by a U.K. buyer of an overseas target since British voters opted on June 23 to leave the European Union. Micro Focus, based in Newbury, England, is one of Britain’s largest technology companies, and coincidentally is replacing ARM Holdings Plc — the chip designer whose sale to Japan’s Softbank was completed this week — in the FTSE-100 index.

Some of the assets will be returning to their home country as well. Micro Focus will be picking up pieces of Hewlett Packard’s troubled acquisition of Autonomy Corp., which had been based in the U.K. The deal was announced under Whitman predecessor Leo Apotheker in 2011.

The following year, the company announced it would take an $8.8 billion charge, citing falsifications — and would subsequently face legal headaches surrounding the deal.

Hewlett Packard Enterprise had been considering a sale of some of those software assets at least since July, according to people familiar with the matter.

Micro Focus shares climbed 22 percent to 2,376 pence at 8:15 a.m. in London. The intraday gain was the biggest in more than five years. HPE shares were little changed in extended trading after earlier gaining 1.1 percent to close at $22.09 in New York. The stock has jumped 45 percent this year.

Profit Forecast

Hewlett Packard Enterprise also Wednesday forecast profit, excluding some items, in the current quarter of 58 cents to 63 cents a share, compared with analysts’ projections of 60 cents. The company reported third-quarter profit of 49 cents a share while analysts had estimated 44 cents, according to data compiled by Bloomberg.

Micro Focus can use the assets to bolster its software products that help customers on a variety of fronts, including business applications, security and with data centers. The combined company will be led by Kevin Loosemore, executive chairman of Micro Focus. Micro Focus expects to improve the margin on Hewlett Packard Enterprise’s software assets by about 20 percentage points by the end of the third full financial year following the close of the transaction, the companies said.

Micro Focus, founded in 1976, has expanded since the global financial crisis through a series of acquisitions, including the $1.2 billion purchase of The Attachmate Group Inc. two years ago and a $540 million deal for Serena Software this year. The M&A strategy has been led by Loosemore, a former executive of IBM U.K., Motorola and Cable & Wireless. The Attachmate deal expanded Micro Focus’s offerings in areas like cloud computing, security, workload management and networking, the company said at the time.

“It’s a really successful pure-play software company that knows how to manage mature assets and growing assets,” Whitman said. “And actually, these assets will get more investment with Micro Focus than they would with us.”

The new company will have annual revenue of about $4.5 billion, Micro Focus said in a statement. The board will include a Hewlett Packard Enterprise senior executive and HPE will nominate half the independent directors.

“The time is right for consolidation in the infrastructure software market and this proposed merger will create one of the leading players in this space,” Loosemore said in the statement. Micro Focus plans to return $400 million to its shareholders before the deal closes, the company said.

JPMorgan Chase & Co. is Micro Focus’s lead financial adviser and is providing $5.5 billion of financing. Numis Corp. also is advising the U.K. company.

You May Also Like