EMC (EMC), it turns out, has huddled with Hewlett-Packard (HPQ) sporadically for about a year to discuss merger options and recently has done the same with now-private Dell, according to a Wall Street Journal report.

EMC (EMC), it turns out, has huddled with Hewlett-Packard (HPQ) sporadically for about a year to discuss merger options and recently has done the same with now-private Dell, according to a Wall Street Journal report. But the talks, at least with HP, appear to have fizzled and, at this point, it’s unclear if its discussions with Dell will go anywhere either.

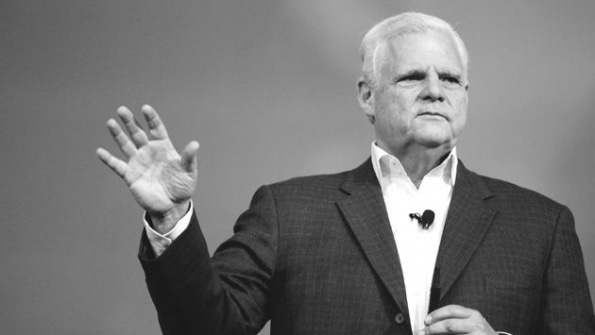

The EMC HP confabs went so far as to figure out that EMC boss Joe Tucci would be chairman and HP chief Meg Whitman chief executive of the combined company, which together would sport a market value of some $130 billion. That’s an impressive number in its own right, but it’s still nearly $70 billion shy of IBM’s (IBM) market cap and only about one-third of Google’s (GOOG) and 20 percent of Apple’s (AAPL).

Still, with a $60 billion market value, more than $23 billion in annual sales and some 60,000 employees worldwide, EMC, whose federated business model spans data storage, virtualization and software development, would be a whale for any IT company to swallow whole.

The news that EMC actively is kicking around options that include selling the company offers clearer air the vendor is planning for iconic chief executive Joe Tucci’s retirement early next year. Tucci, who has held the chairman’s seat since 2006 and the CEO slot since 2001, clearly is EMC’s face to the IT industry. He is said to want to get a deal done before the end of the year, Barron’s reported, so all may not be lost with HP.

HP also has been mentioned as a possible VMware (VMW) buyer. In recent word, EMC was said to be considering offloading its 80 percent stake in virtualization kingpin VMware, which it bought in 2004 for some $600 million and whose market cap currently stands north of $41 billion. Activist investor Elliott Management, which took a 2 percent interest in EMC last July valued at about $1 billion, has been pressuring the storage giant to sell off VMware to improve its stock performance.

But, according to the new buzz, stakes may be far higher than a VMware selloff. Which means other suitors, including Cisco Systems (CSCO), IBM and Oracle (ORCL) certainly are in line to examine an EMC buyout as well. Each of those vendors, Dell and HP included, have impediments in the way of an EMC deal, however, ranging from ongoing iffy financial performances to swallowing a company of EMC’s size.

However, were a deal to take place between EMC and any of these IT heavyweights, what a bonanza that would be for channel partners, replete with a storehouse of possibilities.

The Journal reported that talks between EMC and HP ultimately broke down over concerns on both companies’ part that shareholders would nix any deal. Think hedge fund rabble rouser Elliott was involved in any of those discussions?

Read more about:

MSPsAbout the Author(s)

You May Also Like