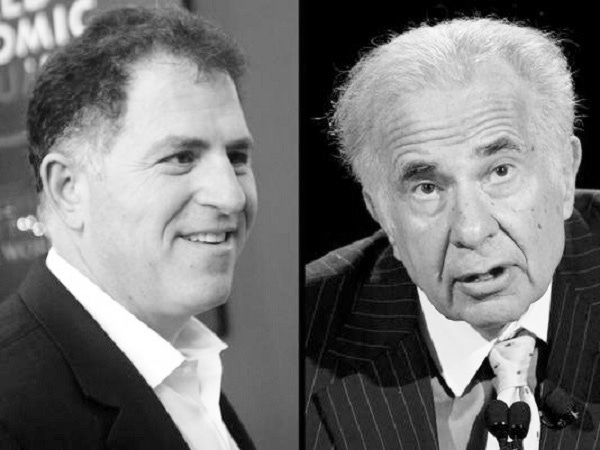

As rumored, Dell’s (DELL) Special Committee rescheduled today’s shareholder vote to July 24 to decide the fate of founder Michael Dell’s and Silver Lake’s $13.65 per share privatization offer, a neon sign the proposal didn’t have enough votes to fly.

As rumored, Dell’s (DELL) Special Committee rescheduled today’s shareholder vote to July 24 to decide the fate of founder Michael Dell’s and Silver Lake’s $13.65 per share privatization offer, a neon sign the proposal didn’t have enough votes to fly.

In a tersely worded statement, Dell said the shareholder vote meeting was “convened and adjourned to provide additional time to solicit proxies from Dell stockholders. No vote was taken on the proposed transaction prior to the adjournment.” The vote now is slated to be held at 5 p.m. Central time at Dell’s Round Rock, Texas, campus, the company said. Shareholders of record on June 3 will still be entitled to vote on the new date.

Billionaire investor Carl Icahn, whose latest volley for control of the company promised investors $15.50 to $18 per share, said, in a joint statement with fellow activist investor Southeastern Asset Management, the delayed vote is “unfortunate, although not surprising,” and “reflects the unhappiness of Dell stockholders with the Michael Dell/Silver Lake offer, which we believe substantially undervalues the company. This is not the time for delay but the time to move Dell forward.”

Word surfaced late on Wednesday that the Special Committee may seek to stall the vote, which drew a vitriolic response from Icahn, who owns 8.7 percent of the company and has made repeated strong plays for its control.

The vote delay is an obvious interim win for Icahn, who on July 17 mocked the move, writing in an open letter to shareholders: “Can you imagine a political election contest where one side could push off the election to wait for a better day to hold the election – a date when it is hoped they might do better in the vote than they would have done on the originally scheduled election date?”

Right now, the nays add up to at least 20 percent of Dell’s shares, and include confirmed opponents BlackRock (BLK), which holds 4.4 percent of Dell shares, and T. Rowe Price, which owns 4.1 percent and likely no voters Harris Associates, Yacktman Asset Management, Pzena Investment and Southeastern Asset Management.

On July 16, Dell’s Special Committee issued an open letter to shareholders in which it scolded Icahn for conducting “his campaign by trying to discredit the Special Committee and accuse it of frightening Dell stockholders. Such accusations do a disservice to all of you.”

The Committee reiterated its position that “based on analyses prepared by our advisors and our own view of the business, we do not believe that Mr. Icahn’s proposal is superior to the certainty of value offered by a sale of the entire Company at $13.65 per share.”

Read more about:

MSPsAbout the Author(s)

You May Also Like