With the twice-postponed Dell (DELL) shareholder vote slated for Aug. 2 to determine future ownership and control, it’s tempting to say the elongated battle has taken on the trappings of a heavyweight prize fight—the combatants have taken their fair share of blows since the opening bell rang in June and the decision will go to the scorecards—they’ll be no knockout.

With the twice-postponed Dell (DELL) shareholder vote slated for Aug. 2 (this Friday) to determine future ownership and control, it’s tempting to say the elongated battle has taken on the trappings of a heavyweight prize fight—the combatants have taken their fair share of blows since the opening bell rang in June and the decision will go to the scorecards—there’ll be no knockout.

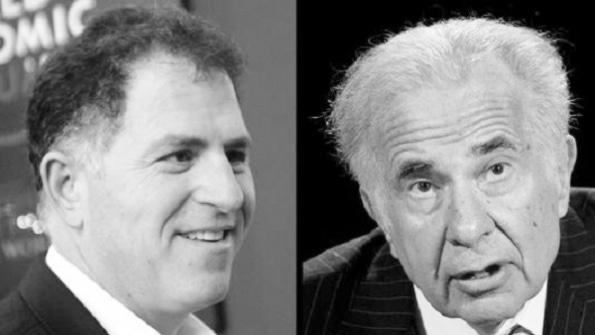

So here’s a compilation of the latest shots thrown by Michael Dell and Silver Lake Partners, and the counterpunching done by Carl Icahn and Southeastern Asset Management. Last Friday, Michael Dell engaged in an email exchange with the Wall Street Journal, in which he took these shots at Icahn:

On the buyout process:

The biggest issue has been the developments since we signed and the way these have impacted the vote requirement. In particular, the emergence of a large shareholder who bought stock only after we announced the deal and the unexpectedly low turnout…

On the opposition:

I actually take Southeastern's opposition as a compliment…In contrast, Carl Icahn was not a shareholder when we announced the deal or at any time before, but the voting standard in our contract gave him the opportunity to buy into the company and organize a blocking position with a minority of the company's shares.

On fighting:

If the deal does not go through, I plan to stay and continue to do my best to make the company successful. I will not support the kind of recapitalization and sale of assets some shareholders are suggesting.

On Monday, Icahn and Southeastern punched back, issuing another open letter to Dell’s Special Committee:

On Dell's offer that would change the voting rules to exclude abstainers:

Dell, Michael Dell and Silver Lake all agreed in writing in the Merger Agreement that the required method of stockholder approval was so important that it could not be waived. But, today, Michael Dell and Silver Lake are offering you a dime to waive this critical protection for stockholders in the Merger Agreement.

On Dell upping his price in exchange for changing the voting rules:

The very protection that Michael Dell and Silver Lake would have you forego (sic) is too important to waive at virtually any price.

On voter turnout:

Contrary to what Michael Dell has told the Wall Street Journal, the turnout at the special meeting now scheduled for August 2 is not “unusually low” and, based on Dell’s recent prior experience with stockholder meetings, should not have been “unexpected.”

On the 'no' votes:

We believe that many Dell stockholders that currently oppose the transaction may have simply not voted because they knew that their inaction would count as a vote against the merger and that the Unaffiliated Stockholder Approval condition could not be waived.

On the Aug. 2 scheduled vote:

Stop postponing the vote…and allow the vote to proceed toward its proper conclusion on August 2.

The final round in this toe-to-toe slugfest is set for Friday. Will it go through as scheduled? Who will be left standing? Wait and see.

Read more about:

MSPsAbout the Author(s)

You May Also Like