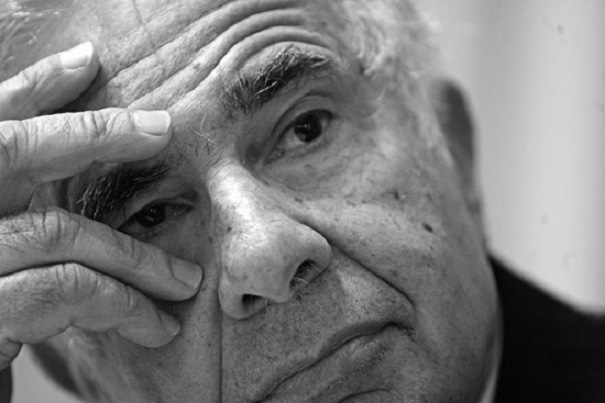

Activist Dell (DELL) investor Carl Icahn, locked in a tussle to wrest control of the company from founder Michael Dell and Silver Lake Partners privatization buyout bid, last week upped his stake in the computer maker, buying 4 million shares to increase his ownership position to 8.9 percent.

Activist Dell (DELL) investor Carl Icahn, locked in a tussle to wrest control of the company from founder Michael Dell and Silver Lake Partners’ privatization buyout bid, last week upped his stake in the computer maker, buying 4 million shares to increase his ownership position to 8.9 percent.

According to an SEC filing, Icahn, through his subsidiary companies High River Limited Partnership, Barberry and Beckton, indirectly purchased an additional 4 million shares at $12.94 a share, upping his stake by .2 percent to some 156.5 million shares. He bought the shares on Aug. 1, one day before Michael Dell agreed to add a special 13 cent dividend to his $13.75 per share offer in exchange for changes in the voting rules on his buyout bid, and the same day Icahn filed suit to force a shareholder vote as scheduled for Aug. 2.

Icahn is now the second largest shareholder in the company, behind only Michael Dell’s 16 percent ownership. Based on the company’s current trading price, Icahn’s shares are worth about $2.1 billion. By prior agreement, he is limited to holding no more than 10 percent of Dell shares and cannot collaborate on deals with other investors who together own more than 15 percent of the company.

Based on Michael Dell’s new deal with the Special Committee, the voting date of record on his and Silver Lake’s buyout bid has been pushed back to Aug. 13, meaning shareholders as of that date are eligible to participate in the Sept. 12 vote. The change in eligibility may benefit Michael Dell in that late-arriving investors looking to snag per-share gains should the buyout go through could favor his proposal.

With the change in voting guidelines, Michael Dell is likely to benefit from abstaining votes no longer counted as “no” votes, as under the prior voting guidelines. The agreement guarantees shareholders a Q3 dividend of 8 cents per share, funded by Michael Dell rolling over his shares at a price lower than the $13.75 deal offer. Added up, the deal now is valued at some $24.8 billion.

In response, Icahn, in an SEC filing last Friday, said the “war is far from over,” and called the bumped up Michael Dell bid “an insult to shareholders.” In the filing, Icahn added, “And promising shareholders an additional 8 cent dividend that we were already entitled to, and pretending that it is some sort of gift, is a further slap in the face.” Icahn’s lawsuit demands that a new voting date must coincide with Dell’s annual meeting, as he has long lobbied, enabling him to simultaneously put his candidates for the board up for a vote.

“We also continue to believe that the Special Committee is improperly putting its thumb on the scales in favor of Mr. Dell’s offer by changing the voting rules midstream and by refusing to hold the Special Meeting and the Annual Meeting on the same date and time — the only mechanism that would give shareholders a true choice. As such, we will continue to vigorously pursue our lawsuit in the Delaware Court of Chancery,” he said.

Dell will hold its next shareholder meeting on Oct. 17, more than a month after the scheduled vote on Michael Dell’s buyout bid. Stockholders of record as of Sept. 10 will be eligible to vote at the meeting.

Read more about:

MSPsAbout the Author(s)

You May Also Like