Apple (AAPL) confirmed it has bought Burstly, a developer of the mobile app testing platform TestFlight and other analytics and management tools, in another deal consistent with the iPhone maker’s current acquisition strategy to snap up smallish companies.

Apple (AAPL) confirmed it has bought Burstly, a developer of the mobile app testing platform TestFlight and other analytics and management tools, in another deal consistent with the iPhone maker’s current acquisition strategy to snap up smallish companies.

TechCrunch first got wind of the deal late last week, piecing together what it called “several odd things”—including Burstly’s ending Android support on March 21, discontinuing its TestFlight software developers’ kit (SDK) and shuttering FlightPath, the developer’s mobile analytics solution—into a suspicion that something was up.

As with most of its acquisitions, Apple didn’t disclose terms of the deal. In fact, the vendor barely confirmed the purchase, with a statement that read: “Apple buys smaller technology companies from time to time, and we generally do not discuss our purpose or plans.”

What does Apple want with Burstly? Other than providing its developers with more and better tools, it’s not very clear, other than perhaps to enhance future products. Developers are said to love TestFlight’s insights, analytics, metrics and dashboard, enabling them to test early app releases in small communities without subjecting themselves to wider audiences and make money from advertising.

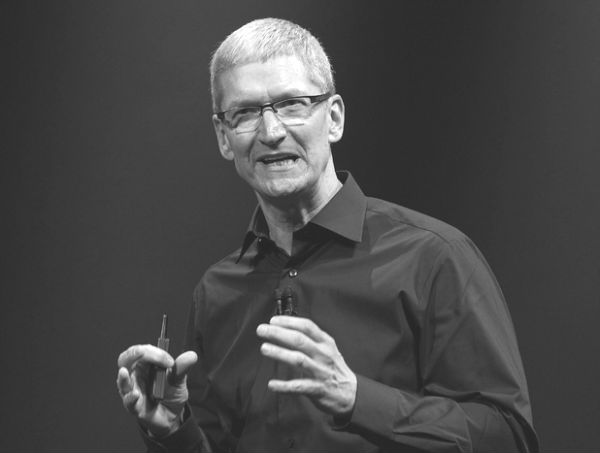

Apple seems for now to be sticking with last year’s blueprint to gobble up smaller companies, even though chief executive Tim Cook said only two weeks ago the company isn’t opposed to making larger acquisitions. In fiscal 2013, Apple completed 15 so-called strategic acquisitions (is there another kind?), most of which it kept quiet but included a number of mapping services and a smorgasbord of others.

By comparison, Apple rival Google (GOOG) has splashed with some big ticket acquisitions, including recent purchases of Internet-of-Everything gadget maker Nest for $2.3 billion, a $400 million pickup of artificial intelligence developer DeepMind and a $1 billion deal for mapping developer Waze, to say nothing of a robotics haul that netted it Boston Dynamics and seven others. In sum, Google has completed 127 acquisitions, investments and sell offs in the past three years, making it the worldwide leader in number of deals, surpassing chip giant Intel’s 121 transactions during the same period.

Read more about:

MSPsAbout the Author(s)

You May Also Like