Whereas ERP is about operating the business, the day-to-day transactional activity, EPM is about managing the business--analyzing, understanding and reporting on the business.

February 4, 2017

Sponsored by Oracle

Coming together is a beginning; keeping together is progress; working together is success.

-Henry Ford �

What is ERP and EPM?

Over 40 years ago, companies developed software applications to help with creating and recording accounting and business transactions. Traditionally, Enterprise Resource Planning (ERP) was heavily focused on addressing the ability to capture transactional data to accurately reflect the economic and operational condition of the organization. ERP expanded from accounting to supply chain to manufacturing to even human resources. For the Office of the CFO, the vision and value of ERP was to streamline one of their main tasks, accounting for and communicating financial information about a business to shareholders and managers. ERP systems were then tremendously helpful in support of the main charter of the Office of the CFO, but over time certain deficiencies became evident. Numerous capabilities like budgeting and forecasting, complex financial consolidations, strategy formulation, analytics, and reporting were either missing or inadequate to meet the demands of the enterprise.

Several years after ERP systems were developed, a completely separate and independent set of capabilities evolved to address such deficiencies. The modern term for such systems is Enterprise Performance Management, or EPM. At first, EPM addressed the need to easily consolidate and depict the accounting representation of all owned entities. Shortly thereafter, planning and budgeting evolved to more effectively facilitate and manage a key set of financial and business processes. As capabilities matured, EPM began to address a variety of other business challenges like strategic planning, account reconciliations, external reporting, tax provisioning, transfer pricing, profitability and costing, as well as managing the critical hierarchies and dimensions (like the Chart of Accounts) used across all systems.

Origin of the Chasm

From their inception, ERP and EPM systems were not necessarily designed to work together, as they were designed with different objectives. Two major categories of software evolved separately and at first glance they appeared to address two distinct groups under the Office of the CFO – accounting and  finance. An artificial chasm between ERP and EPM was born. As processes and organizations matured, software companies began acquiring and consolidating solution offerings to increase and expand their breadth of offerings and relevance to their customers. ERP software companies like Oracle acquired companies like Hyperion to fill the gaps and deficiencies of ERP. Oracle built integrations and drill-through capabilities between ERP and EPM systems which in essence paved the way to begin a very much needed unification. After all, doesn’t the accountant need to reconcile accounts, consolidate the books, do deeper analysis, and prepare and submit internal and external reports? These functions are typically found in EPM solutions, but yet are performed by the same persona that uses and heavily relies on ERP.

finance. An artificial chasm between ERP and EPM was born. As processes and organizations matured, software companies began acquiring and consolidating solution offerings to increase and expand their breadth of offerings and relevance to their customers. ERP software companies like Oracle acquired companies like Hyperion to fill the gaps and deficiencies of ERP. Oracle built integrations and drill-through capabilities between ERP and EPM systems which in essence paved the way to begin a very much needed unification. After all, doesn’t the accountant need to reconcile accounts, consolidate the books, do deeper analysis, and prepare and submit internal and external reports? These functions are typically found in EPM solutions, but yet are performed by the same persona that uses and heavily relies on ERP.

Inflection Point

The marketplace is at an inflection point because of the maturity and momentum associated with cloud computing. The movement toward cloud technology represents a big departure from on-premises software because customers can now simply subscribe to a business function like Accounting, F inance, Supply Chain, Distribution, Manufacturing, Human Capital Management, Sales, Services, Commerce, etc.The costs and headaches associated with managing software, hardware, and data centers disappear in the cloud paradigm. As a result, customers are demanding more innovation to meet their evolving needs coupled with their desire for simplification of the user experience. They expect complete, holistic and seamless service. This new set of demands and expectations are occurring because of this cloud paradigm to a certain extent, but they are also partly due to a new generation of knowledge workers and leaders accustomed to using extremely easy consumer-based Web applications, which change rapidly and constantly showcase new innovations. The marketplace has adjusted to the speed in which information and innovation are provided and the ease by which it is obtained. These same expectations have now arisen in the enterprise.

inance, Supply Chain, Distribution, Manufacturing, Human Capital Management, Sales, Services, Commerce, etc.The costs and headaches associated with managing software, hardware, and data centers disappear in the cloud paradigm. As a result, customers are demanding more innovation to meet their evolving needs coupled with their desire for simplification of the user experience. They expect complete, holistic and seamless service. This new set of demands and expectations are occurring because of this cloud paradigm to a certain extent, but they are also partly due to a new generation of knowledge workers and leaders accustomed to using extremely easy consumer-based Web applications, which change rapidly and constantly showcase new innovations. The marketplace has adjusted to the speed in which information and innovation are provided and the ease by which it is obtained. These same expectations have now arisen in the enterprise.

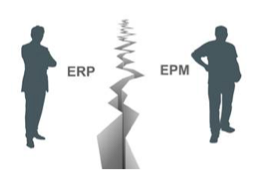

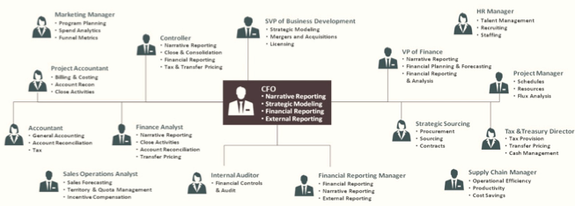

Persona-Based Solutions Focused on the Office of the CFO

As the market sector takes shape and evolves, the Office of the CFO demands the ability to perform all necessary tasks for any persona in a secure manner—that is, still compliant and enforced by an appropriate segregation of duty standards and protocol. This demand to simplify and seamlessly interoperate between ERP and EPM is constant and is therefore eliminating the artificial chasm created several decades ago. Think of all of the personas and tasks associated with the modern organization (see below). Wouldn’t it be powerful and beneficial to have all of those needs met in a single converged system in the cloud?

Oracle is working to do just that–to bring together ERP and EPM with a distinctly unified and seamless set of capabilities meant to address any task and solve any pain point for any persona, on any device, virtually anywhere for the Office of the CFO.

Value that Unified ERP and EPM brings to Customers

Today, most of the industry still offers disparate and separate solutions for ERP and EPM, and only  a few companies like Oracle have built integrations and drill-through capabilities between ERP and EPM systems. These integrations were just the beginning. Closing the chasm between ERP and EPM means even more value to our customers by offering deeper, richer and more extensive integrations, as well as the unification of the user experience. This convergence can lower the total cost of ownership by eliminating costly integrations and needless reconciliations, which most of the industry still experiences.

a few companies like Oracle have built integrations and drill-through capabilities between ERP and EPM systems. These integrations were just the beginning. Closing the chasm between ERP and EPM means even more value to our customers by offering deeper, richer and more extensive integrations, as well as the unification of the user experience. This convergence can lower the total cost of ownership by eliminating costly integrations and needless reconciliations, which most of the industry still experiences.

But fortunately, with Oracle, that is simply not the case. The convergence will offer fast and full transparency, visibility and control across each and every process in the Office of the CFO. Unification of ERP and EPM will improve decision-making and better align strategic needs across an organization. It will, no doubt, improve efficiency and effectiveness, while lowering risk. It will help organizations become more responsive and, therefore, much more agile.

Your Future with the Oracle Cloud

So imagine being an Oracle Cloud customer working excitedly throughout the week. Friday night comes, and suddenly you are feeling a bit melancholy. Not sure why, but you are feeling a bit down. Nonetheless, you enjoy the weekend with friends and family. When Sunday night finally arrives, you get an unexplainable burst of excitement and energy because you glance at your watch and realize that you are only 12 hours away from returning to work!

Oracle customers are excited to return to work because they are spending time doing analysis and providing value, which is what they were originally hired to do! Instead of spending time collecting, collating, reconciling and formatting data, our customers are frequently interacting with their internal constituents and collaborating based on what they discovered from their analysis. They are adding value to the organization they work for by leveraging technology that is beautifully simple, uniquely complete and distinctly unified!

Are you ready to join the New Digital Finance Revolution?

All the best,

Jeff Jacoby & Michael Gobbo

Jeff Jacoby & Michael Gobbo are Master Principal Sales Consultants at Oracle

You May Also Like