The distributor says it will become the third-largest broadline distributor after posting its latest financials.

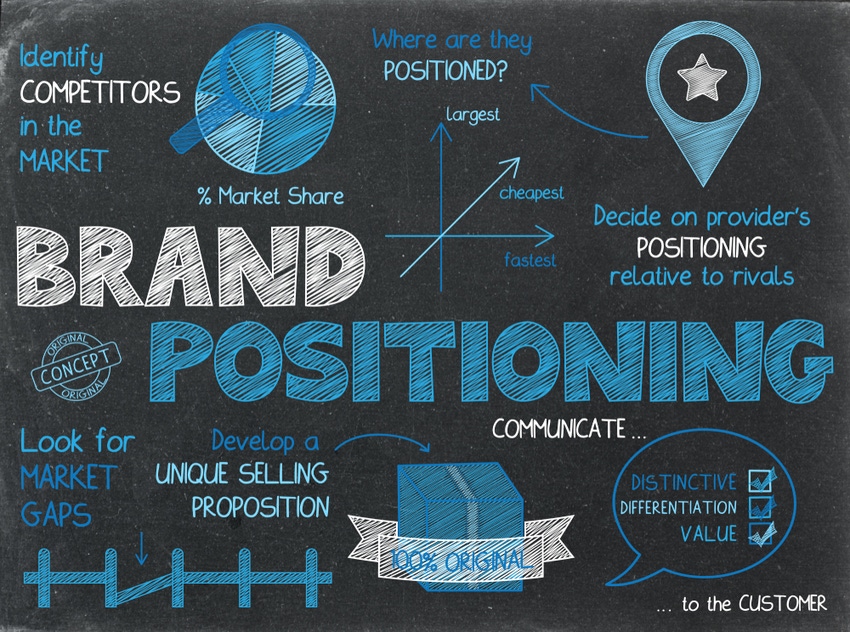

D&H Distributing is positioning itself as a rival to the combined might of Tech Data-Synnex.

The distributor says it will become the third largest broadline distributor off the back of its latest financials.

D&H’s combined U.S. and Canadian revenue now exceeds $5 billion. It expects its full fiscal year growth to exceed 19% in the US and 15% in Canada. The company also experienced 34% growth of business through its VARs, and double-digit growth in its consumer sector.

D&H saw double- and even triple-digit growth in key areas in its last fiscal quarter. This includes a 160% increase in cloud sales bookings, and 53% growth in professional services.

D&H Distributing co-president Dan Schwab commented on the impending merger of two of the firm’s largest competitors. He said it only demonstrates distribution’s “inherent ability to evolve.” He said they were “cultivating new business practices in order to present new deliverables and opportunities for partners.”

However, D&H pointed out it is the only distribution giant to focus primarily on SMB and midmarket partners.

Schwab added that D&H was “exceedingly proud” of the role its partners have played in maintaining stability in the business community throughout 2020.

Investment in Personnel

The distributor also saw growth in endpoint devices and collaboration technology supporting work-from-anywhere and remote learning. It also logged “solid performances” in still-emerging categories such as ProAV and esports.

Elsewhere, the company claimed its demand-generation business model helped drive the strong growth. This is supported by the employee co-owners that own more than a third of the company.

The firm is adding more than 100 personnel in the areas of sales, solution engineering and sales support.

The distributor also has a new Components and Gaming team. It has appointed four new leaders dedicated to esports sales and deployment, especially in K-12 education.

D&H has also launched an Education Community engagement group. This is a peer engagement council that will work with vendors to develop direction for programs and services.

Increasing Credit

D&H is also extending its $225 million in monthly downstream credit increases across the U.S. and Canada. This will continue to expand to an additional $300 million per month to support partners’ business needs.

D&H’s Michael Schwab

This will bolster purchasing power for key channel accounts, for partners to pursue higher-scale projects in the midmarket. The extensions can help partners to take advantage of imminent infrastructure refreshes for employees working from home. Upgrades will span high-performance computing devices, Wi-Fi, security, printing and imaging, and software for use in remote work environments.

“Through years of market highs and lows, D&H’s partner-centric model has been proven successful,” said D&H co-president Michael Schwab. “We’ll continue to develop credit offerings, educational opportunities and enablement for the channel.”

D&H will also open a 750,000 square-foot distribution center in its home city of Harrisburg, Pennsylvania, in September. The increased warehousing capacity will include a fully modernized supply-chain logistics program to support manufacturers.

Want to contact the author directly about this story? Have ideas for a follow-up article? Email Christine Horton or connect with her on LinkedIn. |

Read more about:

VARs/SIsAbout the Author(s)

You May Also Like