Lenovo, HPE and Dell EMC unveil support for the “Rome” processors as AMD looks to steal share from Intel.

August 8, 2019

(Pictured above: AMD’s Lisa Su on stage at the company’s Epyc Horizon event in San Francisco, Aug. 7.)

AMD EPYC HORIZON — AMD is launching the second generation of its Epyc server processor family, giving system makers a lineup of new chips to use in their hardware and their channel partners another choice of x86 servers to offer customers.

At an event in San Francisco Aug. 7, AMD officials officially rolled out the Epyc 7002 Series – formerly codenamed “Rome” – of 7-nanometer processors that come with a broad array of new and enhanced features that include up to 64 cores – twice that of the first-generation processor – more I/O with 128 or more PCIe 4.0 lanes and up to 3.4GHz frequency. It also delivers more security capabilities.

At an event in San Francisco Aug. 7, AMD officials officially rolled out the Epyc 7002 Series – formerly codenamed “Rome” – of 7-nanometer processors that come with a broad array of new and enhanced features that include up to 64 cores – twice that of the first-generation processor – more I/O with 128 or more PCIe 4.0 lanes and up to 3.4GHz frequency. It also delivers more security capabilities.

AMD beat Intel to 7nm, with the larger rival planning to launch its 7nm process in 2021. The chip maker is offering twice the performance in its new Epyc chips than Intel has in its current 10nm Xeon Scalable processors, according to AMD president and CEO Lisa Su. Rome will deliver twice the performance per dollar, 40-50% lower operating costs and 25-50% lower total cost of ownership (TCO) than competitive processors.

“Our goal is to make the data centers of today and tomorrow substantially better than the data centers of today,” Su said during her keynote.

The Epyc chips started shipping in July.

The Epyc Rome launch is the latest step in a remarkable comeback by AMD, which until the release of the first-generation Epyc “Naples” processor in 2017 had seen its share of the server chip market almost disappear. The company in the mid-2000s had more than 20% of the market on the strength of its Opteron chips, but a series of missteps with later generations of Opteron by AMD and Intel’s aggressive product rollouts tipped the scales back in favor of the larger competitor.

With the development of the Zen microarchitecture, which is the foundation for not only the Epyc server processors but also AMD’s chips for client systems, AMD has re-established itself.

AMD’s new Epyc chips come at a time of rapid change in the server market, with modern workloads using technologies like artificial intelligence (AI), machine learning and data analytics and more applications going to the cloud. Intel continues to dominate the server chip market, with more than a 90% share, but is facing greater competition than it has in the past. Key among the competition is AMD with Epyc, which is based on the company’s Zen microarchitecture.

Some industry observers expect AMD to continue the momentum the first generation of Zen-based Epyc chips began in 2017. According to Mercury Research analysts, AMD held 2.9% of the market in the first quarter. However, in a report released in May, Spiceworks found that while 93% of organizations use Intel-base servers, 16% also used systems powered by AMD. Four percent use Arm-based systems. Spiceworks officials in the report said they expect 21% will use AMD-powered servers within two years. In addition, AMD continues to make headway in enterprises, they said.

Server OEMs Roll Out Systems

System makers are embracing the new chip. Lenovo announced two new one-socket ThinkSystem servers – the SR635 and SR655 – that leverage features in the new Epyc chips like support for PCIe Gen 4.0 interconnect and expanded security capabilities and are designed to drive down hardware and licensing costs. The servers, due out this month, address such modern workloads as video surveillance, software-defined storage and network intelligence, and support virtualized and edge environments with such features as up to 32 NVMe or 20 SATA drives and up to 16 GPU accelerators, officials said.

Hewlett Packard Enterprise is putting the second-generation Epyc chips into its single-socket ProLiant DL325, dual-socket DL385 and high-density Apollo 35 servers, and listed three dozen records for …

… performance, efficiency and security. Mark Potter, HPE CTO and director of HP Labs, said that in a year, the company will have 12 systems powered by Rome. Dell EMC said it will roll out one- and two-socket PowerEdge systems powered by the new Epyc chips in the fall with improved system performance, security and management.

The Channel Opportunity

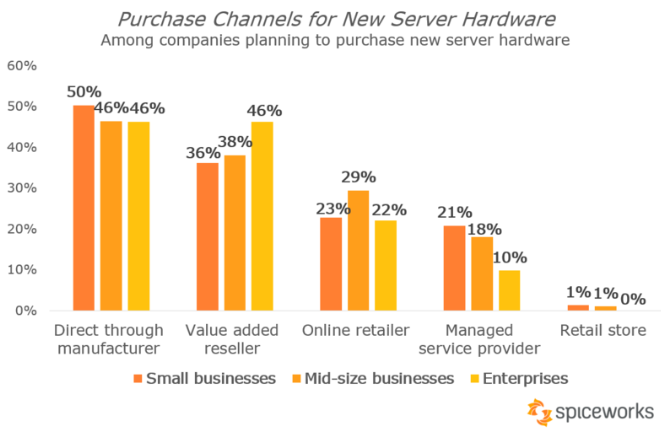

The launch of the next-generation Epyc chips and servers from OEMs create a significant opportunity for channel partners, who will play a key role in expanding AMD’s reach in the enterprise and other markets. The Spiceworks report found that while businesses tend to buy half of their servers directly from the manufacturers, the rest come from a combination of VARs, online retailers and MSP.

Courtesy: Spiceworks

“There is going to be a big channel play for Epyc,” Patrick Moorhead, principal analyst with Moor Insights and Strategy, told Channel Futures, adding that it’s particularly true for distributors and resellers.

AMD has been investing more in such areas as resellers, ISVs and field sales over the last two years, but still lags Intel in this area, Moorhead said. The chip maker “will need to lean on OEMS like HPE, Dell and Lenovo, none of whom have a recent track record of creating demand for AMD.” That includes through the channel.

Industry analysts for years have said organizations have been thirsty for a viable alternative to Intel in the data center, both for improving competition and lowering pricing. With Epyc, AMD is giving them that. However, officials with the chip maker and its OEM partners said customers are less interested in what CPU is powering a system and more about how they address particular workloads.

Lenovo’s Doug Fisher

“It’s not just us,” Doug Fisher, COO and senior vice president of business units for Lenovo’s Data Center Group, told journalists at the event. “Everybody is going toward workload-type behavior. Everybody is driving the workload, and that’s why it was so critical for us to establish what workloads we could actually benefit from with this platform. That’s what drove the engagement, that’s what drove us building this, it’s what drove our investment in the platform. There are some workloads that will benefit from this platform. You’re seeing more and more that it’s about the workload and the value you bring against that workload. It’s not a conversation of AMD vs. Intel. It’s a conversation about Lenovo vs. our competition.”

Scott Aylor, corporate vice president and general manager, AMD data center solutions, said during the meeting with journalists that organizations are looking for solutions, and that their focus on workloads is a good way for AMD to get into the door of enterprises. Once enterprises see what the Epyc chips can do with a particular workload, they will be more open to expanding the use for other applications in their environments, Aylor said.

AMD’s Scott Aylor

The channel “tends to be more of a transactional process,” he said. “That’s where value needs to be apparent and thee problem that you’re solving needs to be very obvious as well. Going in that direction [is what] we find, especially in the channel.”

Ravi Pendekanti, senior vice president of product management for Dell EMC’s server and infrastructure systems unit, told Channel Futures that the worldwide total addressable market (TAM), which recently sat at $75 billion, will hit …

… $100 billion in the next 12 to 18 months. At the same time, modern workloads are growing, such as the edge, the internet of things, and AI and machine learning.

“The use cases and workloads we have today are more divergent and getting more specific,” Pendekanti said. “This means that more servers are now needed in a lot more places than we thought possible 10-15 years ago. If you put these two [trends] together, it becomes important for us to work with our partner community to ensure we have the products available to a wider customer base.”

IDC analyst Matt Eastwood told Channel Futures that partners could see an opportunity among larger companies in the Global 2000, which run workloads with demands similar to those in high-performance computing. The next step down, commercial businesses, which Eastwood said have 500 to 10,000 employees, could prove more difficult.

“The challenge in commercial is that it takes a lot for these companies to switch plans,” he said, adding that they’re not as price-sensitive as the larger businesses.

The new Epyc chips give server makers – and their partners – a wider range of systems to offer customers, but partners will need to bring along with them more than just the ability to sells hardware, Eastwood said. About 80% of the opportunity for the channel lies above the hardware level, so if partners want to succeed, they need to offer services and solutions as well as the systems.

Read more about:

VARs/SIsAbout the Author(s)

You May Also Like