Colocation offers some relief to businesses in a network-capacity crunch — and a real opportunity for partners. We break it down in this one-stop gallery.

June 29, 2016

Colocation: A Differentiator for Partners

The massive increase in cloud services and applications is disrupting the data center like never before. Business networks are reaching capacity, and it’s only going to get worse.

Most businesses aren’t ready for this crisis and don’t have the money or technical expertise to handle it. It’s also unrealistic to migrate everything to the cloud at once. So what’s the answer?

Colocation offers some relief to businesses and a real opportunity for partners. We break it down in this one-stop gallery.

**Source material by Kurt Marko**

Follow senior online managing editor Craig Galbraith on Twitter.

Colocation: Mind-Blowing Internet Traffic

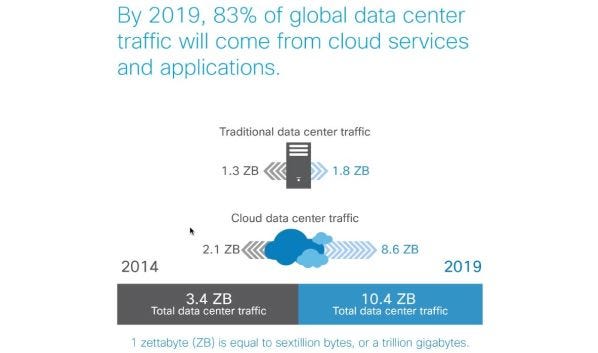

Need proof that there’s a growing capacity problem? Check out the Cisco Global Cloud Index. It predicts worldwide data-center traffic on the Internet will triple over the next five years. Cloud and mobile-device use are the drivers.

Just three years from now, expect 83 percent of global data-center traffic to come from cloud services and apps — a huge shift from the heavy loads usually produced by traditional, enterprise data centers, the networking giant says.

Colocation: Third-Party Providers Growing

Most enterprises won’t be able to do a wholesale cloud migration. Colocation is an answer.

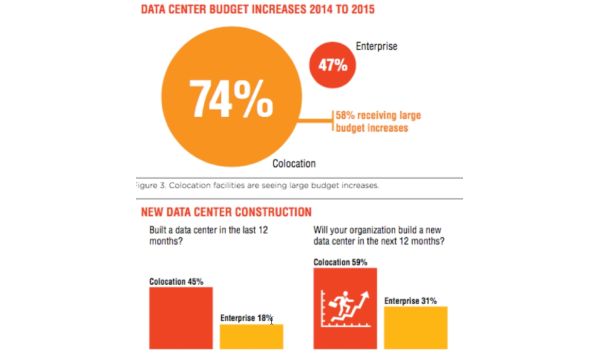

The 2015 Uptime Institute data center survey revealed that colocation facilities are expanding at a breakneck pace. Nearly half (45 percent) of respondents at third-party providers reported expansion of colocation facilities in the past year. That compared to just 18 percent for enterprise IT.

Budgets are rising significantly as well. Last year, nearly three in four (74 percent) third-party data center respondents in the survey said they got budget increases; only 47 percent of the enterprise companies said so.

*Infographic courtesy Uptime Institute

Colocation: Reasons for Growth

Third-party providers are finding success for a number of reasons.

Cost is a big one. Price per square foot of floor space is less in a large facility. Also, warehouse-size operations optimize their use of space, cramming many systems into a rack. That results in more efficient cooling, which of course also reduces costs.

Typically, third-party data center operators are specialists: The Uptime report found that more than two-thirds (68 percent) of colo operators have a formal energy-management plan; just 39 percent of enterprise IT organizations surveyed had one.

Furthermore, automation in a colo facility keeps costs down and reduces the chance for human error. Redundant power sources and multiple backups are commonplace, giving customers peace of mind.

And colo operators have dedicated network operations, security and forensic teams monitoring their own – and their customers’ – infrastructure.

Colocation: Business Models

Colo services are categorized as either wholesale or retail.

The wholesale model is geared toward big companies willing to sign multiyear leases. They usually have no operational role in the data-center operations.

The retail model is where the provider owns and operates the facility, and rents out space. Colo providers started out by offering the space, physical security, uninterrupted power, and WAN connections with external network monitoring. Recently, they’ve expanded with a number of managed services.

Colocation: SUPERNAP

The SUPERNAP facility in Las Vegas is a great example of a third-party data center provider reaping the benefits of going BIG. It is connected to more than 50 carriers and cable providers, who have extended their fiber networks into hundreds of these types of facilities in the U.S. and around the world.

Naturally, connection reliability and performance are critical at colo facilities like these. Private connectivity is a big advantage with colocation.

Colocation: More Business Benefits

Colocation trades CapEx for OpEx — a major benefit as data centers get more sophisticated and more expensive. CFOs will like the sound of that.

Colos are connected to many backbone carriers and major cloud providers, offering businesses advanced network capabilities. The big ones have operations all over the world, meaning workloads are closer to most users.

Colocation facilities have experts in various areas: network management and monitoring, WAN provisioning and configuration, and security, just to name a few. SMBs and partners with expertise in only some of these areas will find adding these managed services to be useful.

Colocation: Public Cloud Alternatives

Colo facilities can solve the problem for businesses that want cloud-scale efficiencies without a full migration to public clouds. These data facilities offer a way to exploit warehouse-scale operational efficiencies for privately owned infrastructure. Existing hardware can be forklift-migrated in many cases.

Colocation: A Partner’s Advantage

Colocation can be a differentiator for a solution provider.

It allows you to offer advanced hosting services without capital investment, and deliver those services more efficiently, reliably and with greater security.

You get to keep costs low by using the colo provider as a subcontractor; expand your physical footprint; and provide high-quality, fast network connectivity and tighter cloud integration.

Colocation: Do Your Research

You’re not ready to recommend colocation unless you’ve done some internal and external research.

First, consider if it be more efficient to outsource the value-added hosting and network services that you already provide. Then identify those services that you don’t offer, but want delivered through a colo provider. Services that can be bundles as optional add-ons to your portfolio would be ideal.

Next, take a close look at the colo provider’s network services, including private cloud connections. You want to find those that best fit your customer’s needs and existing carrier relationships.

Now you’re ready to make the financial case for colo to the customer. You’ll have to weigh the costs of bundling colo in with various services vs. typical on-premises costs.

And before locking in a provider, do some trial runs with your final choices.

Colocation: A Differentiator for Partners

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author(s)

You May Also Like