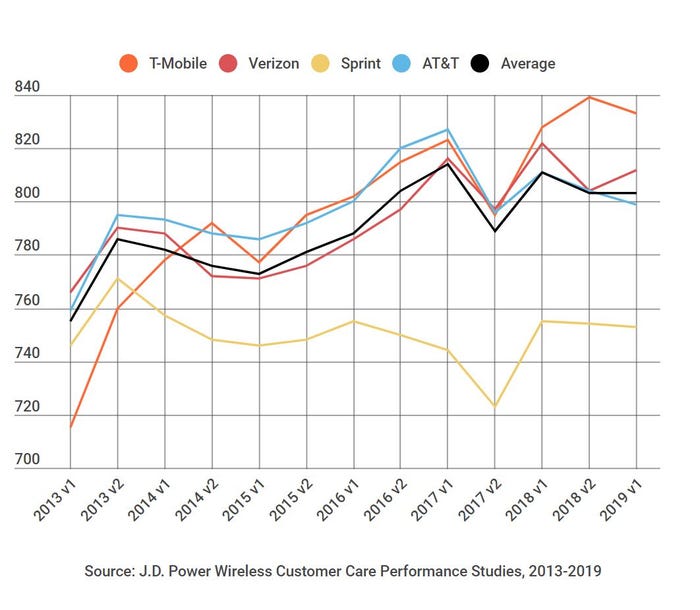

T-Mobile is hot; Sprint, not so much.

One carrier is outclassing its peers in J.D. Power’s latest customer-satisfaction survey.

Source: J.D. Power

T-Mobile dominated the most recent Wireless Customer Care Performance study, in which J.D. Power asked mobile customers to rate several facets of their experience with carriers. Thousands of people answered questions about the support service providers offered via website, contact center, social media and other platforms.

Verizon, AT&T and Sprint – three companies well-known in the channel – trailed T-Mobile.

Cricket and Consumer Cellular won the two “non-contract” carrier categories, but we focused on the “full-service” group for this gallery.

You might ask, why does a consumer-oriented survey like this matter to channel partners? The truth is that the study underscores one of our biggest weaknesses as an industry: customer experience.

Influential channel figures like Tiffani Bova and Verizon’s Catherine Sugarbroad have harped on the message that customer service matters more than we previously thought. And if businesses are having negative direct interactions with their carriers, channel partners can make up the difference.

Scroll through the slides below to learn more about the survey’s findings.

Read more about:

AgentsAbout the Author(s)

You May Also Like