We think you'll find some of these numbers from our compensation survey to be surprising.

August 4, 2016

7 More Insights From the 2016 U.S. Channel Compensation Survey

Our report on the 2016 U.S. Channel Compensation Survey, conducted by Channel Partners and the 451 Alliance, a division of 451 Research, digs into career satisfaction metrics, the gender pay imbalance, revenue generators, education levels and more.

Some top-level findings: Compensation in the indirect IT and telecom channel is competitive with the IT job market overall, and executives are doing particularly well: The mean compensation for IT executives in midsize enterprises, according to Janco, is now $131,384. Among channel respondents, one quarter (25 percent) earn $101,000 to $150,000, and nearly another quarter (23 percent) report earning more than $150,000.

Respondents’ No. 1 primary revenue generator today? Telephony provisioning and/or management. In two years? Cloud computing, public or hybrid, moves into the top spot, seven full points ahead of telephony.

In the full report we run down our top seven findings. In this gallery, we share seven more that might surprise you. And be sure to attend this informative session at Channel Partners Evolution on Aug. 16, where a panel will discuss the results.

Follow editor in chief Lorna Garey on Twitter.

Compensation Survey Insights: Homogenous? Hardly

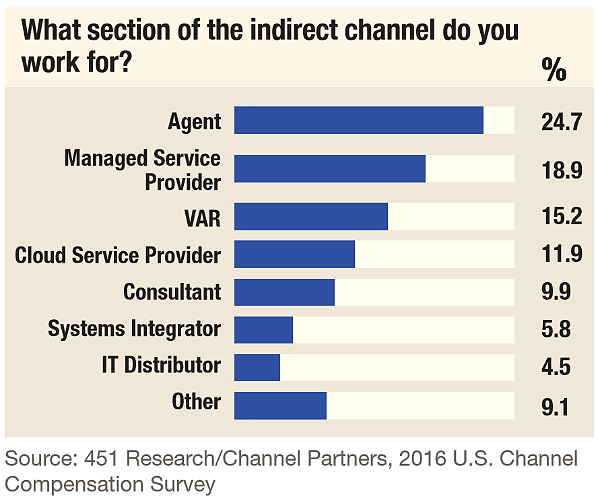

We limited survey participation to U.S.-based channel professionals. The Top 5 respondent types: agent, 25 percent; MSP, 19 percent; VAR, 15 percent; cloud service provider, 12 percent; and consultant, 10 percent. The other 20 percent? SIs, distributors and “other” — proving that the channel is diverse and morphing.

One demographic question we do have: Where are the nerds? Sales and project management staff, at a combined 22 percent of total respondents, outnumber technical staff (3.5 percent) by more than five-to-one.

Compensation Survey Insights: Location Really, Really Matters

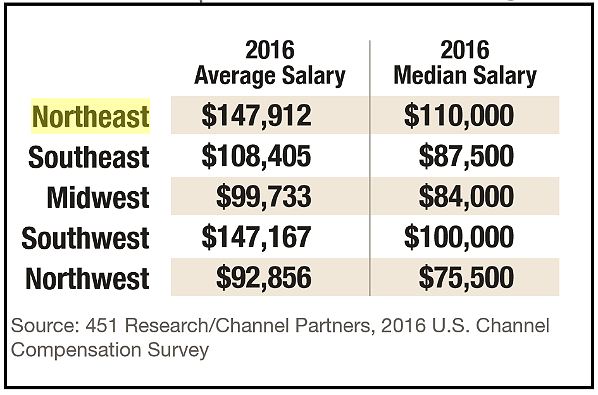

Salaries are highest in the Northeast, at nearly $148,000 on average (median of $110,000). Channel pros in the Southwest are not far behind at just over $147,000 on average (median of $100,000). Respondents in the Northwest, Midwest and Southeast earn a median range of $75,500 to $87,500. The Northeast is most likely influenced by New York City, Boston and Washington, D.C., while the Southwest is no doubt skewed by Silicon Valley and the rest of the Golden State.

Compensation Survey Insights: Expected Perks — and Unexpected Results

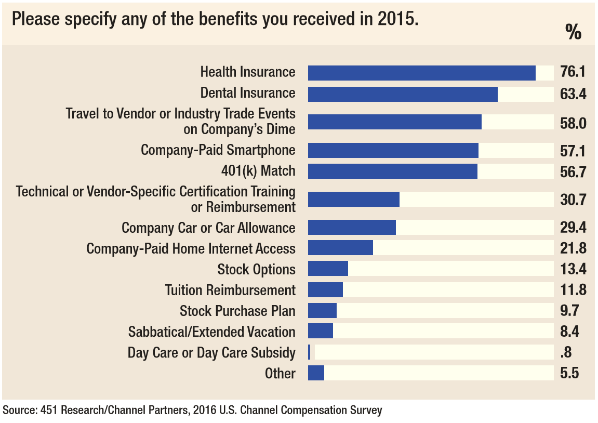

While 90 percent expect to receive bonuses in 2016, health insurance – the top non-financial benefit – is received by just 76 percent, a low number given that 98 percent are full-time employees; 63 percent receive dental coverage.

Rounding out the Top 5 benefits are paid travel to vendor or industry trade events (58 percent, and we approve), a company-paid smartphone (57 percent, again, small given the industry) and a 401(k) match (56 percent). Few respondents receive a stock purchase plan (10 percent), a sabbatical or extended vacation (8 percent) or day care or day care subsidy (1 percent).

Still, 63 percent say they are satisfied (45 percent) or very satisfied with their overall benefits packages.

Compensation Survey Insights: Loyalty or Inertia?

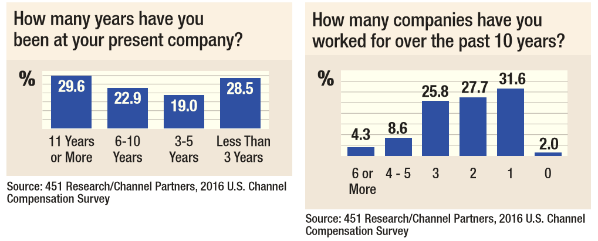

Remember when people stayed at one company for their entire careers? We’re not saying channel pros never job hop (just see our latest Channel People on the Move gallery), but a surprising 32 percent have worked for only one company over the past 10 years. That’s especially interesting given that 41 percent are currently job hunting (21 percent) or expect to within six months (20 percent). Most, 59 percent, say they are seeking higher compensation, followed by 35 percent who say they dislike their present employer’s management or culture.

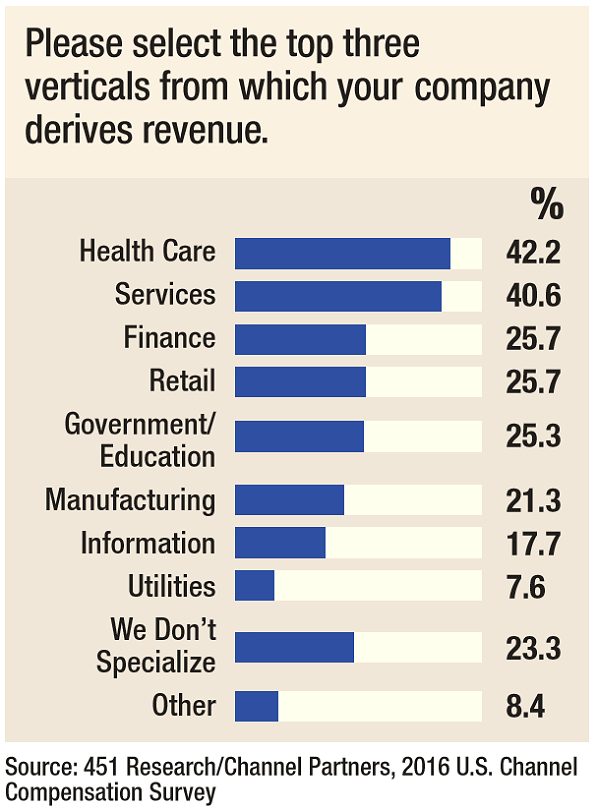

Compensation Survey Insights: Verticals — Go Where The Crowd Isn’t

Where the competition is not? Utilities, cited by only 8 percent. However, as partners add IoT practices, that number could grow significantly, given the right investments. According to EnergyCentral, 63 percent of utility respondents in a recent SAS survey said IoT was critical to their companies’ future success.

While metering and meter-data management is the top use now, cited by 55 percent, the biggest opportunity is better customer engagement, named by 73 percent. Plenty of lessons from health care, services and retail are transferrable.

Compensation Survey Insights: Lucrative Add-Ons

We offered 16 choices for main and secondary revenue generators. One tidbit buried in the data is that while just .8 percent say physical security, like support for video surveillance, is a primary income source, 2.4 percent say it’s a secondary moneymaker. Same for training — .8 percent primary, 2 percent secondary. Every little bit counts.

We think training, specifically security training to avoid the main causes of ransomware, is a vastly under-tapped opportunity.

Compensation Survey Insights: Talent — Grow or Go

More than half, 56 percent, see an internal talent shortage in one or more areas important to serving customers. Of the 137 respondents experiencing a lack of expertise, 64 percent have missed revenue opportunities, and 53 percent have had to delay customer projects.

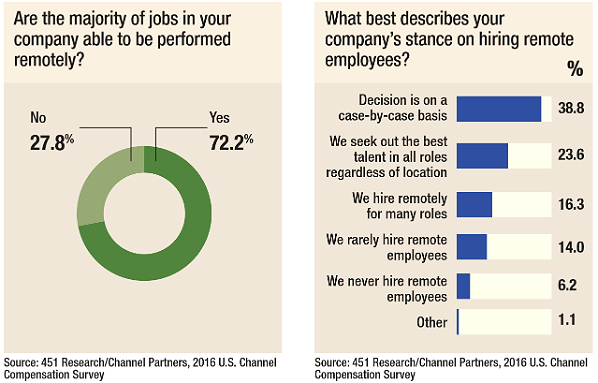

So what are we doing about it? Not enough. Just 31 percent of respondents have access to technical or vendor-specific certification training or reimbursement, and only 12 percent get tuition reimbursement as a paid benefit. In addition, while 72 percent say the majority of the jobs in their companies can be performed remotely, just 24 percent seek out the best talent in all roles regardless of location. Twenty percent rarely or never hire remotely.

Click here for access to the full report, which we will discuss during this informative session at Channel Partners Evolution on Aug. 16.

7 More Insights From the 2016 U.S. Channel Compensation Survey

Please click here for more Channel Partners galleries.

Read more about:

AgentsAbout the Author(s)

You May Also Like